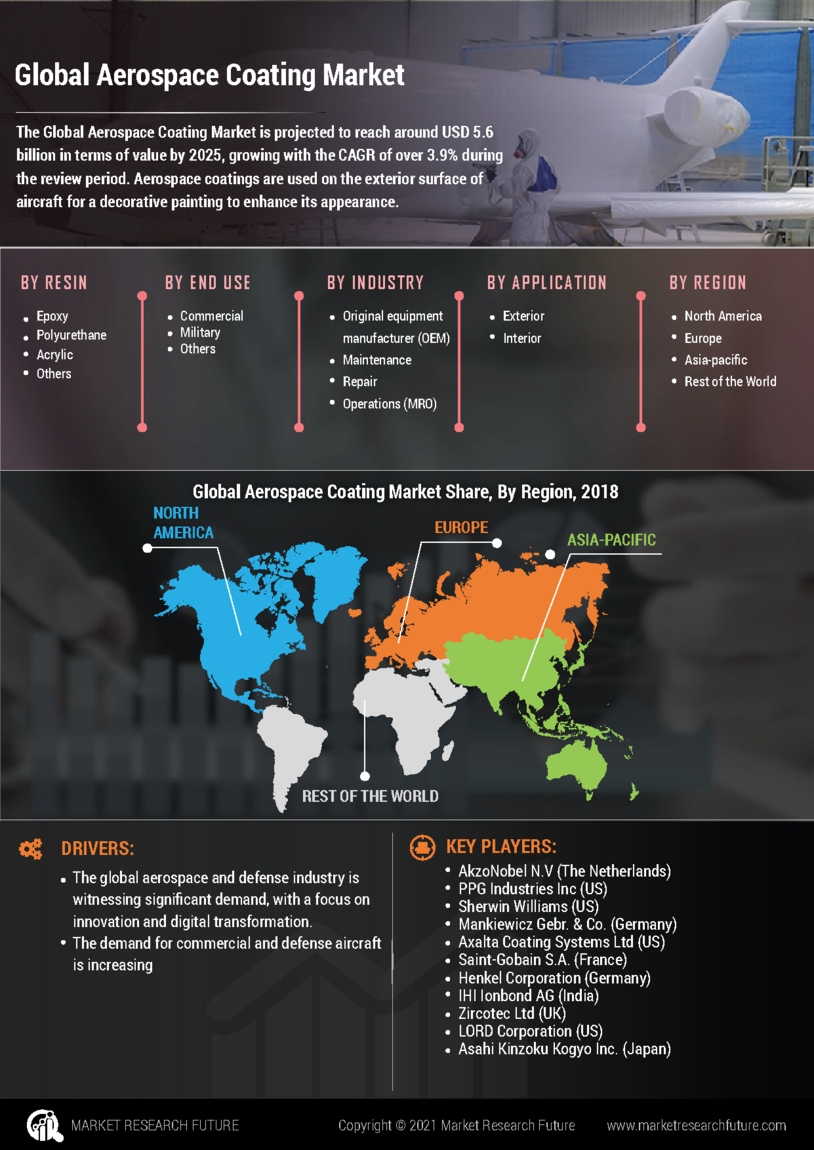

Leading market players are investing heavily in research and development to expand their product lines, which will help the Aerospace Coating market to grow further. Market participants are also undertaking strategic approaches to expand and strengthen their footprint, with important market developments including new product establishments, partnerships, mergers and acquisitions, higher investments, and strategic alliances with other organizations. The Aerospace Coating industry must offer cost-effective and sustainable products to survive and capture major market share in a highly fragmented market.Manufacturing locally to minimize expenses is one of the key business tactics organizations use in the Aerospace Coating industry to benefit clients and capture major market revenue. In recent years, the Aerospace Coating industry has offered some of the most significant advantages to the aviation field.Major players in the aerospace coatings market include AkzoNobel N.V. (The Netherlands), PPG Industries Inc (US), Sherwin Williams (US), and Mankiewicz Gebr. & Co. (Germany), Axalta Coating Systems Ltd (US), Saint-Gobain S.A. (France), Henkel Corporation (Germany), IHI Ionbond AG (India), Zircotec Ltd (UK), LORD Corporation (US), and Asahi Kinzoku Kogyo Inc. (Japan), are attempting to cater untapped market share by investing in research and development to offer affordable and sustainable products.To offer consumers cutting-edge products and services, Textron, a multi-industry firm, uses its extensive network of enterprises in the aerospace, defense, industrial, and financial sectors. Textron is the largest aircraft manufacturer, established in 2014. Textron's strong brands include Bell, Cessna, Arctic Cat, Pipistrel, Beechcraft, Lycoming, E-Z-GO, and Textron Systems, which are well-known internationally.

In October Skyscapes Next Generation (NG) by Sherwin-Williams Aerospace Coating received Textron Aviation's approval for using an external basecoat and clearcoat system for Beechcraft, Cessna, and Hawker aircraft.The business claims that its proprietary method, an of-component polyurethane topcoat created for MRO and OEM aircraft refinishing, offers quicker processing times, simpler repair, and richer color than rival systems.The Sherwin-Williams Company works with experts to develop, produce, distribute, and sell paint and protective coatings. The organization's four main segments are Paint Stores Group, Consumer Group, Finishes Group, and Latin America Coatings Group. The section known as "Paint Stores Group" is made up of company-owned specialty paint shops that engage in the business of selling paint and coatings to end users all over the world. Sherwin-Williams-branded architecture paint and coatings, commercial and marine goods, and related goods are marketed and sold in this division.

In September A JetPen for adjustments of aviation coatings was introduced by Sherwin Williams, a major manufacturer of coatings and painted worldwide. The JetPen is a 2K completely reactive paint that offers aircraft paint remarkable strength and corrosion resistance.