Focus on Sustainability

Sustainability initiatives are becoming increasingly relevant in the Military Aerospace Coating Market. As environmental regulations tighten, military organizations are seeking eco-friendly coating solutions that minimize environmental impact. The shift towards sustainable practices is prompting manufacturers to develop coatings that are free from harmful solvents and chemicals. This transition is not only beneficial for the environment but also aligns with the growing public demand for responsible military operations. Moreover, sustainable coatings often offer enhanced performance characteristics, such as improved adhesion and resistance to corrosion. As military forces adopt greener practices, the Military Aerospace Coating Market is likely to witness a significant transformation, with a rising preference for sustainable products driving innovation and market growth.

Increased Defense Budgets

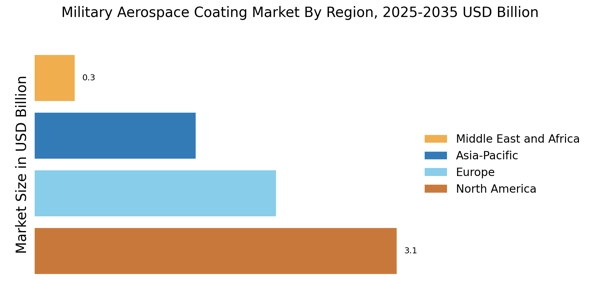

The Military Aerospace Coating Market is poised for growth due to increased defense budgets across various nations. Governments are allocating more resources to modernize their military fleets, which includes upgrading aircraft with advanced coatings. According to recent data, defense spending is projected to rise by approximately 3% annually over the next five years, reflecting a renewed focus on national security. This trend is particularly evident in regions with heightened geopolitical tensions, where nations are investing in advanced military capabilities. As a result, the demand for high-performance coatings that can withstand extreme conditions is expected to escalate. This increase in defense budgets not only supports the development of innovative coating solutions but also stimulates competition among manufacturers in the Military Aerospace Coating Market.

Technological Innovations in Coatings

The Military Aerospace Coating Market is experiencing a surge in technological innovations that enhance the performance and durability of coatings. Advanced materials, such as nanotechnology and smart coatings, are being developed to provide superior protection against environmental factors and wear. These innovations not only improve the lifespan of military aircraft but also reduce maintenance costs. For instance, the introduction of self-healing coatings is expected to revolutionize the industry by minimizing the need for frequent repairs. As military forces increasingly prioritize operational readiness, the demand for these advanced coatings is likely to rise, driving growth in the Military Aerospace Coating Market. Furthermore, the integration of digital technologies in coating applications is anticipated to streamline processes and improve efficiency, further contributing to market expansion.

Rising Demand for Aircraft Maintenance

The Military Aerospace Coating Market is significantly influenced by the rising demand for aircraft maintenance and refurbishment. As military aircraft age, the need for protective coatings that can restore and enhance their performance becomes critical. Maintenance programs are increasingly focusing on applying advanced coatings to extend the lifespan of aircraft and improve their operational capabilities. Data indicates that the aircraft maintenance market is expected to grow at a compound annual growth rate of 4% over the next few years, which directly correlates with the demand for high-quality coatings. This trend underscores the importance of coatings in maintaining military readiness and operational efficiency, thereby driving growth in the Military Aerospace Coating Market.

Geopolitical Tensions and Defense Strategies

Geopolitical tensions are a driving force in the Military Aerospace Coating Market, as nations reassess their defense strategies in response to emerging threats. The need for advanced military capabilities is prompting countries to invest in modernizing their aerospace fleets, which includes the application of high-performance coatings. As nations face evolving security challenges, the demand for coatings that provide enhanced protection and durability is likely to increase. This trend is particularly evident in regions experiencing heightened military activity, where governments are prioritizing the development of advanced technologies. Consequently, the Military Aerospace Coating Market is expected to benefit from these strategic investments, as manufacturers respond to the growing need for innovative coating solutions that meet the demands of modern warfare.