Focus on Cash Flow Management

The Accounts Receivable Automation Market is driven by an intensified focus on cash flow management. Companies are recognizing that effective cash flow is vital for sustaining operations and funding growth initiatives. Automation tools facilitate timely invoicing and follow-ups, which can lead to improved cash flow positions. Recent studies suggest that businesses implementing automation can see a reduction in days sales outstanding (DSO) by as much as 15 days. This improvement in cash flow management is crucial for organizations aiming to enhance their financial stability and operational efficiency, thereby propelling the growth of the Accounts Receivable Automation Market.

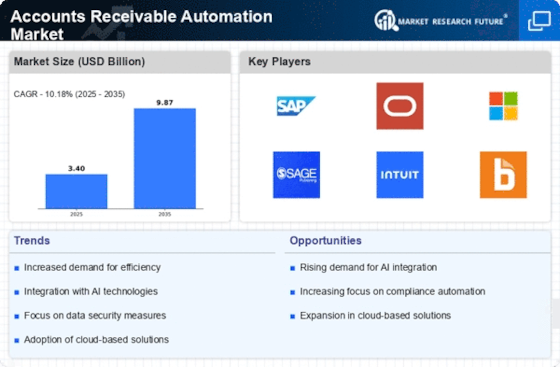

Increased Demand for Efficiency

The Accounts Receivable Automation Market is experiencing a surge in demand for efficiency as businesses seek to streamline their financial processes. Companies are increasingly recognizing the importance of reducing the time spent on manual invoicing and payment collection. According to recent data, organizations that implement automation can reduce their accounts receivable cycle time by up to 30%. This efficiency not only enhances cash flow but also allows finance teams to focus on strategic initiatives rather than routine tasks. As a result, the drive for operational efficiency is a key factor propelling the growth of the Accounts Receivable Automation Market.

Enhanced Data Analytics Capabilities

The Accounts Receivable Automation Market is benefiting from enhanced data analytics capabilities that automation solutions provide. Businesses are increasingly leveraging data to gain insights into customer payment behaviors and trends. This analytical approach allows organizations to tailor their collection strategies effectively, potentially reducing overdue accounts by up to 25%. The ability to analyze data in real-time empowers finance teams to make informed decisions, thereby improving overall financial health. Thus, the integration of advanced analytics into accounts receivable processes is a pivotal driver of the Accounts Receivable Automation Market.

Regulatory Compliance and Risk Management

The Accounts Receivable Automation Market is significantly influenced by the need for regulatory compliance and effective risk management. Organizations are under constant pressure to adhere to financial regulations, which necessitates accurate record-keeping and timely reporting. Automation solutions can help businesses maintain compliance by providing real-time data and audit trails. Furthermore, the ability to mitigate risks associated with late payments and defaults is crucial for financial stability. As such, the emphasis on compliance and risk management is a driving force behind the expansion of the Accounts Receivable Automation Market.

Rising Adoption of Digital Payment Solutions

The Accounts Receivable Automation Market is witnessing a notable rise in the adoption of digital payment solutions. As businesses transition to online platforms, the need for automated accounts receivable processes becomes increasingly apparent. Data indicates that companies utilizing digital payment methods can improve their collection rates by approximately 20%. This shift not only expedites the payment process but also enhances customer satisfaction, as clients prefer the convenience of digital transactions. Consequently, the growing trend towards digital payments is a significant driver of the Accounts Receivable Automation Market.