Research Methodology on Building Automation System Market

Introduction

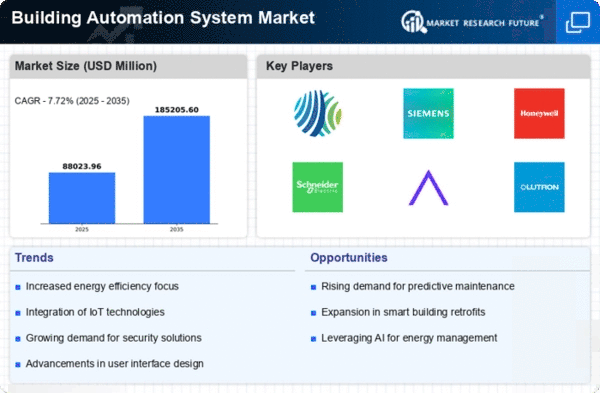

This research report is about the market for building automation systems (BAS). Building automation systems are automated managing systems that allow for real-time, local or remote monitoring and control of various types of building functions such as lighting, temperature, access control and other building functions. The development of efficient and cost-effective automated systems has become a key priority for building owners and operators.

Research Methodology

The research methodology adopted for this study consists of both primary and secondary research. The primary research is conducted using interviews with industry experts and a survey. The interviews are carried out with key industry personnel such as manufacturers, systems integrators, solution providers, and industry technicians. In addition, a survey is conducted with owners and building managers of commercial and residential buildings. The survey is conducted using a web-based survey platform and the results are collated and analyzed.

Secondary research is conducted to gather information on the market size of the building automation systems industry, the key technology components and regulations with respect to building automation systems, as well as regulatory and technological developments impacting the building automation systems industry. Secondary research data is collected from various industry sources such as market reports, trade journals, conference proceedings, press releases and regulatory documents.

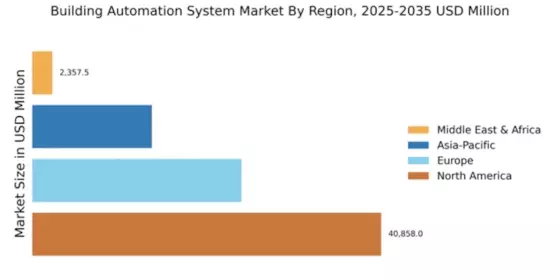

The data collected from both primary and secondary research is organized and analyzed to gain an insight into the market size of the building automation systems industry as well as to identify the key trends, technological developments and market drivers and challenges pertinent to the industry.

Data Analysis

The data collated from the primary and secondary research is analyzed using various tools such as Porter’s Five Forces model and the SWOT (Strengths, Weaknesses, Opportunities and Threats) analysis. Additionally, the analysis includes an overview of the market for building automation systems and the value chain analysis for the building automation systems industry.

Conclusion

The research methodology adopted for this study encompassed both primary and secondary research. Primary research is conducted through interviews with industry experts, and a survey is conducted with building owners and managers. Secondary research is conducted to gather information on the size of the building automation systems market, the major technology components, and regulations about building automation systems. Data analysis was conducted using Porter’s Five Forces model and the SWOT analysis. An overview of the market for building automation systems and the value chain analysis is also developed. The data collated is used to gain an insight into the market size of the building automation systems industry and identify the major trends, technological developments, market drivers and challenges pertinent to the industry.