Rising Incidence of Accidents

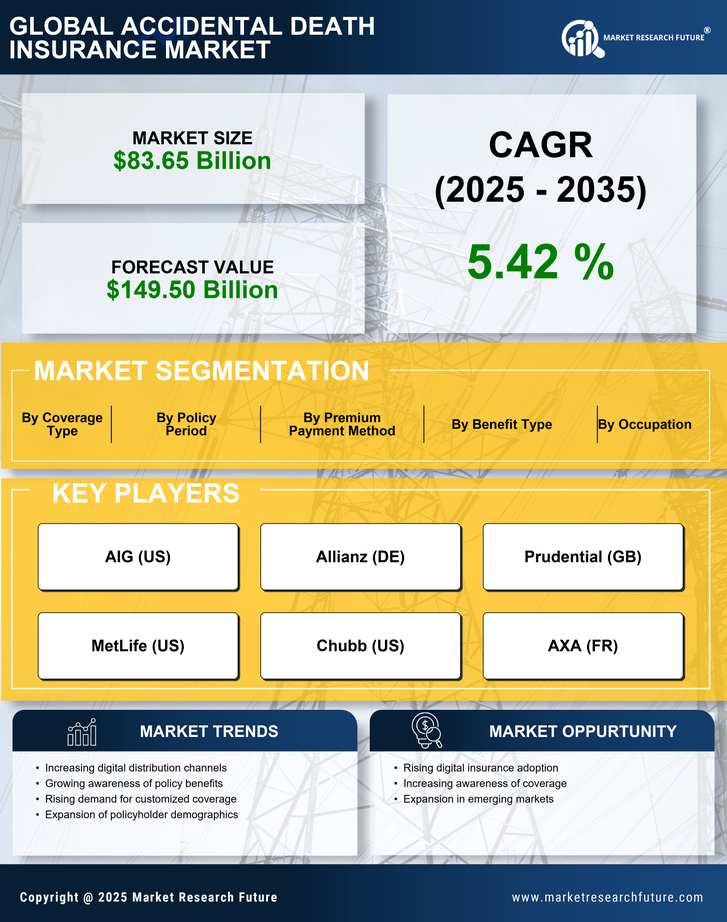

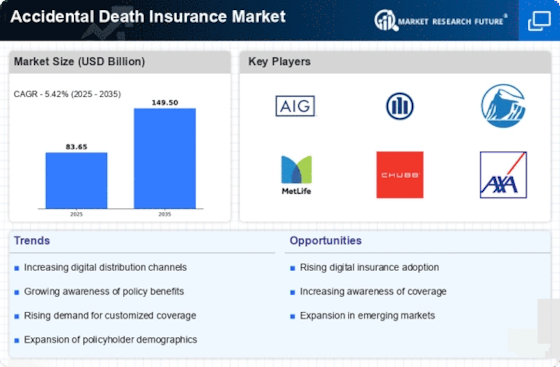

The Accidental Death Insurance Market is experiencing growth due to the rising incidence of accidents across various sectors. According to data, unintentional injuries are among the leading causes of death, prompting individuals to seek financial protection. The increasing number of road accidents, workplace incidents, and recreational mishaps contributes to this trend. As awareness of these risks grows, consumers are more inclined to invest in accidental death insurance policies. This shift is reflected in the market's expansion, with projections indicating a potential increase in policy uptake. The heightened focus on safety measures and accident prevention may also drive demand, as individuals seek to mitigate financial risks associated with unforeseen events.

Growing Middle-Class Population

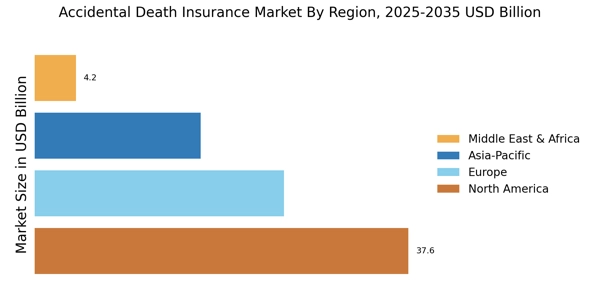

The Accidental Death Insurance Market is likely to benefit from the growing middle-class population, particularly in emerging economies. As disposable incomes rise, more individuals can afford insurance products, including accidental death coverage. This demographic shift is significant, as the middle class often seeks financial security and protection for their families. Market data suggests that the demand for insurance products is expected to increase, with a notable percentage of the population recognizing the importance of safeguarding against accidental deaths. This trend indicates a potential for market expansion, as insurers tailor their offerings to meet the needs of this burgeoning consumer base.

Increased Regulatory Frameworks

The Accidental Death Insurance Market is influenced by the establishment of increased regulatory frameworks aimed at protecting consumers. Governments are implementing stricter regulations to ensure transparency and fairness in insurance practices. This regulatory environment encourages insurers to offer more comprehensive accidental death policies, enhancing consumer trust. As a result, individuals are more likely to invest in these products, knowing that they are backed by robust regulations. The market may see a rise in policy sales as consumers become more aware of their rights and the protections afforded to them under these regulations. This trend could lead to a more competitive landscape among insurers.

Rising Awareness of Financial Security

The Accidental Death Insurance Market is experiencing a surge in demand driven by rising awareness of financial security among consumers. Individuals are increasingly recognizing the importance of having a safety net in place to protect their families from the financial burden of accidental deaths. This awareness is reflected in market trends, with more people actively seeking out insurance products that provide peace of mind. The potential for economic instability may also contribute to this trend, as consumers prioritize financial preparedness. As awareness campaigns and educational initiatives proliferate, the market is likely to see a continued increase in policy adoption, further solidifying its growth trajectory.

Technological Advancements in Insurance

The Accidental Death Insurance Market is witnessing a transformation due to technological advancements. Insurers are increasingly adopting digital platforms to streamline the purchasing process and enhance customer experience. Innovations such as mobile applications and online policy management tools are making it easier for consumers to access accidental death insurance. Market data indicates that the integration of technology is likely to attract a younger demographic, who prefer digital solutions. This shift may lead to an increase in policy sales, as technology facilitates quicker decision-making and greater accessibility. The ongoing evolution of insurtech could further reshape the market landscape.