Rising Cyber Threats

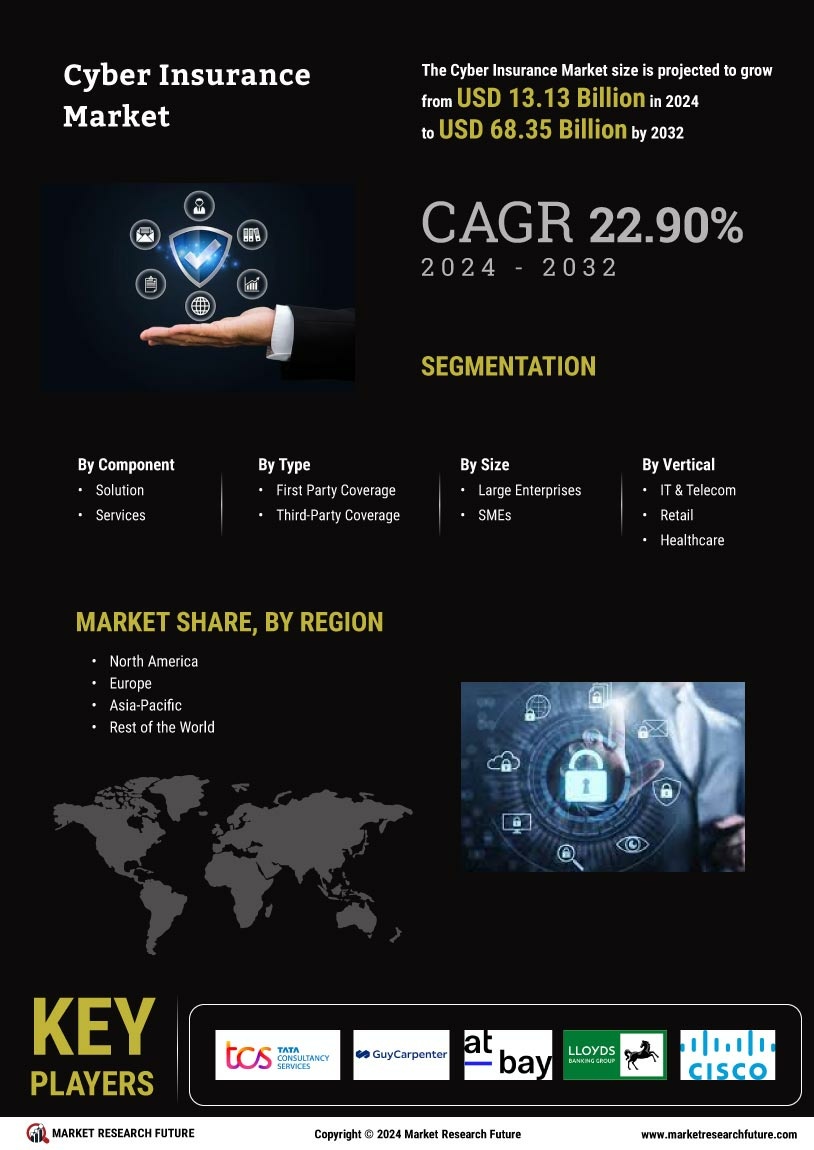

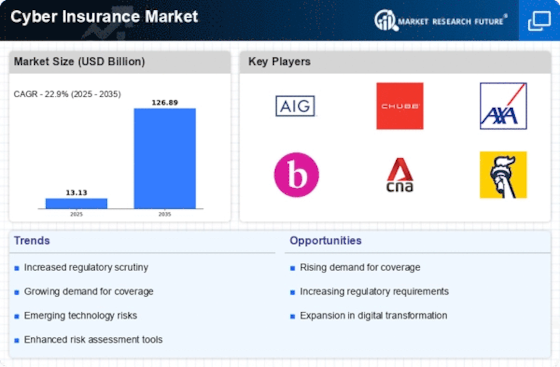

The Cyber Insurance Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations across various sectors are facing heightened risks from ransomware attacks, data breaches, and other cyber incidents. According to recent data, the number of reported cyber incidents has escalated significantly, prompting businesses to seek insurance solutions that can mitigate potential financial losses. This trend indicates a growing awareness of the need for robust cyber risk management strategies. As companies recognize the potential impact of cyber threats on their operations and reputations, the Cyber Insurance Industry is likely to expand, with insurers developing more comprehensive policies to address these evolving risks.

Growing Awareness of Cyber Risks

The Cyber Insurance Industry is benefiting from a growing awareness of cyber risks among businesses and consumers alike. As high-profile data breaches and cyberattacks make headlines, organizations are becoming increasingly cognizant of the potential financial and reputational damage associated with such incidents. This heightened awareness is prompting companies to proactively seek cyber insurance solutions to mitigate risks. Surveys indicate that a significant percentage of businesses now view cyber insurance as an essential part of their risk management strategy. As awareness continues to rise, the Cyber Insurance Market is likely to expand, with insurers developing tailored products to meet the diverse needs of organizations.

Increased Digital Transformation

The ongoing digital transformation across industries is a key driver for the Cyber Insurance Market. As organizations increasingly adopt cloud computing, IoT devices, and digital platforms, they expose themselves to new vulnerabilities and cyber risks. This shift towards digitalization necessitates a reevaluation of risk management strategies, leading many companies to consider cyber insurance as a critical component of their overall security framework. Data suggests that businesses investing in digital technologies are also prioritizing cyber insurance to safeguard their assets and operations. The Cyber Insurance Industry is thus poised for growth as more organizations recognize the importance of protecting their digital infrastructure against potential cyber threats.

Regulatory Compliance Requirements

The Cyber Insurance Market is influenced by the evolving regulatory landscape that mandates organizations to adopt stringent cybersecurity measures. Governments and regulatory bodies are increasingly implementing laws and guidelines that require businesses to protect sensitive data and report breaches. For instance, regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) have heightened the need for organizations to ensure compliance. This regulatory pressure is driving companies to invest in cyber insurance as a means of demonstrating due diligence and protecting against potential fines and legal liabilities. Consequently, the Cyber Insurance Market is likely to see growth as businesses seek coverage that aligns with these compliance requirements.

Technological Advancements in Cybersecurity

Technological advancements in cybersecurity are playing a pivotal role in shaping the Cyber Insurance Market. As new technologies emerge, they not only enhance the ability of organizations to protect themselves against cyber threats but also influence the types of coverage available in the insurance market. Innovations such as artificial intelligence, machine learning, and advanced threat detection systems are becoming integral to cybersecurity strategies. Insurers are increasingly incorporating these technologies into their underwriting processes, allowing for more accurate risk assessments and tailored policies. This trend suggests that the Cyber Insurance Industry will continue to evolve, with insurers adapting their offerings to align with the latest technological developments in cybersecurity.