Rising Vehicle Ownership

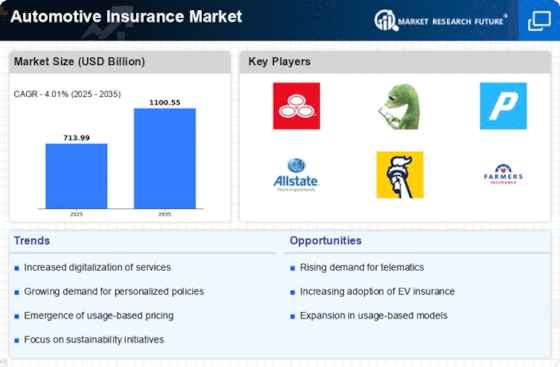

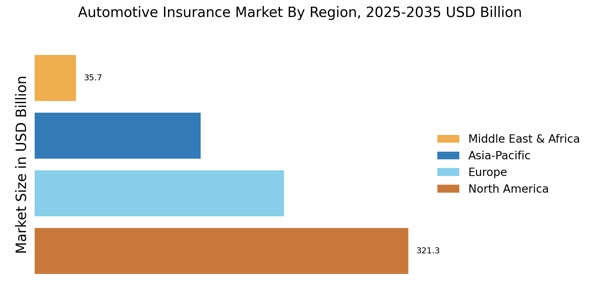

The increasing rate of vehicle ownership is a pivotal driver for the Automotive Insurance Market. As more individuals acquire vehicles, the demand for insurance coverage naturally escalates. Recent statistics indicate that vehicle ownership has surged, with millions of new cars registered annually. This trend is particularly pronounced in emerging markets, where economic growth is facilitating greater access to automobiles. Consequently, insurance providers are compelled to adapt their offerings to cater to a diverse clientele, ensuring that policies are accessible and relevant. The expansion of the vehicle fleet not only amplifies the need for insurance but also encourages competition among providers, leading to innovative products and pricing strategies. Thus, the rising vehicle ownership serves as a fundamental catalyst for growth within the Automotive Insurance Market.

Technological Advancements

Technological advancements are reshaping the Automotive Insurance Market in profound ways. The integration of artificial intelligence and machine learning into underwriting processes is enhancing risk assessment and pricing accuracy. Insurers are increasingly utilizing data analytics to evaluate driving behavior, which allows for more personalized insurance premiums. Moreover, the proliferation of mobile applications is streamlining the claims process, making it more efficient for consumers. According to recent data, insurers leveraging technology have reported a significant reduction in operational costs and improved customer satisfaction rates. This technological evolution not only attracts new customers but also retains existing ones, as policyholders appreciate the convenience and transparency offered by tech-driven solutions. Therefore, the ongoing technological advancements are likely to continue driving growth and innovation within the Automotive Insurance Market.

Regulatory Changes and Compliance

Regulatory changes and compliance requirements are significant drivers of the Automotive Insurance Market. Governments worldwide are implementing stricter regulations regarding vehicle safety and insurance coverage, compelling insurers to adapt their policies accordingly. For instance, mandatory insurance laws are being enforced in various jurisdictions, ensuring that all vehicle owners maintain a minimum level of coverage. This regulatory environment not only protects consumers but also creates a larger market for insurance providers. Additionally, compliance with evolving regulations necessitates continuous investment in technology and training for insurers, which can lead to increased operational costs. However, these challenges also present opportunities for innovation, as companies develop new products to meet regulatory standards. Consequently, the dynamic nature of regulatory changes is likely to shape the future landscape of the Automotive Insurance Market.

Increased Awareness of Road Safety

The heightened awareness of road safety is a crucial driver for the Automotive Insurance Market. As public consciousness regarding safe driving practices grows, individuals are more inclined to seek comprehensive insurance coverage. Campaigns promoting road safety have led to a decline in accident rates in various regions, which paradoxically influences insurance premiums. Insurers are adjusting their pricing models to reflect the reduced risk associated with safer driving behaviors. Furthermore, the emphasis on safety features in vehicles, such as advanced driver-assistance systems, is prompting consumers to consider insurance policies that offer incentives for such technologies. This shift not only benefits policyholders through potential discounts but also encourages manufacturers to innovate further. Thus, the increased awareness of road safety is likely to sustain demand for automotive insurance, fostering a more competitive landscape within the Automotive Insurance Market.

Shift Towards Sustainable Practices

The shift towards sustainable practices is emerging as a vital driver for the Automotive Insurance Market. As environmental concerns gain prominence, consumers are increasingly opting for eco-friendly vehicles, such as electric and hybrid cars. This transition not only influences purchasing decisions but also impacts insurance policies. Insurers are beginning to offer specialized coverage options tailored to electric vehicles, which often come with unique risks and benefits. Recent data suggests that the market for electric vehicles is expanding rapidly, prompting insurers to reassess their risk models and pricing strategies. Furthermore, companies that adopt sustainable practices may enhance their brand reputation, attracting environmentally conscious consumers. This alignment with sustainability trends is likely to foster growth and innovation within the Automotive Insurance Market, as insurers strive to meet the evolving needs of a more environmentally aware clientele.