Health Insurance Market Summary

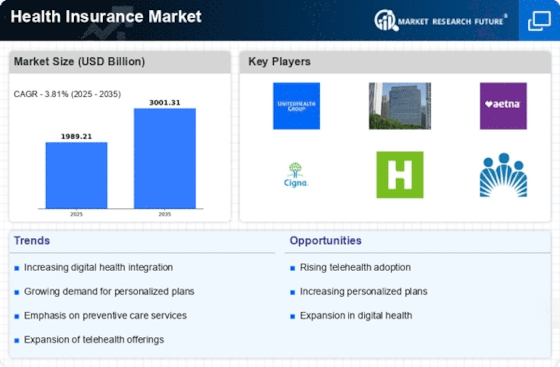

As per Market Research Future analysis, the Health Insurance Market was estimated at 1989.21 USD Billion in 2024. The Health Insurance industry is projected to grow from 2065.0 USD Billion in 2025 to 3001.31 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.81% during the forecast period 2025 - 2035

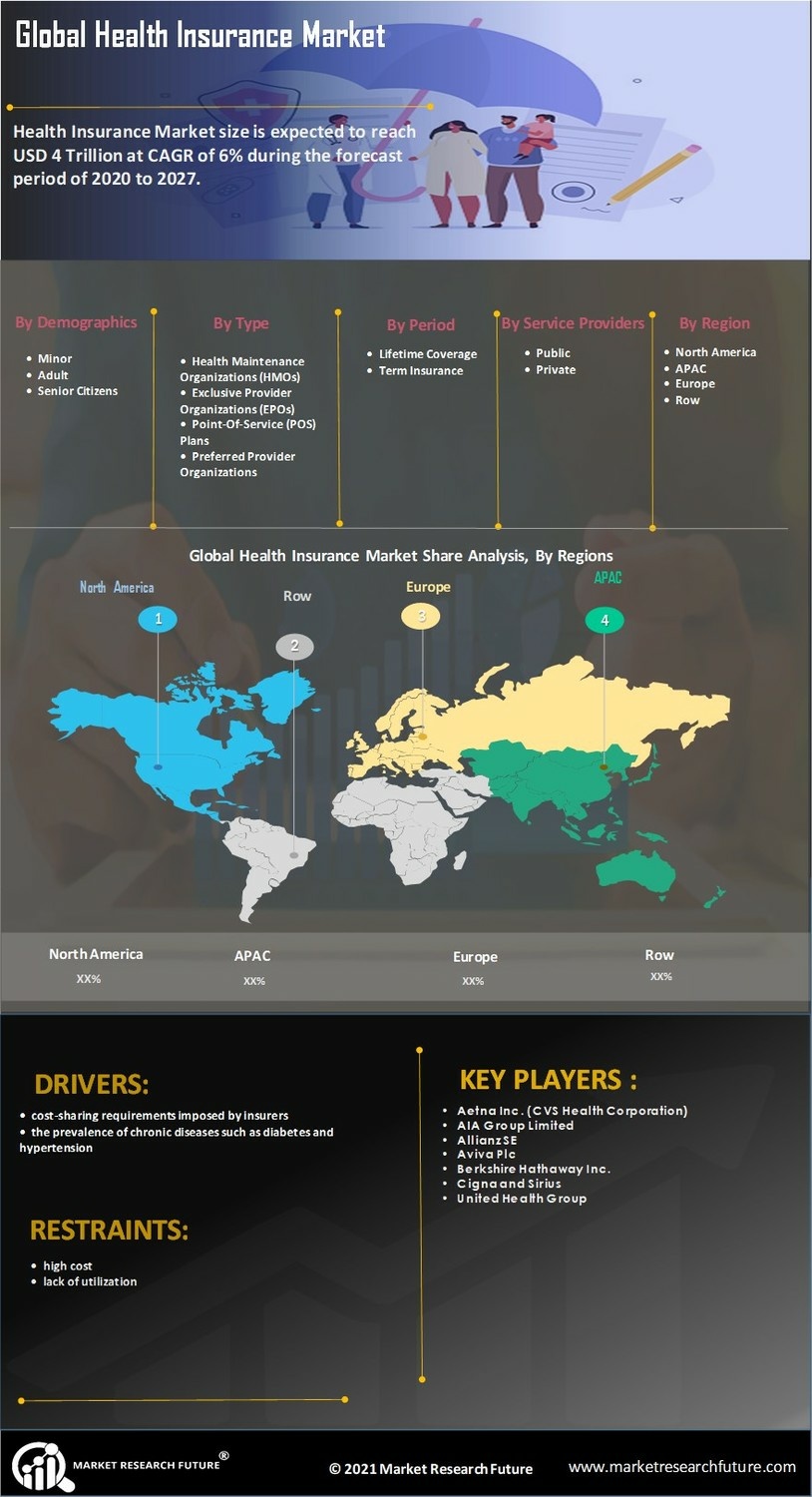

Key Market Trends & Highlights

The Health Insurance Market is experiencing transformative changes driven by technology and evolving consumer needs.

- The rise of telehealth services is reshaping patient engagement and access to care, particularly in North America.

- Integration of technology into health insurance processes enhances efficiency and customer experience across the Asia-Pacific region.

- Regulatory changes are influencing market dynamics, prompting insurers to adapt their offerings to comply with new standards.

- The increasing demand for preventive care and the aging population are major drivers propelling growth in private health insurance and employer-sponsored insurance segments.

Market Size & Forecast

| 2024 Market Size | 1989.21 (USD Billion) |

| 2035 Market Size | 3001.31 (USD Billion) |

| CAGR (2025 - 2035) | 3.81% |

Major Players

UnitedHealth Group (US), Anthem (US), Aetna (US), Cigna (US), Humana (US), Kaiser Permanente (US), MediCare (US), Centene Corporation (US), WellCare Health Plans (US), Blue Cross Blue Shield (US)