Regulatory Compliance

Stringent regulatory requirements regarding data protection and security are compelling organizations to invest in electronic access control systems. Compliance with regulations such as GDPR and HIPAA necessitates the implementation of robust security measures to safeguard sensitive information. This trend is evident in the Global Electronic Access Control Systems Market Industry, where organizations are increasingly adopting access control solutions to meet compliance standards. The growing emphasis on regulatory adherence is likely to contribute to the market's expansion, as businesses recognize the importance of protecting their data and maintaining compliance.

Rising Security Concerns

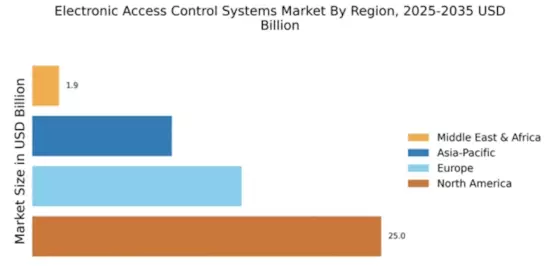

The increasing prevalence of security threats across various sectors drives the demand for advanced security solutions. Organizations are prioritizing the protection of sensitive information and assets, leading to a surge in the adoption of electronic access control systems. In the Global Electronic Access Control Systems Market Industry, this trend is particularly evident in sectors such as finance and healthcare, where data breaches can have severe consequences. As a result, the market is projected to reach 25 USD Billion in 2024, reflecting a growing recognition of the need for robust security measures.

Technological Advancements

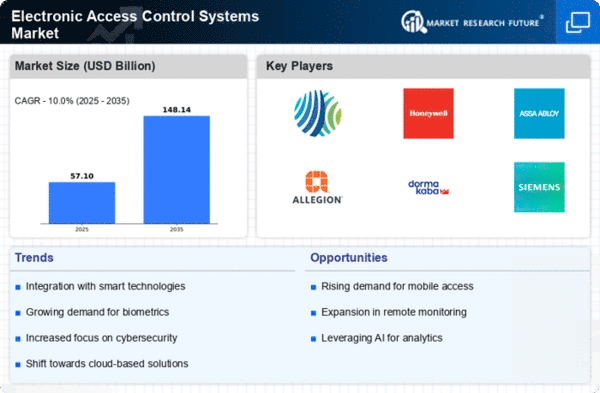

Rapid technological advancements in electronic access control systems are reshaping the market landscape. Innovations such as biometric authentication, mobile access control, and cloud-based solutions enhance security and user convenience. These developments are particularly relevant in the Global Electronic Access Control Systems Market Industry, where organizations seek to leverage cutting-edge technology to improve operational efficiency. As a result, the market is expected to experience a compound annual growth rate of 6.5% from 2025 to 2035, indicating a strong trajectory fueled by continuous innovation.

Integration with IoT Devices

The integration of electronic access control systems with Internet of Things (IoT) devices is transforming the security landscape. This convergence allows for enhanced monitoring and control capabilities, enabling organizations to streamline their security operations. In the Global Electronic Access Control Systems Market Industry, the adoption of IoT-enabled access control solutions is gaining traction, as businesses seek to leverage interconnected devices for improved security management. This trend is expected to drive market growth, as organizations recognize the potential of IoT to enhance their security infrastructure.

Growing Demand in Emerging Markets

Emerging markets are witnessing a surge in demand for electronic access control systems, driven by urbanization and economic growth. As cities expand and new businesses emerge, the need for effective security solutions becomes paramount. The Global Electronic Access Control Systems Market Industry is experiencing increased penetration in regions such as Asia-Pacific and Latin America, where investments in infrastructure and security are on the rise. This trend is likely to contribute to the market's growth, with projections indicating a potential market size of 50 USD Billion by 2035, reflecting the expanding opportunities in these regions.