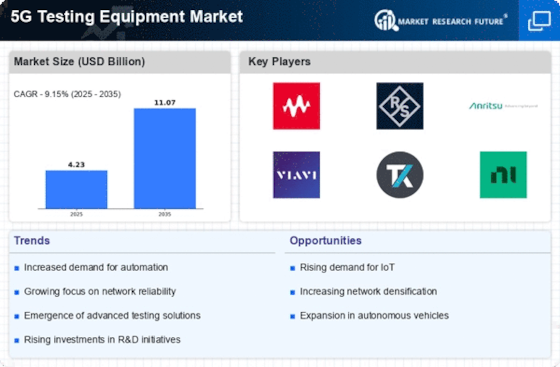

Surge in 5G Network Deployments

The ongoing surge in 5G network deployments is a primary driver for the 5G Testing Equipment Market. As telecommunications companies expand their 5G infrastructure, the need for robust testing equipment becomes paramount. This equipment ensures that networks operate efficiently and meet the high standards expected by consumers and businesses alike. According to recent data, the number of 5G subscriptions is projected to reach over 1 billion by the end of 2025, indicating a substantial market for testing solutions. The rapid rollout of 5G technology necessitates comprehensive testing to address challenges such as latency, speed, and connectivity. Consequently, the demand for advanced testing equipment is likely to grow, propelling the 5G Testing Equipment Market forward.

Emergence of IoT and Smart Devices

The emergence of Internet of Things (IoT) and smart devices is significantly influencing the 5G Testing Equipment Market. As more devices become interconnected, the complexity of network testing increases. 5G technology is designed to support a vast number of devices simultaneously, which necessitates specialized testing equipment to ensure seamless connectivity and performance. The proliferation of smart devices, including wearables, smart home appliances, and industrial IoT applications, is expected to drive the demand for testing solutions. Market data suggests that the number of connected IoT devices could exceed 30 billion by 2025, further emphasizing the need for effective testing equipment to validate network performance and reliability in the 5G Testing Equipment Market.

Regulatory Compliance and Standards

Regulatory compliance and adherence to industry standards are critical drivers for the 5G Testing Equipment Market. As governments and regulatory bodies establish guidelines for 5G technology, companies must ensure their equipment meets these requirements. Compliance with standards not only enhances network reliability but also fosters consumer trust. The establishment of frameworks such as the International Telecommunication Union (ITU) standards for 5G necessitates rigorous testing to validate compliance. This regulatory landscape creates a demand for specialized testing equipment capable of meeting these stringent requirements. As the 5G ecosystem matures, the emphasis on compliance is likely to intensify, further driving the growth of the 5G Testing Equipment Market.

Advancements in Testing Technologies

Advancements in testing technologies are propelling the 5G Testing Equipment Market. Innovations such as software-defined testing, automated testing solutions, and AI-driven analytics are transforming how testing is conducted. These technologies enhance the efficiency and accuracy of testing processes, allowing for quicker identification of issues and improved network performance. The integration of machine learning algorithms into testing equipment enables predictive analysis, which can foresee potential network failures before they occur. As the industry evolves, companies are increasingly investing in these advanced testing technologies to stay competitive. This trend is likely to result in a robust growth trajectory for the 5G Testing Equipment Market, as organizations seek to leverage cutting-edge solutions to optimize their 5G networks.

Increased Investment in Telecommunications Infrastructure

Increased investment in telecommunications infrastructure is a significant driver of the 5G Testing Equipment Market. Governments and private entities are allocating substantial resources to enhance their telecommunications networks, recognizing the economic and social benefits of 5G technology. This investment is not only focused on the deployment of 5G networks but also on the development of testing facilities and equipment. As a result, the demand for advanced testing solutions is expected to rise, as stakeholders seek to ensure the reliability and performance of their networks. Market analysis indicates that global spending on telecommunications infrastructure is projected to reach trillions of dollars by 2025, underscoring the potential for growth within the 5G Testing Equipment Market.

.png)