EV Revolution: Battery Prices Drop Below USD 100/kWh Amid China's Dominance of the Market in 2025

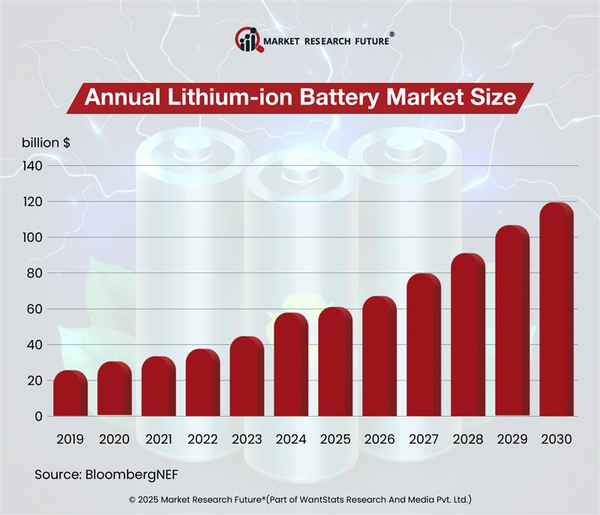

The global electric vehicle (EV) industry has reached a pivotal milestone. The average price of lithium-ion battery packs has dropped below the USD 100 per kilowatt-hour (kWh) threshold, a benchmark long considered critical for achieving price parity between EVs and conventional gasoline-powered cars. This significant development is poised to accelerate the mass adoption of EVs worldwide.

This trend is expected to continue in 2025, further solidifying EVs' competitiveness. Several factors have contributed to the decline in battery prices, including overcapacity in cell manufacturing, economies of scale, reduced prices for raw materials such as lithium, and the increased adoption of cost-effective lithium-iron-phosphate (LFP) batteries. These factors are anticipated to drive further reductions in battery costs by 2025, making EVs more accessible to a broader consumer base.

China has emerged as the dominant force in the global battery market, producing more than three-quarters of all batteries sold worldwide. In 2024, China's average battery pack prices dropped faster than any other region, falling nearly 30 percent to USD 94/kWh. This price point is significantly lower than in Europe and North America, where battery packs are 31 percent and 48 percent more expensive, respectively.

China's leadership in battery production is expected to continue in 2025, influencing global pricing trends and encouraging other regions to enhance their manufacturing capabilities. The affordability of batteries in China has been a significant factor in making many EV models more cost-competitive than their internal combustion engine counterparts. This price advantage has spurred domestic sales and favored Chinese manufacturers in the global market.

In February 2024, BYD delivered 322,846 EVs, and XPeng delivered 570 percent more. Chinese manufacturers' worldwide expansion is likely to continue in 2025. Lithium prices decreased 85 percent from their high in 2022, lowering battery costs. Reducing raw material costs has helped battery producers offer more competitive prices.

The EV sector may profit from stable raw material costs by 2025. Despite these advances, the global battery production environment confronts overcapacity and the need for technical innovation. More than 2.5 times the yearly lithium-ion battery demand, the worldwide battery-cell production capacity was 3.1 TWh in 2024. Overcapacity may enhance manufacturer competitiveness and drive in costs. Companies may optimize output in 2025 to balance supply and demand.

Battery costs are falling rapidly, and China dominates the industry, creating possibilities and difficulties for other areas. European carmakers face trade difficulties, Chinese competitiveness, and the complicated electric vehicle transition. Renault has overcome structural problems, proving that more minor carmakers can pursue profitability-focused strategies. European manufacturers should boost EV market competitiveness in 2025.

Continued investment in R&D, manufacturing process improvements, and supply chain capacity growth could lower battery costs. Next-generation technologies like solid-state electrolytes and cathode materials could lower prices in the future decade.

These advancements might make EVs more accessible and sustainable by 2025. EV battery pack costs falling below USD 100/kWh is a significant step toward broad EV adoption. China's battery manufacturing and price dominance highlight the global market's competitiveness, forcing other areas to innovate and adapt to electric mobility's quick evolution. By 2025, these developments will impact transportation, with EVs becoming more accessible to customers globally.