キャップとクロージャーの市場シナリオ

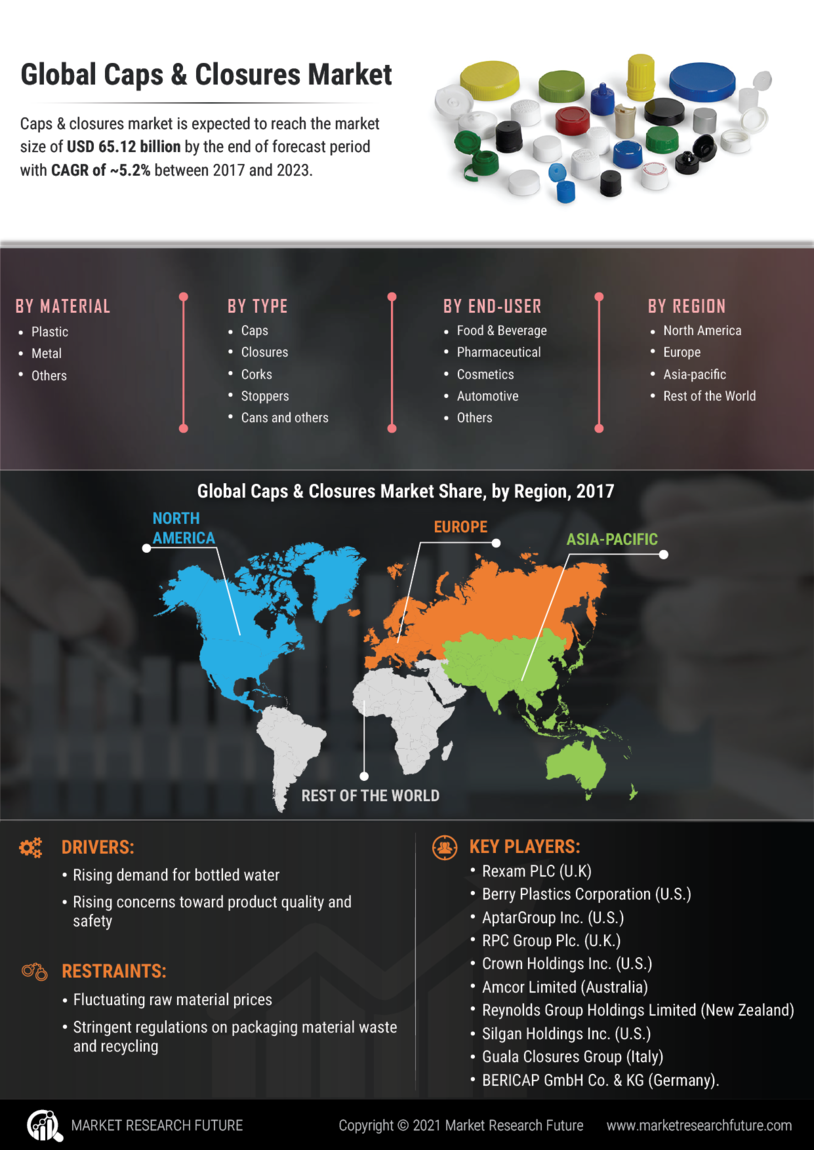

pキャップとクロージャーは、パッケージのディスペンスおよびシーリングコンポーネントを指します。キャップとクロージャーは、パッケージ製品への製品の流入と流出を保証します。キャップとクロージャーはパッケージングにおいて重要な役割を果たし、キャップや缶などの容器が含まれます。これは、製品の貯蔵寿命を延ばすプロセスに役立ち、汚れ、湿気、および酸素に対するバリアを提供します。食品、飲料、ヘルスケアなどのエンドユーザー業界からのボトル入り飲料水の需要の高まりとより小さなパッケージサイズ、および製品の品質と安全性に対する懸念の高まりは、キャップ&クロージャー市場の成長を改善する要因です。包装の使用の増加は、キャップとクロージャー市場の成長を牽引しています。

これは、多くの市場におけるプラスチック容器の重要性と、他の容器タイプでのプラスチッククロージャーの普及の高まりを反映しています。プラスチック製クロージャーの見通しは、ほとんどの市場ですでに高いプラスチック容器の普及率と、新しい大量用途の欠如によって制約されます。

プラスチッククロージャーによる侵入とビール市場でのアルミ缶の復活による継続的な損失にもかかわらず、ロールオンクロージャーの使用の増加に基づいて、ユニットは適度に増加しますワインと、アイスティーやコーヒーなどのすぐに飲める飲み物のネジとラグクロージャーの機会があります。

世界のキャップ&クロージャーの市場規模は、2022年から2030年の間に4.7%のCAGRを記録し、2027年にはおよそ91,718.9百万米ドルに達すると予想されています。

キャップとクロージャーは、主にアプリケーション、輸送、コストの削減、およびフレーバー、栄養、およびテクスチャーを長期間保存する能力により、食品および飲料業界でいくつかの用途があります走れ。キャップとクロージャーは、ブランドアイデンティティを強化するとともに、製品の賞味期限を延ばすのに役立ちます。

包装された食品および飲料、特に液体および半液体の食品および飲料の需要の増加は、キャップおよびクロージャーの需要を引き起こす主要な要因の1つと考えられています。世界中で加工および包装された食品および飲料の生産を確実に増加させることによって満たされる需要が高まっています。ヨーロッパでは、加工食品および飲料市場セグメントにおける新しい企業の出現に伴い、食品および飲料業界の売上高が上昇しています。

包装ソリューションの技術的進歩は、キャップとクロージャーの需要を促進する上で重要な役割を果たします。高度なテクノロジーにより、企業は従来のものに固執するのではなく、製品にイノベーションを取り入れることができました。このため、いくつかの企業が研究開発に投資しており、より優れたシーリング機能、貯蔵寿命の延長、漏れ防止、再利用性などの特性を備えた技術的に高度な製品を考え出しています。このような特性は、追加の防腐剤を使用せずに保存期間を延ばしながら、食品の品質と一貫性を効果的に維持します。

キャップ&クロージャー市場はより技術主導型になり、より高いレベルの研究開発投資を引き出しています。このような投資は技術開発につながり、付加価値と低コストでのプレミアム製品の製造につながります。これにより、組織化されたインフラストラクチャを通じて、競争力を高め、プラスチック製クロージャーメーカーに機会を創出することができます。したがって、パッケージングソリューションの急速な革新は、予測期間中の世界のキャップ&クロージャー市場の成長を促進すると予想されます。

インド、ブラジル、インドネシアなどの発展途上国では、包装および加工食品および飲料の需要のダイナミクスが変化しています。一人当たりの可処分所得の増加、顧客の嗜好の変化、働く女性人口の増加、小売店の数の増加などの前向きな経済指標により、消費パターンは長年にわたって変化しています。これは経験値です食品や飲料の包装に広く使用されているキャップやクロージャーなど、包装業界の成長を揺るがすために行動しました。これらの国々は、スマートパッケージング技術を採用しており、パッケージング会社が製品提供を多様化および強化する別の機会を提供しています。新しいソリューションスイートは、ブランドオーナーが棚の魅力を高め、温度監視、断熱輸送、その他の鮮度指標を使用して保存期間を延ばすスマートフォンやデザインを介して直接消費者とのインターフェースを可能にすることを目指すのに役立ちます。

原材料費は、樹脂メーカーとの契約期間と期間によって異なり、通常は1年から数年で変動します。原材料の入手可能性は、世界および地域の需要と供給力と政府の規制によって異なります。樹脂の価格は、需給力、輸出入シナリオ、政策、規制などの外部市況により変動する可能性があります。これらの要因は、最終的には樹脂に関連するコストである原材料コストに影響します。また、この変動により、会社の財務パフォーマンスに悪影響を与える可能性があります。

キャップ・アンド・クロージャ業界の主な参加者は、クラウン、アムコー、クロージャー・システムズ・インターナショナル、ボール・コーポレーション、シルガン・ホールディング株式会社、ベリー・グローバル社、アプター・グループ・インク、ベリカップ、日本クロージャーズ株式会社です。株式会社; ソノコプロダクツカンパニー

キャップ&クロージャー市場の世界市場は、タイプ、材料タイプ、最終用途産業、および地域に基づいて分割されています。タイプに基づいて、世界のキャップ&クロージャー市場は、プラスチック製のキャップとクロージャー、ロールオンボールなどに分割されます。プラスチック製のキャップとクロージャーは、ボトル入り飲料水、炭酸清涼飲料、および非炭酸ソーダ飲料の包装で人気を博しています。

材料の種類に基づいて、世界のキャップ&クロージャー市場はプラスチック、金属などに分割されます。ボトル入り飲料水の需要の増加、利便性の必要性、製品の安全性とセキュリティへの懸念、製品の差別化とブランド化、およびパッケージサイズの減少が、プラスチックキャップとクロージャーの市場を牽引しています。プラスチック容器は経済的で軽量です。金属製のクロージャーは、外部要素からの信頼性の高いバリアを提供し、飲み物を新鮮に保ち、簡単に閉じることができるパッケージの利便性を提供します。また、ブランドオーナーは、パッケージに知られ信頼されている伝統的な外観と感触を提供したいと考えているため、金属製のクロージャーを好みます。

最終用途業界に基づいて、世界のキャップ&クロージャー市場は、食品、飲料、包装水ボトル、医薬品、化粧品、自動車などに分割されています。飲料セグメントはさらにアルコールに分割されます。飲料、ノンアルコール飲料。新鮮で高品質の包装食品の需要の高まり、消費者の利便性、および食品のより長い貯蔵寿命に対する製造業者の懸念が、sと閉鎖の市場を牽引しています。多くの企業が、さまざまな食品の包装に適した幅広い種類のキャップとクロージャーを提供しています。食品の消費量の増加に伴い、キャップとクロージャーの消費量が増加しています。長い間、飲料業界はキャップとクロージャーの需要の高まりに大きく貢献してきました。しかし、最近では、これはヘルスケアなどの他の業界と密接に競合しています。飲料などのさまざまな製品グループでのディスペンシングクロージャーとポンプクロージャーの人気の高まりは、キャップ&クロージャー市場の成長に拍車をかける可能性があります。

市場細分化

p世界のキャップ&クロージャー市場は、世界中で成長している包装産業により、予測期間中に高い成長が見込まれると予想されます。キャップとクロージャーの需要は、特に発展途上国において、地域を超えたスマートシティの継続的な建設やその他の巨大建設プロジェクトによって推進されると予想されます。地域に基づいて、キャップアンドクロージャー市場は北米、ヨーロッパ、アジア太平洋、中東およびアフリカ、および南米に分割されます。中国はキャップAの最大の市場の1つになると予想されています

FAQs

What is the projected market valuation for the Caps and Closures Market in 2035?

The projected market valuation for the Caps and Closures Market in 2035 is expected to reach 104.92 USD Billion.

What was the overall market valuation of the Caps and Closures Market in 2024?

The overall market valuation of the Caps and Closures Market was 67.42 USD Billion in 2024.

What is the expected CAGR for the Caps and Closures Market during the forecast period 2025 - 2035?

The expected CAGR for the Caps and Closures Market during the forecast period 2025 - 2035 is 4.1%.

Which material type segment is projected to have the highest valuation by 2035?

The Plastic segment is projected to have the highest valuation, increasing from 30.0 USD Billion in 2024 to 46.0 USD Billion by 2035.

What are the key players in the Caps and Closures Market?

Key players in the Caps and Closures Market include Crown Holdings, Ball Corporation, Amcor, Silgan Holdings, and Berry Global.

How does the Beverage segment perform in the Caps and Closures Market?

The Beverage segment was valued at 25.0 USD Billion in 2024 and is projected to grow to 38.0 USD Billion by 2035.

このレポートの無料サンプルを受け取るには、以下のフォームにご記入ください

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”