Market Trends

Key Emerging Trends in the Recombinant DNA Technology Market

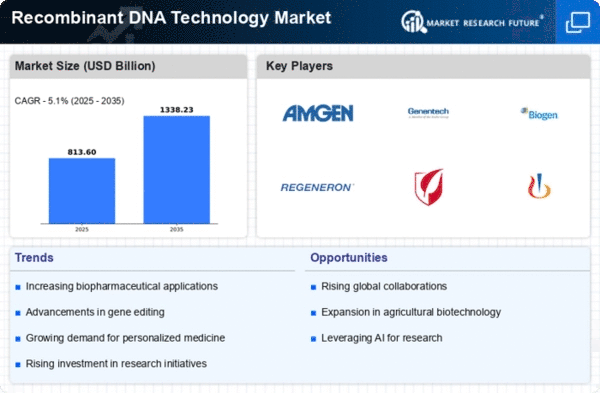

Trends in the recombinant DNA technology business are being driven by genetic engineering uses, research and development, and technology. Gene treatment can't work without recombinant DNA. Genetic engineering is being used to create new and effective treatments for rare inherited diseases. People are putting money into this field of treatment because it offers targeted and focused therapy. Recombinant DNA has changed a lot because of CRISPR technology. More options are available for functional genomics, gene therapy, and genetic change thanks to better and more precise gene editing. Genetic study and science are being changed by the widespread use of CRISPR technology. In biopharmaceuticals, recombinant DNA is used a lot. It may produce medical proteins, enzymes, and antibodies in yeast, bacteria, or human cells. Biopharmaceuticals developed recombinant DNA technology for more efficient and scalable manufacture. The use of synthetic DNA in vaccinations is intriguing. With this method, better and more effective vaccines can be developed and made. To help solve world health problems, recombinant DNA is used to make medicines against viral diseases and new bacteria. Recombinant DNA is used in synthetic biology to make new species. For bio-based things, biosensors, and biofuels, scientists make manufactured DNA structures. This pattern shows how genetic engineering can be used in non-traditional ways. Recombinant DNA technology is needed for personalized treatment to move forward. Gene editing and change make it possible to make drugs that are specific to each patient. This development is driving researchers to identify more precise and accurate treatments for many diseases. Research schools, pharmaceutical corporations, and biotech businesses collaborate increasingly. These groups will work together to create and market recombinant DNA goods and treatments by sharing their knowledge and resources. Collaborations help new ideas come to life and markets grow. To study gene expression and gene relationships in live things, recombinant DNA technology is a must. In functional genetics, scientists study how genes affect how living things work. This trend is very important. Recombinant DNA goods are made and sold with the help of regulatory officials. Making sure that methods and standards are all the same makes genetic engineering safe and effective. Customers and R&D spending go up when regulations are in place. Recombinant DNA technology is being used to deal with biocontrol and bioremediation. Engineered bacteria remove pollutants from the environment or keep bugs away. This pattern shows how genetic engineering could help solve problems with the world.

Leave a Comment