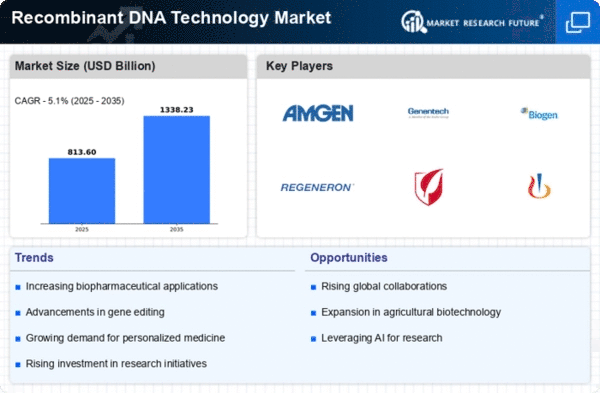

Market Growth Projections

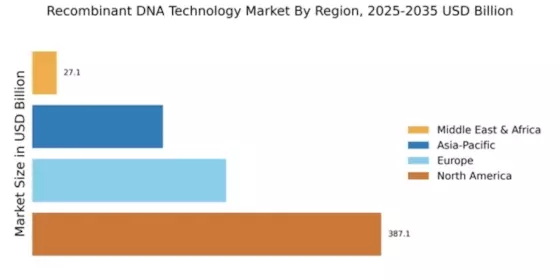

The Global Recombinant DNA Technology Market Industry is projected to experience substantial growth over the coming years. With a market value of 774.1 USD Billion in 2024, it is anticipated to reach 1338.2 USD Billion by 2035, reflecting a robust CAGR of 5.1% from 2025 to 2035. This growth trajectory indicates a strong demand for recombinant DNA technologies across various sectors, including pharmaceuticals, agriculture, and diagnostics. The increasing focus on personalized medicine, biopharmaceuticals, and sustainable agricultural practices further fuels this expansion. As the industry evolves, it is likely to play a crucial role in addressing pressing global challenges and improving health outcomes.

Rising Investments in Biotechnology

The Global Recombinant DNA Technology Market Industry benefits from increasing investments in biotechnology research and development. Governments and private entities are channeling funds into innovative projects aimed at harnessing the potential of recombinant DNA technology. For example, substantial funding initiatives are being launched to support the development of next-generation therapeutics and diagnostics. This influx of capital not only accelerates technological advancements but also fosters collaboration between academia and industry. As a result, the market is poised for expansion, with the potential to reach 1338.2 USD Billion by 2035, reflecting the growing recognition of biotechnology's role in addressing global health challenges.

Expanding Applications in Agriculture

The Global Recombinant DNA Technology Market Industry is witnessing a diversification of applications, particularly in agriculture. The use of recombinant DNA technology in developing genetically modified crops enhances yield, pest resistance, and nutritional value. This trend is increasingly relevant as global food security concerns escalate. For instance, genetically engineered crops are being adopted to withstand climate change impacts and improve food production efficiency. As agricultural biotechnology continues to evolve, the market is expected to expand, driven by the need for sustainable farming practices and increased agricultural productivity. This diversification of applications underscores the versatility of recombinant DNA technology in addressing global challenges.

Growing Awareness of Genetic Disorders

The Global Recombinant DNA Technology Market Industry is significantly impacted by the increasing awareness of genetic disorders and the need for effective treatments. As public understanding of genetic conditions expands, there is a corresponding demand for innovative therapies that leverage recombinant DNA technology. This awareness drives research initiatives focused on gene therapy and personalized medicine, which aim to provide tailored solutions for patients. The market's growth is further supported by regulatory bodies advocating for the development of gene-based therapies. Consequently, the industry is likely to experience robust growth as it addresses the unmet medical needs associated with genetic disorders.

Increasing Demand for Biopharmaceuticals

The Global Recombinant DNA Technology Market Industry experiences a notable surge in demand for biopharmaceuticals, driven by advancements in genetic engineering. As the industry evolves, the production of therapeutic proteins, vaccines, and monoclonal antibodies becomes more efficient, leading to improved patient outcomes. For instance, the market is projected to reach 774.1 USD Billion in 2024, reflecting a growing reliance on recombinant DNA technology for drug development. This trend is further supported by the increasing prevalence of chronic diseases, which necessitates innovative treatment solutions. Consequently, the biopharmaceutical sector is expected to play a pivotal role in shaping the future of the Global Recombinant DNA Technology Market Industry.

Technological Advancements in Genetic Engineering

Technological innovations in genetic engineering significantly influence the Global Recombinant DNA Technology Market Industry. The advent of CRISPR-Cas9 and other gene-editing technologies enhances the precision and efficiency of genetic modifications. These advancements facilitate the development of novel therapies and genetically modified organisms, which are crucial for agricultural and medical applications. As a result, the market is likely to witness substantial growth, with projections indicating a CAGR of 5.1% from 2025 to 2035. This growth trajectory underscores the importance of continuous research and development in driving the adoption of recombinant DNA technologies across various sectors.