Market Analysis

In-depth Analysis of Point of Care Diagnostics Testing Market Industry Landscape

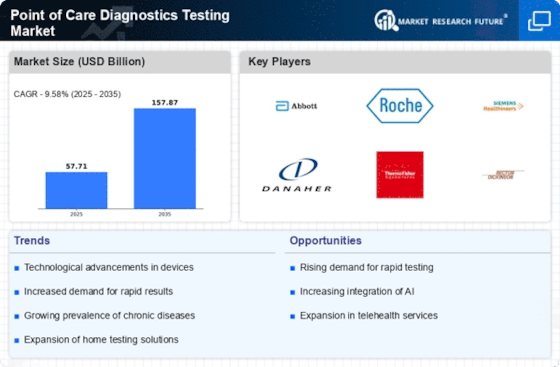

There has been a significant evolution in the market dynamics for Point-Of-Care Diagnostics/ Testing (POCT), completely transforming medical diagnostics. The term "point-of-care" refers to tests performed near patients, producing quick results that inform immediate clinical decisions. The need for faster and more convenient diagnostic solutions is one of the major factors driving growth in the POCT market. Traditionally, laboratory-based testing was characterized by lengthy procedures and delays before results were presented. Decentralization of healthcare services has played a key role in shaping the growth of the POCT market. As healthcare delivery models shift towards more community-based and patient-centric approaches, the demand for point-of-care testing has increased. POCT allows healthcare professionals to carry out diagnostic tests in various settings, including physician offices, clinics, pharmacies, or even at home. Technological advancements have been a driving force behind innovative POCT solutions. The development of portable and user-friendly testing platforms has been achieved through the miniaturization of diagnostic devices and the integration of microfluidics as well as biomolecules. Application of biosensors coupled with miniaturization techniques and microfluidic systems has enabled the production of portable and easy-to-use diagnostics. Market competition between established companies and newcomers has become fiercer, with both aiming to claim their part of the growing POCT market. Well-established diagnostic firms are expanding their portfolios on POCT through acquisitions or collaborations, while new startups bring about unique technologies along with devices. The emergence of the COVID-19 pandemic has greatly influenced these dynamics, resulting in changes within this sector. The global spread of the virus necessitates fast, widespread test administration to identify and control its spread, thus leading to an increase in demand for point-of-care test solutions. Regulatory considerations highly influence the market dynamics of POCT. For the safety and efficiency of point-of-care diagnostic devices, regulators around the world have established standards and guidelines. Getting approvals from regulators is a critical move for manufacturers because it influences product development timelines and entry into the market. The regulatory framework has also been evolving in line with peculiar challenges and opportunities presented by point-of-care testing. Also, the market dynamics of POCT depend on cost-effectiveness. In view of this, affordable point-of-care solutions are increasingly being sought as value-based healthcare gains ground. This aspect is crucial, especially in areas characterized by scarcity of resources or where healthcare decisions are greatly affected by the costs involved.

Leave a Comment