Fiber Optic Connector Size

Market Size Snapshot

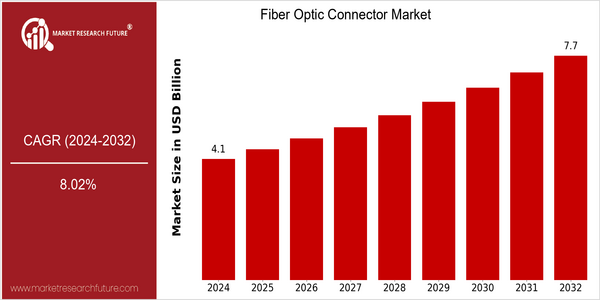

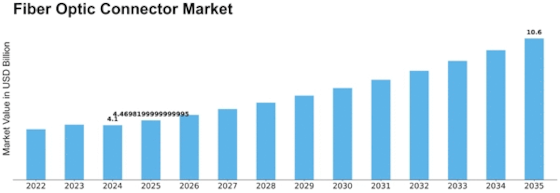

| Year | Value |

|---|---|

| 2024 | USD 4.1 Billion |

| 2032 | USD 7.7 Billion |

| CAGR (2024-2032) | 8.02 % |

Note – Market size depicts the revenue generated over the financial year

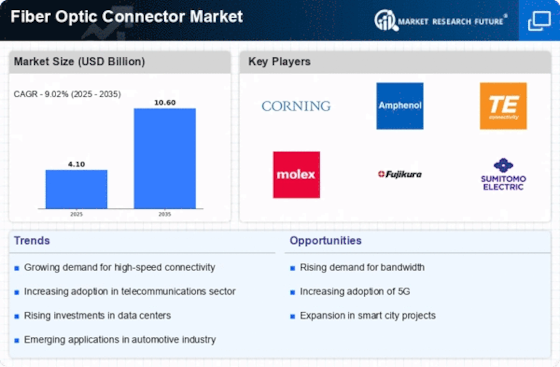

The fibre-optic connection market is expected to grow at a CAGR of 8.02% between 2024 and 2032. This upward trend is due to the increasing demand for high-speed data transmission and the spread of fibre-optic networks in various sectors, such as telecommunications, data centres and enterprise networks. The growing deployment of 5G requires the development of fibre-optic infrastructures to ensure high bandwidth and connectivity. The growing trend towards digital transformation and the Internet of Things is also driving the demand for reliable and high-performance fibre-optic solutions. Strategic initiatives, such as product launches and strategic alliances, are being undertaken by the leading players in the market, such as Corning Incorporated, Amphenol Corp. and TE Connectivity. In the past few years, the players have made significant investments in R&D and have launched next-generation fibre-optic connectors to seize the growing opportunities in the market.

Regional Market Size

Regional Deep Dive

The market for optical fiber cables is experiencing a strong growth in many regions, driven by the rising demand for high-speed Internet, the development of telecommunications, and the proliferation of data centers. Each region has its own specific characteristics, depending on the technological development, the regulatory framework and the economic situation. North America is leading in terms of innovation and rollout, while Asia-Pacific is growing rapidly, a consequence of urbanization and the digital transformation. Europe is focusing on green issues and sustainable development, while the Middle East and Africa are seeing a rise in the number of new connections due to the efforts of governments. Latin America is gradually adopting fiber-optic technology, mainly because of the increasing telecommunications investments.

Europe

- In Europe, the European Union's Green Deal is influencing the fiber optic connector market by promoting sustainable technologies and encouraging investments in eco-friendly fiber optic solutions.

- Key players like Prysmian Group are focusing on developing advanced fiber optic connectors that meet stringent environmental standards, which is expected to enhance market competitiveness.

Asia Pacific

- The Asia-Pacific region is experiencing rapid urbanization, with countries like China and India investing heavily in fiber optic infrastructure to support their growing digital economies, leading to increased demand for connectors.

- Innovations in manufacturing processes, such as the introduction of automated production lines by companies like Sumitomo Electric, are improving efficiency and reducing costs in the fiber optic connector market.

Latin America

- In Latin America, the growing demand for high-speed internet is prompting investments in fiber optic networks, with countries like Brazil and Mexico leading the way in infrastructure development.

- Regulatory support from governments to enhance telecommunications infrastructure is fostering partnerships between local and international companies, driving growth in the fiber optic connector market.

North America

- The North American market is witnessing a surge in demand for fiber optic connectors due to the expansion of 5G networks, with companies like Corning and Amphenol leading the charge in innovation and production.

- Regulatory changes, such as the Federal Communications Commission's initiatives to promote broadband access, are driving investments in fiber optic infrastructure, enhancing connectivity in rural areas.

Middle East And Africa

- Government initiatives in the Middle East, such as the UAE Vision 2021, are driving the adoption of fiber optic technology to enhance digital infrastructure, significantly impacting the fiber optic connector market.

- Companies like Ooredoo are investing in fiber optic networks to improve connectivity in underserved areas, which is expected to boost demand for fiber optic connectors.

Did You Know?

“Did you know that fiber optic cables can transmit data at speeds of up to 100 Gbps over long distances without significant loss of signal quality?” — International Telecommunication Union (ITU)

Segmental Market Size

The market for optical fibres and their associated accessories plays a crucial role in the telecommunications and data transmission industry, which is currently enjoying steady growth on the back of the growing demand for high-speed data services. The development of 5G networks, which require advanced fibre-optic solutions, will also have a positive impact on this market. In addition, the regulatory drive to provide universal access to the Internet is driving demand for fibre-optic accessories. At present, the development of fibre-optic accessories is in its commercialisation phase, with Corning and Amphenol leading the way in terms of innovation and market penetration. Significant projects in North America and Europe include the construction of large-scale metropolitan networks. Applications for this technology are predominantly in telecommunications, data centres and automation, where high-speed data transmission is essential. The trend towards more sustainable building materials and the need to improve urban transport systems are accelerating the growth of this market. New developments in the field of smart materials and smart connections are shaping the evolution of the market.

Future Outlook

The fibre-optic connector market is expected to grow at a CAGR of 8.02% between 2024 and 2032. This growth is mainly due to the increasing demand for high-speed Internet and the increasing number of data centers, which need advanced connections to support the growing data traffic. Moreover, as organizations continue to invest in digital transformation, the use of fibre-optic technology is expected to increase in various industries, such as telecommunications, health, and automobiles, which will positively affect the overall market dynamics. Furthermore, the development of high-density connectors and the improvement in the manufacturing process are expected to further drive market growth. Government initiatives, such as smart city projects and the expansion of broadband, are also expected to create opportunities for fibre-optic network investment. The trend of integrating fibre-optic technology into 5G networks and the Internet of Things (IoT) will also play a key role in shaping the future development of the market. As these two technologies mature, the demand for reliable and efficient fibre-optic connections will continue to rise, which will further drive the market growth.

Leave a Comment