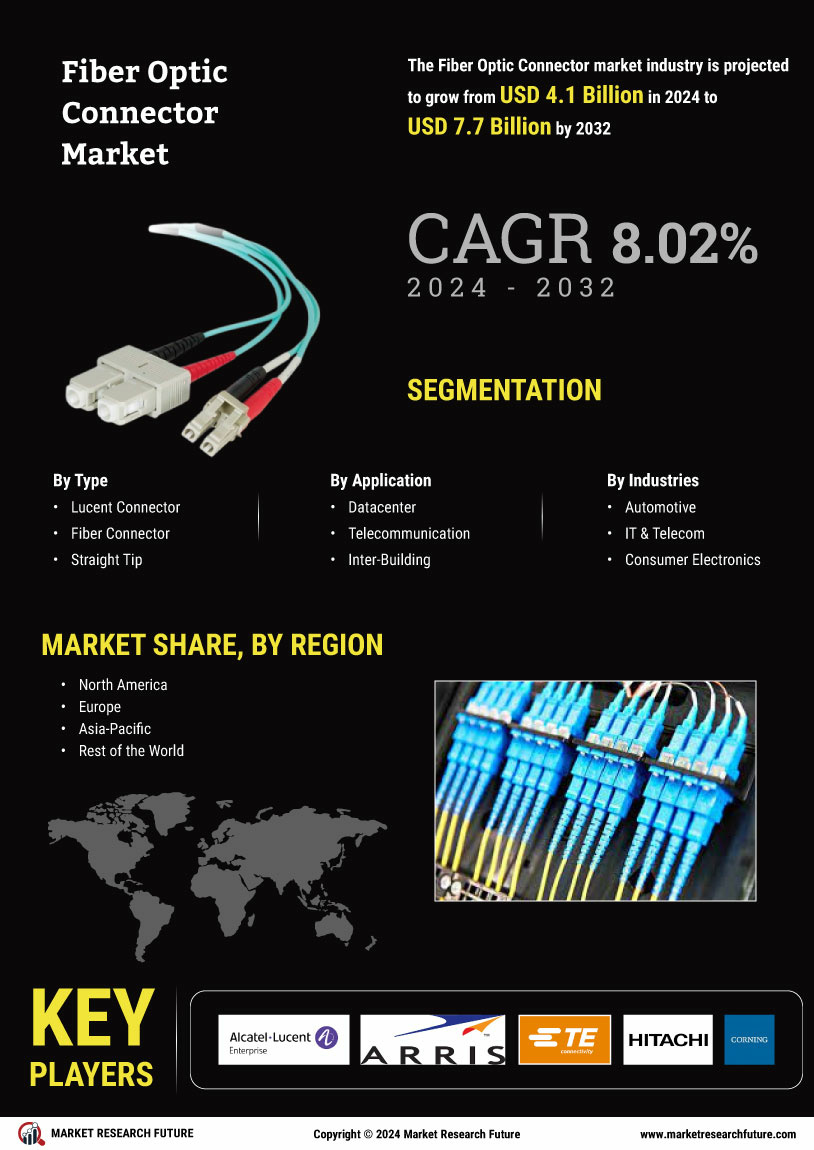

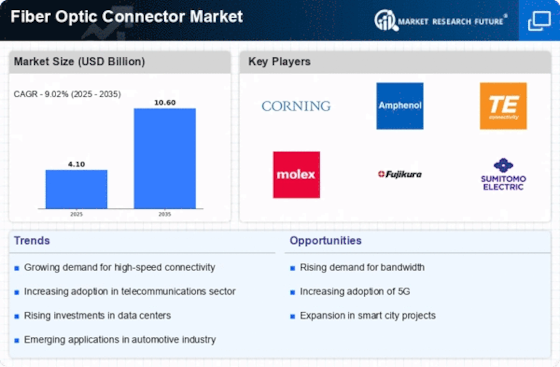

Increasing Data Traffic

The Fiber Optic Connector Market is experiencing a surge in demand due to the exponential growth of data traffic. As more devices connect to the internet and data consumption rises, the need for high-capacity fiber optic networks becomes paramount. Reports indicate that global internet traffic is projected to reach 4.8 zettabytes per year by 2022, necessitating robust infrastructure. Fiber optic connectors play a crucial role in ensuring efficient data transmission, thereby supporting the backbone of modern communication networks. This increasing data traffic is likely to drive investments in fiber optic technologies, further propelling the Fiber Optic Connector Market.

Emergence of Smart Cities

The concept of smart cities is gaining traction, which is likely to impact the Fiber Optic Connector Market positively. As urban areas evolve to incorporate smart technologies, the demand for reliable and high-speed communication networks increases. Fiber optic connectors are integral to the infrastructure that supports smart city initiatives, including traffic management, public safety, and energy efficiency. The Fiber Optic Connector Market is anticipated to reach USD 2.57 trillion by 2025, indicating a substantial opportunity for fiber optic technologies. This trend suggests that the Fiber Optic Connector Market will play a pivotal role in the development of smart urban environments.

Technological Advancements

Technological innovations are significantly influencing the Fiber Optic Connector Market. The development of advanced connectors, such as LC, SC, and MPO, enhances performance and reliability in various applications. These advancements facilitate faster data transmission rates and improved signal integrity, which are essential for meeting the demands of contemporary communication systems. Furthermore, the integration of automation and smart technologies in fiber optic networks is expected to streamline installation and maintenance processes. As a result, the Fiber Optic Connector Market is likely to benefit from these technological enhancements, fostering growth and efficiency.

Growing Demand in Data Centers

The Fiber Optic Connector Market is significantly influenced by the expanding data center sector. As organizations increasingly rely on cloud computing and big data analytics, the need for efficient data management and storage solutions intensifies. Fiber optic connectors are essential for ensuring high-speed connectivity within data centers, facilitating rapid data transfer and minimizing latency. The data center market is projected to grow at a CAGR of 12% from 2021 to 2026, which suggests a corresponding increase in the demand for fiber optic connectors. This growth trajectory highlights the importance of fiber optics in supporting the infrastructure of modern data centers.

Rising Adoption in Telecommunications

The telecommunications sector is a primary driver of the Fiber Optic Connector Market. With the ongoing rollout of 5G networks, there is an increasing need for high-performance fiber optic connectors to support the infrastructure. The transition from traditional copper-based systems to fiber optics is becoming more prevalent, as fiber optics offer superior bandwidth and lower latency. Market data suggests that The Fiber Optic Connector Market is expected to grow at a CAGR of 10.5% from 2021 to 2026, indicating a robust demand for fiber optic connectors. This trend underscores the critical role of fiber optic technology in modern telecommunications.