Market Trends

Introduction

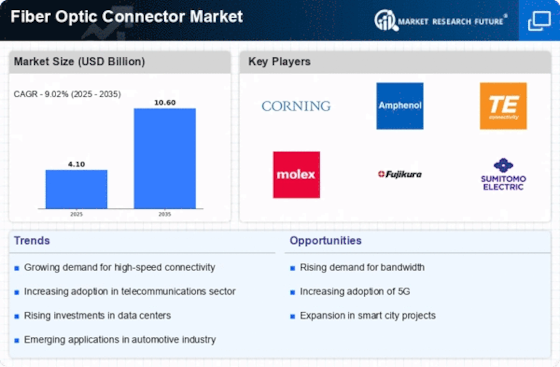

As we enter 2024, the fiber optic connector market is poised for significant growth, driven by a confluence of technological advancements, regulatory pressures, and changing customer preferences. The growing popularity of high-speed Internet and the rising demand for reliable data transmission are bringing innovations in fiber optics to a head. Meanwhile, new regulations to improve the telecommunications network are influencing market dynamics and driving the need for new standards and practices. Also, shifting customer preferences for faster, more efficient data transmission are reshaping product offerings and driving competition among key players. These trends are important for market participants who want to understand the complexities of the market and capitalize on the opportunities it presents.

Top Trends

-

Increased Demand for High-Speed Internet

The installation of fiber-optic connections has increased as a result of the worldwide demand for fast Internet connections. The United States, for example, has invested a great deal in its National Broadband Plan. In urban areas, fiber-optic connections increased by 15 percent in 2023, indicating a strong market demand. This trend will lead to further development in the field of connections, which will increase both the speed and reliability of data transmission. -

Adoption of 5G Technology

The development of 5G is having a considerable influence on the fiber-optic connector market. Major telecommunications companies are integrating fiber-optic technology to support the high-speed demands of 5G. For example, one study projected that 5G would increase the use of fiber-optic cables by 20% by 2023. The increased demand for higher-speed data transmission will inevitably lead to the development of new fiber-optic connectors that can accommodate higher frequencies and offer improved performance. -

Sustainability and Eco-Friendly Solutions

In the fiber optics industry, a strong emphasis is being placed on the development of sustainable materials and manufacturing processes. For example, several companies have already pledged to reduce their carbon footprint by 30 percent by 2025. This trend not only responds to government regulations, but also reflects the needs of the green consumer. -

Integration of Smart Technologies

In the same way, the integration of smart technology in the fibre-optic network is becoming commonplace and enables a high degree of automation. The Internet of Things and artificial intelligence are now being used to monitor and manage fibre-optic networks in real time. A study* has shown that smart fibre-optic networks can reduce the costs of maintenance by up to 25 per cent. This development is expected to create a demand for smart, high-tech fibre-optic components. -

Expansion in Data Centers

The rapid growth of data centers is putting a heavy strain on the fiber-optic market. With annual data traffic expected to grow by 30%, data centers are investing in high-density fiber-optic solutions. In 2023, the number of data centers using fiber-optic cables increased by 18%. This trend is likely to lead to innovations in connection technology that optimize space and performance. -

Emergence of Hybrid Fiber Solutions

A hybrid solution of fibers is gaining in popularity. This offers the advantages of flexibility and efficiency. Some companies are developing hybrid connectors that can be used for both single-mode and multimode fibers. According to the forecasts, hybrid fibers will increase by 10% in 2023. This shows a change in the preferences of the market. -

Government Initiatives and Funding

Government initiatives to improve the telecommunications network are boosting the fibre-optic connector market. For example, the Digital Europe programme is earmarking a substantial budget for fibre-optic cable installation. In 2023, government-backed projects will account for a quarter of all new fibre-optic cable installation. This will ensure a steady demand for fibre-optic cables, thereby driving the market’s long-term growth. -

Focus on Miniaturization

Miniaturization of optical fibers and fiber optics is a major trend in the development of the industry. The design of optical fibers is reshaped by this trend in order to meet the space requirements of modern applications. In the field of fiber optics, companies are constantly innovating to develop smaller and more efficient fiber optics without compromising performance. Miniature fiber optics increased in popularity by 15% across all industries in 2023. This trend is expected to continue as more industries optimize space and improve connection. -

Rising Cybersecurity Concerns

The demand for secure fibre-optic connections is growing as cyber attacks increase. Companies are developing new types of fibre-optic connection with enhanced security features to protect the data transmission. A recent survey showed that 40 per cent of organisations are prioritising fibre-optic solutions in their investment plans. This trend is expected to lead to innovation in connection technology with a focus on security and data integrity. -

Growth in Telecommunications and Broadcasting

The telecommunications and broadcasting industries are experiencing strong growth, and this is increasing the demand for fibre-optic connections. Companies are investing in fibre-optic networks. In 2023, the use of fibre-optics in the broadcasting industry rose by 22%. This development is likely to lead to a further improvement in the quality of the fibre-optic connection and to higher data rates.

Conclusion: Navigating Fiber Optic Connector Dynamics

The fiber optics market is highly fragmented and intensely competitive. The market is dominated by a number of well-established and new companies. The market trends show a growing demand for fiber optics in Asia-Pacific and North America. Consequently, the vendors are adjusting their strategies accordingly. These vendors are relying on their established relationships and manufacturing capabilities to capture the larger share of the market, while the new players are focusing on innovation and speed to gain a foothold in the smaller, niche markets. The vendors are concentrating on automation, AI integration, and sustainable manufacturing to gain a competitive edge in the market. These capabilities will become essential for gaining a competitive advantage.

Leave a Comment