Market Share

Introduction: Navigating the Competitive Landscape of Fiber Optic Connectors

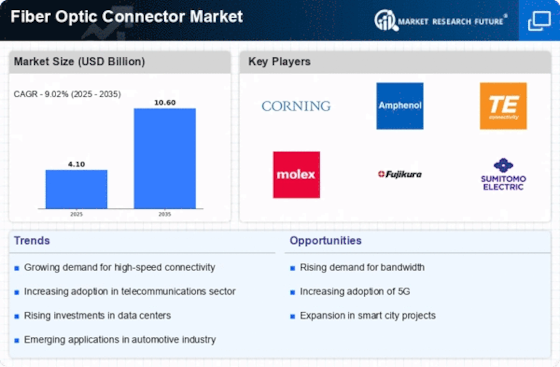

Optical fiber is a rapidly growing market, driven by technology changes, the evolution of regulatory frameworks, and the increasing need for performance and connection. The main players, including the original equipment manufacturers, IT service providers, and network operators, are striving for market leadership through strategic alliances and product innovations. Meanwhile, new entrants, such as the artificial intelligence start-ups, are utilizing new advanced technology such as AI-based data analysis and IoT integration to enhance operational efficiency and customer experience. The companies are now repositioning themselves as technology-driven companies, focusing on automation and green solutions to meet the needs of the sustainable development. Strategic deployments are emerging in Asia-Pacific and North America to meet the growing need for speed and smart cities. This report provides an in-depth understanding of the current state of the optical fiber industry. It also provides an outlook for the future and the opportunity for C-level managers and strategic planners to take advantage of the evolving industry.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions encompassing various aspects of fiber optic connectivity.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Alcatel-Lucent SA | Strong telecom infrastructure expertise | Telecommunications solutions | Global |

| TE Connectivity Ltd. | Diverse product portfolio | Connectivity solutions | Global |

| Hitachi Ltd. | Advanced technology integration | Optical networking | Asia, North America |

| Corning Cable Systems LLC | Leader in optical fiber technology | Fiber optic cables and connectors | Global |

Specialized Technology Vendors

These vendors focus on niche technologies and innovative solutions within the fiber optic connector space.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Arris Group Inc. | Expertise in broadband solutions | Data and video connectivity | North America, Europe |

| The 3M Company | Innovative adhesive technologies | Fiber optic splicing and connectors | Global |

| Optical Cable Corporation | Custom solutions for unique applications | Specialty fiber optic cables | North America |

| Hirose Electric Co. Ltd. | High-performance connector designs | Precision connectors | Asia, North America |

Infrastructure & Equipment Providers

These vendors supply essential infrastructure and equipment for fiber optic networks.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Amphenol Aerospace | Robust aerospace-grade connectors | Aerospace and military applications | Global |

| Sumitomo Electric Industries, Ltd. | Expertise in fusion splicing technology | Fiber optic splicing equipment | Asia, North America |

Emerging Players & Regional Champions

- Optical Solutions Inc., USA: specializes in fiber-optic interconnection devices and data-center-customized solutions. It recently obtained a contract to supply new data-centers with fiber-optic interconnection devices. Its products are more flexible and scalable than those of established suppliers.

- A company that specializes in fiber optics and whose production is based on sustainable manufacturing, and that has recently completed a project for a European telecommunications company to modernize its network, complements the offerings of the large established suppliers and caters to the growing demand for green technology.

- ConnectWise Fiber (Australia): With its modular fibre-optic connectors, it offers a quick way to get fibre to remote locations. It has recently teamed up with a government initiative to improve rural communications, and is positioning itself as a challenger to the big vendors by focusing on the less developed markets.

- Asia Fiber Optics, China, provides fiber-optic connections at reasonable prices for the Asian market. It recently won a contract to supply a regional telecommunications company with fiber-optic connectors for a nationwide network. Its price and service are comparable to those of the established companies.

Regional Trends: In 2024 the spread of fibre-optic technology in the Asia-Pacific and European regions increases significantly, driven by the demand for high-speed internet and 5G networks. Companies are increasingly specializing in sustainable and flexible solutions to meet the need for rapid deployment in remote areas. Customization and flexibility are gaining in importance and newcomers are carving out niches in the market, which challenge established players.

Collaborations & M&A Movements

- The partnership between Corning and CommScope will lead to the development of a new generation of fiber-optic connections that will enhance data center efficiency and reduce installation time, enabling the companies to better compete in the growing data center market.

- TE Connectivity acquired the fiber optics division of Molex in early 2024 to expand its product portfolio and market share in the high-speed connectivity segment, responding to increasing demand for advanced telecommunications infrastructure.

- The two companies are collaborating to improve the performance and reliability of optical fibers and their connections, which they hope will enhance their respective positions in the telecommunications industry.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| High-Speed Data Transmission | Corning, Amphenol | Corning has implemented advanced fiber optic technology that supports data rates exceeding 400 Gbps, making it a leader in high-speed applications. Amphenol's connectors are designed for low insertion loss, enhancing performance in data centers. |

| Durability and Reliability | TE Connectivity, Molex | TE Connectivity offers ruggedized connectors that withstand harsh environments, evidenced by their use in military applications. Molex's connectors are known for their robust design, ensuring long-term reliability in industrial settings. |

| Ease of Installation | Panduit, Belden | Panduit's innovative plug-and-play solutions simplify installation processes, reducing labor costs. Belden's pre-terminated fiber assemblies are designed for quick deployment, which has been well-received in commercial projects. |

| Sustainability Initiatives | CommScope, Furukawa Electric | CommScope has committed to sustainable practices by using recyclable materials in their connectors. Furukawa Electric has developed eco-friendly fiber optic solutions that minimize environmental impact, aligning with global sustainability goals. |

| Customization and Flexibility | Huber+Suhner, Nexans | Huber+Suhner offers customizable fiber optic solutions tailored to specific customer needs, enhancing their market appeal. Nexans provides flexible connector options that cater to various applications, from telecommunications to industrial use. |

Conclusion: Navigating Fiber Optic Connector Dynamics

The fiber optics market is highly fragmented and highly competitive. The market is characterized by a large number of players. The suppliers have been adjusting their strategies to meet the demand in Asia-Pacific and North America. The big companies have benefited from their brand loyalty and long-standing relationships, while the smaller companies have been able to capture niche markets through innovation and speed. The future market leaders will be those with the most capable capabilities such as artificial intelligence, automation of manufacturing processes, sustainable initiatives and flexible operations. As managers navigate this changing landscape, they will need to align their product offerings with these capabilities to gain a sustainable advantage.

Leave a Comment