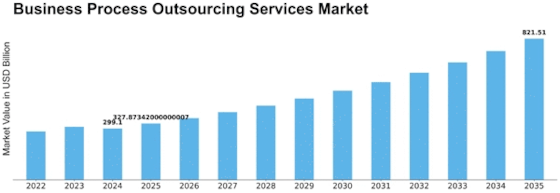

Business Process Outsourcing Services Size

Business Process Outsourcing Services Market Growth Projections and Opportunities

Many things affect the BPO services market and they all together decide how it works. A big factor is lowering prices. Businesses look to outsourcing as a smart way to cut down on running costs. By giving non-main tasks to outside helpers, businesses can save on costs that come from having more things. They also get special skills and pay less for their workers. This money-focused way is still a key factor in the choice businesses make when they look at BPO services. World events have a big impact on the market for BPO Services. When businesses grow and work in different places, it becomes very important to have fast processes that are the same everywhere. BPO services help businesses grow all over the world and keep things uniform.

This makes it easy for them to work in different places without any hassle. This factor is very important in jobs like money and computers worldwide, because one can easily send work to other parts of the world. This makes it easy for these companies to have a global reach all around. The BPO Services Market is heavily affected by progress in technology. The use of digital tools, like AI and RPA along with cloud computing has changed how outsourcing works. Firms look for BPO companies that can add these high-tech tools into their workflows. This makes them more efficient, accurate and able to handle bigger tasks. BPO services need to keep up with technology changes.

This is important for clients' changing needs in a fast-growing digital world of business. Following the rules is very important in the BPO Services Market. Different areas and businesses have particular laws that cover privacy, safety of data, and methods specific to their industry. BPO service companies have to deal with tricky laws and rules to check that they follow what the law says. BPO firms need to create strong rules for following the law and meet industry standards. This helps clients trust them more and reduces risks of not meeting government requirements by chance.

The number of skilled workers is a big thing that affects the BPO Services Market. As companies try to give away certain jobs, they search for BPO service providers who have a bunch of talented workers. BPO centers often pick places with lots of skilled people. This can affect where they decide to outsource work. The skills and abilities of workers in jobs like customer service, money matters and computer stuff are very important. They decide how good BPO teamwork is.

Leave a Comment