Market Analysis

In-depth Analysis of Bioelectronic Sensors Market Industry Landscape

The Bioelectronic Sensors Market is shaped by dynamic market forces that influence its growth, evolution, and competitiveness. One key market dynamic is the increasing prevalence of chronic diseases worldwide. As chronic conditions continue to rise, the demand for advanced diagnostic and monitoring solutions, such as bioelectronic sensors, grows exponentially. These sensors play a crucial role in providing real-time, accurate, and personalized health information, contributing to improved disease management and healthcare outcomes.

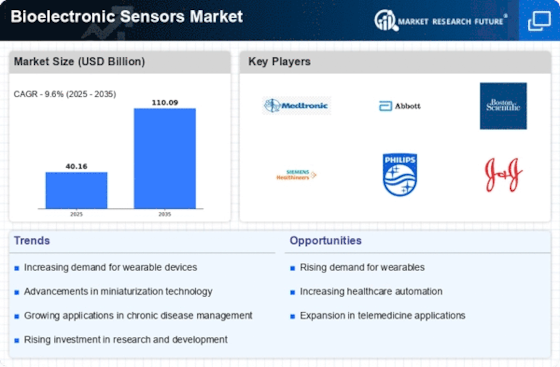

Technological advancements stand out as a prominent market dynamic driving the Bioelectronic Sensors Market. Continuous research and development efforts lead to the introduction of more sophisticated sensor technologies. Miniaturization, enhanced sensitivity, and improved connectivity are key trends propelling the market forward. These technological innovations not only enhance the performance of bioelectronic sensors but also expand their applications across diverse sectors, including healthcare, fitness, and beyond.

Regulatory dynamics play a pivotal role in shaping the Bioelectronic Sensors Market. The healthcare industry is subject to stringent regulations and standards to ensure the safety and efficacy of medical devices. Compliance with these regulations is imperative for market players to gain necessary approvals and commercialize their bioelectronic sensor products. The evolving regulatory landscape influences product development strategies, market entry timelines, and overall market competitiveness.

Market competition is another dynamic that significantly impacts the Bioelectronic Sensors Market. The sector is characterized by a mix of established companies and emerging players, fostering a competitive environment. Key players often engage in strategic collaborations, partnerships, and mergers and acquisitions to gain a competitive edge, expand their product portfolios, and increase market share. The competition in the market not only drives innovation but also contributes to continuous improvements in bioelectronic sensor technologies.

Economic factors and funding dynamics also play a role in the market dynamics of bioelectronic sensors. The availability of funds and favorable investment climates support research and development activities in the sector. Government initiatives and funding programs aimed at promoting healthcare technologies and innovations further fuel market growth. Economic stability, funding support, and investment opportunities contribute to the overall vibrancy of the Bioelectronic Sensors Market.

Consumer awareness and acceptance are integral components of market dynamics. As awareness of the benefits of personalized medicine and real-time health monitoring increases, the demand for bioelectronic sensors rises. Educating healthcare professionals, institutions, and end-users about the applications and advantages of these sensors is essential for market expansion. Market dynamics are positively influenced by the growing acceptance of bioelectronic sensors as valuable tools in improving patient outcomes and enhancing healthcare delivery.

Globalization and international market dynamics also impact the Bioelectronic Sensors Market. Companies operating in this sector need to navigate diverse regulatory frameworks, cultural differences, and market preferences across regions. Understanding and adapting to these international dynamics are essential for successful market entry and sustained growth on a global scale.

Leave a Comment