Market Trends

Introduction

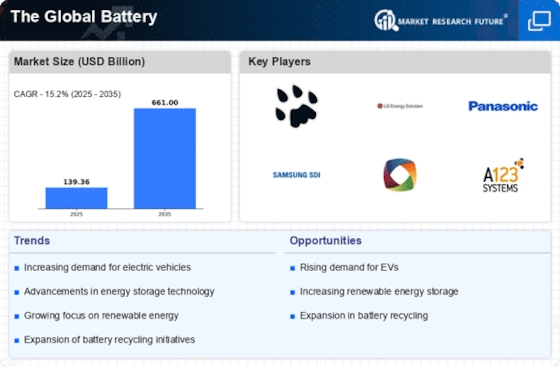

At the beginning of 2024, the Battery Market is undergoing a major transformation, driven by a combination of macro-factors, such as rapid technological development, changing regulatory frameworks and changing consumer preferences. Various innovations in the field of chemistry and energy density are improving the performance and the environment of batteries. Tightening regulations on CO2 emissions are driving the industry to adopt more sustainable production methods. Meanwhile, the growing demand for electric vehicles and storage solutions for renewable energy is changing the way people use electricity and driving and leading to a rise in investment in batteries. These trends are strategically important for all market participants, as they not only influence the positioning of the industry but also determine the future of energy storage and mobility solutions.

Top Trends

-

Increased Demand for Electric Vehicles (EVs)

A booming market for electric vehicles (EVs) is driving the demand for batteries, with a projected 30 million units to be sold by 2030. Governments are providing incentives for consumers to buy EVs, as in the United States with tax breaks and in Europe with stricter emissions standards. The trend is pushing manufacturers to improve battery technology, leading to greater energy density and faster charging. The operational impact is to increase production capacity and adjust the supply chain to meet the growing demand. -

Advancements in Solid-State Batteries

The solid-state batteries are gaining ground because of their greater energy density and safety over the lithium-ion batteries. In 2025, they are expected to represent up to 20 per cent of the market. The shift to solid-state batteries would mean lower costs and better performance for the e-mobility sector. But it would also require new production methods and new materials. -

Recycling and Sustainability Initiatives

With the growing production of batteries, the focus is increasingly on the environment and the re-use of batteries. By establishing closed systems, companies can recover the valuable materials in the batteries and by 2030 the percentage of batteries that are recycled is expected to be 90%. The government also wants to increase battery re-use and thereby influence business strategies. This is not only a question of the environment, but also of the raw material, which is used and thus of the circular economy. -

Integration of AI and IoT in Battery Management

The intelligent battery is a battery that combines the Internet of Things and artificial intelligence. Its performance and service life are greatly improved by the Internet of Things and artificial intelligence. The intelligent battery has sensors that monitor its health and optimizes the charging cycle, resulting in an increase of up to 30 percent in energy efficiency. This is an advanced technology that can reduce operating costs and improve the experience of users. Predictive maintenance and remote monitoring are also possible in the future. -

Expansion of Battery Storage Solutions

Large batteries are the most promising solution for energy storage. With the ever-increasing use of solar and wind energy, a stable grid is becoming increasingly important. Industry estimates predict that by 2025 the global market for batteries will reach 200 GWh. This trend is causing companies to invest in scalable solutions, which is affecting their production and distribution strategies. -

Emergence of Alternative Chemistries

In consequence of the lithium shortage, research into other batteries, such as sodium-ion and lithium-sulfur, is gaining ground. These alternatives might offer cheap and sustainable solutions. Sodium-ion batteries are expected to enter commercial production by 2025. Lithium-ion markets may then be disrupted. This could force lithium-ion manufacturers to diversify their products and respond to changing consumer demands. -

Government Policies Supporting Battery Innovation

Governments around the world are promoting the development of batteries and are supporting research and development. For example, the U.S. Department of Energy has allocated significant resources to the development of batteries. These policies will increase the performance of batteries and reduce their costs. The practical outcome is that the public and private sectors will work together more closely and this will help to develop the innovation system. -

Focus on Fast-Charging Technologies

The demand for fast-charging solutions is rising, especially in the EV sector where consumers are looking for convenience. Companies are developing ultra-fast charging systems that can charge batteries in less than half an hour. This trend is expected to increase the uptake of EVs and also affect the development of charging stations and investment strategies. Future developments could result in a shift towards the development of a fast-charging network. -

Growth of Battery-as-a-Service (BaaS) Models

For example, in the case of a company, a battery-as-a-service model is a flexible solution that allows the customer to pay for the use of the battery rather than the ownership of the battery. This is a trend that is gaining ground in the field of electric mobility and the storage of renewable energy. A company that has adopted this model reduces the cost of entry and increases customer retention. This has an operational impact on the company by requiring new business models and strategies. -

Increased Focus on Safety Standards

The batteries have developed and become more complex, the standards for safety have to be kept up. Authorities are tightening the rules to prevent accidents caused by battery failures. Companies are investing in safety certification and in testing, which increases costs but strengthens consumer confidence. The next step will probably be to standardize the industry's safety regulations, which will have a direct influence on product design and manufacturing.

Conclusion: Navigating the Competitive Battery Landscape

The battery market in 2024 will be marked by intense competition and significant fragmentation, with both the established and the new players vying for market share. Regional trends are pointing to a trend towards more localized production and innovation, particularly in Asia and North America, where regulatory and sustainable development concerns are reshaping strategies. Suppliers are concentrating on the development of new capabilities such as data analysis, automation of manufacturing processes and sustainable development to gain a competitive advantage. As the market evolves, those who can show flexibility in their offerings and adapt to changing customer needs are likely to come out on top. Strategic alliances and research and development investments will be crucial to companies that want to secure their position in this fast-changing market.

Leave a Comment