Market Share

Introduction: Navigating the Competitive Landscape of the Battery Market

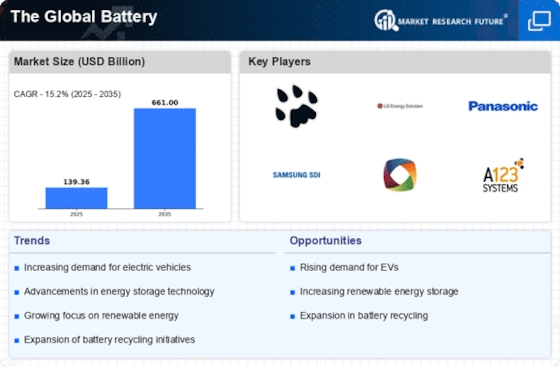

The battery market is going through a transformation. The competition is getting stronger because of the fast development of technology, the stricter regulatory framework and the changing expectations of consumers for both performance and sustainability. The major players, such as system houses, IT companies and system suppliers, are competing for leadership with strategic alliances and new solutions. The system houses are investing in automation and artificial intelligence to increase production efficiency. The IT companies are integrating IoT capabilities to optimize battery management systems. The system suppliers are developing new battery chemistries and implementing advanced recycling methods. And the new players, especially the green technology companies, are challenging the established business models with biometrics and advanced recyclate technology. The geographical opportunities are especially strong in Asia-Pacific and North America, where strategic trends are in line with government incentives and increasing demand for electric vehicles and storage solutions for renewable energy. These strategic developments will be crucial for all actors who want to succeed in this rapidly changing market by 2024-25.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive battery solutions, integrating various technologies and services to meet diverse customer needs.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Panasonic Corporation | Strong R&D and manufacturing capabilities | Lithium-ion batteries | Global |

| LG Chem | Leading in battery chemistry innovation | Advanced lithium batteries | Asia, North America, Europe |

| Johnson Controls Inc | Diverse energy storage solutions | Automotive and industrial batteries | North America, Europe |

Specialized Technology Vendors

These companies focus on niche battery technologies, providing specialized products for specific applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Saft Groupe | Expertise in high-performance batteries | Industrial and aerospace batteries | Europe, North America |

| Exide Technologies | Strong legacy in lead-acid technology | Lead-acid batteries | Global |

| The Furukawa Battery Co. Ltd. | Innovative lead-acid solutions | Lead-acid batteries | Asia, North America |

Infrastructure & Equipment Providers

These vendors supply the necessary infrastructure and equipment for battery production and management.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Chaowei Power Holding Ltd. | Strong domestic market presence | Lead-acid batteries and components | China |

| Penn Manufacturing Company Inc | Custom battery solutions for niche markets | Specialty batteries | North America |

| Fengfang Co. Ltd. | Cost-effective battery solutions | Lead-acid batteries | Asia |

| Delphi Automotive | Integration of battery systems in vehicles | Automotive battery systems | Global |

Emerging Players & Regional Champions

- Northvolt (Sweden): Specializes in sustainable lithium-ion batteries, recently secured a contract with BMW for battery supply, challenging established players like LG Chem by focusing on green manufacturing processes.

- QuantumScape (USA): Develops solid-state battery technology with a focus on electric vehicles, recently partnered with Volkswagen for large-scale production, positioning itself as a competitor to traditional lithium-ion battery manufacturers.

- AIONICS (Germany): This company has developed and is deploying an advanced battery management system that uses artificial intelligence to optimize battery performance. It has already implemented its system for a number of European EV manufacturers and has enhanced the product offerings of established battery suppliers.

- The United States' Amprius Technologies has been developing high-energy lithium-ion batteries for aircraft and electric vehicles. It has just announced a partnership with a major aircraft manufacturer, and it is now challenging conventional batteries with its silicon-nanowire anode.

- Farasis Energy (China): a producer of high-performance lithium-ion batteries for electric vehicles and energy storage systems. It has recently expanded its production capacity in Europe, and it is now competing with established Chinese manufacturers in the region.

Regional Trends: In 2024, there is a significant shift towards more sustainable batteries, especially in Europe and North America, prompted by regulatory pressures and the growing demand for greener solutions. There are significant advances in solid-state and high-energy-density batteries, which are gaining ground. In the meantime, the Asia-Pacific region remains the most important manufacturing region. The new entrants increasingly focus on niche markets and new technologies in order to differentiate themselves from the established players.

Collaborations & M&A Movements

- Tesla and Panasonic expanded their partnership to enhance battery cell production at the Gigafactory in Nevada, aiming to increase supply chain efficiency and reduce costs amidst rising demand for electric vehicles.

- LG Energy Solution acquired a 51% stake in a joint venture with Honda to develop advanced battery technologies for electric vehicles, positioning itself as a leader in the growing EV battery market.

- Samsung SDI and BMW entered into a long-term supply agreement to provide high-performance battery cells for the next generation of electric vehicles, strengthening their competitive positioning in the automotive sector.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Energy Density | Tesla, LG Chem, Panasonic | In the next step, the 4680 cell is supposed to improve the energy density of the battery and thus the range of the car. The NCM technology developed by LG Chem, which is based on N-doped carbon material, has been used in many electric vehicles. |

| Sustainability | Northvolt, BMW, Tesla | The Northvolt group has specialised in the production of batteries with a view to a sustainable production, and makes use of materials which have been recycled and energy which is renewable. The materials for the batteries are procured in a responsible way. The aim is to close the circle, so to speak, with a closed-loop battery life cycle. |

| Fast Charging | Porsche, ABB, Ionity | With its 800 volt architecture, the Taycan is capable of ultra-fast charging, reducing the time between refueling and driving. Across Europe, ABB and Ionity are leading the development of high-voltage charging stations, which will enable electric vehicles to be recharged much more quickly. |

| Battery Management Systems (BMS) | A123 Systems, Nuvation Energy | A123 System provides advanced BMS solutions that enhance the performance and safety of batteries, especially in the automobile. Nuvation Energy offers customized BMS solutions to optimize the life and efficiency of batteries in various industries. |

| Recycling and Second Life Applications | Li-Cycle, Redwood Materials | The Li-Cycle Company has invented a hydrometallurgical process for the recovery of the materials from lithium-ion batteries. Redwood Materials is a specialist in the circular economy of batteries, focusing on second-life applications and the recovery of materials. |

Conclusion: Navigating the Competitive Battery Landscape

In 2024 the battery market will be characterized by intense competition and a large degree of fragmentation. Both established and new players will compete for a share of the market. Regional developments point to a trend towards more localized production and innovation, especially in Asia and North America. Regulatory and social requirements are reshaping business strategies. In order to gain a competitive edge, the market players are increasingly focusing on their artificial intelligence-based data analysis, automation and sustainable production processes. The most agile companies, who can adapt quickly to changing customer needs, are likely to be the market leaders. Strategic alliances and R&D investments will be essential for companies that want to position themselves strategically in this rapidly changing market.

Leave a Comment