Market Trends

Introduction

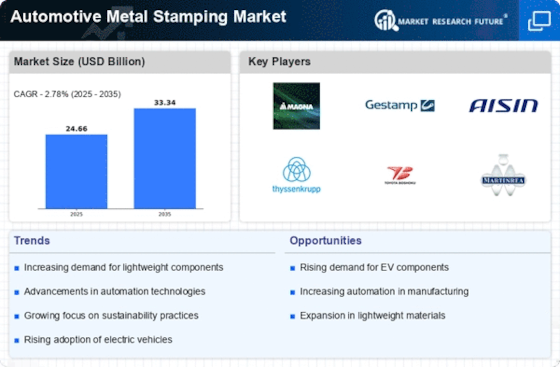

In 2023, the world market for automobile stampings will be undergoing significant changes. The increasing use of automation and smart manufacturing technology is bringing greater precision and efficiency to the production process. Stringent new regulations are driving the industry towards more sustainable production methods and materials. The growing preference among consumers for lightweight and fuel-efficient vehicles is influencing the design and material composition of automobile components. These trends will be important to the industry's strategic planning, as it responds to competition, regulatory changes, and the expectations of a growing number of consumers who are becoming more aware of the environment.

Top Trends

-

Sustainability Initiatives

The governments of the world are promoting the establishment of the industry on a sound basis. The European Green Deal is an example of this. The industry is adopting a policy of using scrap metal in the manufacture of metal stampings. Ford, for example, has promised to use 25 per cent of recycled materials in its cars by 2025. The industry is changing its methods, investing in new and greener technology. And there will be further developments in the future. There will be stricter regulations and an increase in the demand for products of a sustainable nature. -

Advanced Automation and Robotics

The use of automation in the forming of sheet metal is a rapidly growing trend. The integration of advanced robots in the production of sheet metal parts is an example of this. According to industry reports, automation can reduce the cost of production by up to 30 percent. This trend is reshaping the labor market, requiring the skills of a technologically skilled workforce. Future developments could lead to a completely automatic stamping plant, further reducing the time required to produce parts and reducing the possibility of human error. -

Lightweight Materials Adoption

Lightweight materials are used in the manufacture of automobiles to reduce fuel consumption. The use of aluminum and high-strength steel is on the increase in the stamping of automobiles. For example, the use of aluminum for many parts in BMW has reduced the weight of the automobile by 20 percent. This trend is reflected in the design and manufacturing of automobiles and requires new stamping techniques. In the future, more research is necessary to develop even lighter materials to meet increasingly strict fuel consumption requirements. -

Digital Twin Technology

In the field of automobile stamping, digital twins are changing the industry. They make it possible to simulate and monitor the stamping process in real time. General Motors is using this technology to optimize production. Reports indicate that digital twins can reduce downtime by 30 percent. Predictive maintenance and operational efficiency are gaining ground. In the future, digital twins will be able to derive insights from the data, and this will make it possible to continuously improve the process. -

Customization and Flexibility

Customized car parts are in great demand, and this has led to an increase in the number of stamping presses. Companies such as Volkswagen are investing in systems with interchangeable stamping tools that can be used for various parts. Market research indicates that 60 percent of consumers want to buy a car that is unique to them. This demand is pushing innovation in the car industry, and this will eventually result in shorter delivery times and greater customer satisfaction. -

Supply Chain Resilience

The need for resilient supply chains in the automobile industry has been accentuated by recent disruptions. Consequently, to reduce the risks of disruption, companies are diversifying their suppliers and concentrating on local sourcing. For example, Toyota has increased its domestic sourcing to ensure stability. This trend is changing procurement strategies and the operational framework, and the future will see greater emphasis on digital supply chain management tools to improve visibility. -

Integration of IoT in Manufacturing

It is the metal-working industry that has assimilated the IoT into its manufacturing processes. Honda, for example, is using sensors to monitor the health of its machines and optimize their performance. The IoT is said to bring a productivity improvement of up to 25 per cent. The IoT is transforming the way in which data is collected and analysed, with future applications involving the use of predictive maintenance and the automation of production. -

Regulatory Compliance and Safety Standards

Stricter regulations and safety standards are influencing the metal stamping market, as governments are enforcing new regulations. For example, the NHTSA has introduced new regulations for the safety of car components. This trend is resulting in an increase in the quality assurance process, which has a significant effect on the costs of production. Moreover, future developments could lead to even stricter regulations, resulting in the need for continuous adaptation of production practices. -

Emergence of Electric Vehicles (EVs)

The introduction of the electric vehicle is affecting the metal stamping industry, which has to adapt to new designs and materials. A company like Rivian is now focusing on lightweight stampings for EV components. Market research shows that EV production will double by 2025. This trend will lead to a need for new stampings and special tooling and equipment. -

Globalization of Manufacturing

The stamping of sheet metal for the automobile industry is changing, thanks to the globalization of the production system, which is extending to new countries. Many manufacturers have set up in Southeast Asia, for example, taking advantage of the lower cost of labour there. This development is affecting logistics and supply-chain strategies, and requires a focus on global compliance. There is likely to be further cross-border collaboration and competition in the future.

Conclusion: Navigating Competitive Terrain in Metal Stamping

The 2023 Automotive Stampings Market is characterized by intense competition and considerable fragmentation, with both established and new players vying for market share. Localization of production is a trend, driven by the need for speed and responsiveness to consumer demand. Strategically, vendors are deploying advanced capabilities such as AI, automation, and sustainable initiatives, which are becoming critical differentiators in this landscape. In the future, those companies that can successfully integrate flexibility into their operations will be able to respond quickly to changing regulations and consumer preferences. The strategic implications of these trends and developments are critical for the success of any company operating in this rapidly evolving market.

Leave a Comment