Top Industry Leaders in the Automotive Metal stamping Market

*Disclaimer: List of key companies in no particular order

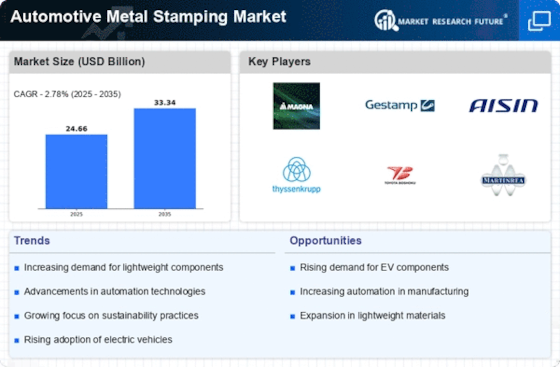

The realm of automotive metal stamping is a fierce battleground within the automotive industry, teeming with intense competition and strategic maneuvers among established juggernauts and nimble newcomers. To navigate this dynamic arena effectively, comprehending the strategies of key players, understanding the metrics influencing market share, and identifying emerging trends are imperative.

Established Giants: Strategic Approaches

Dominated by influential players like Aro Metal Stamping Co., Kenmode Precision Metal Stamping, Martinrea International Inc., Shiloh Industries, Inc., Acro Metal Stamping Co., Manor Tool & Manufacturing Company, American Industrial Company, Wisconsin Metal Parts, Inc., Clow Stamping Co., and others, this market is commanded by automotive giants such as Magna International, Gestamp, and CIE Automotive. Their strategies primarily hinge upon operational excellence, leveraging global networks, and vertical integration. For instance, Magna harnesses its expansive production footprint across 27 countries, adeptly meeting diverse automaker demands and optimizing supply chains. Gestamp focuses on technological supremacy, boasting a dedicated R&D division and spearheading lightweighting solutions for enhanced fuel efficiency.

Agile Regional Players: Emerging Navigators

While global powerhouses wield considerable influence, regional contenders like Martinrea International in North America and TS Tech in Asia are carving out distinct spaces. Their forte lies in agility, catering precisely to regional demands and offering cost-competitive solutions. Martinrea, leveraging its lean manufacturing expertise and proximity to American automakers, excels in swift turnaround times. In contrast, TS Tech exploits its deep comprehension of the Asian market and cost-effective production in countries like China, attracting budget-conscious automakers.

Market Share Analysis: Unveiling Key Metrics

Deciphering market share in this intricate landscape entails probing beyond revenue dominance. Factors such as geographic presence, portfolio diversity, customer mix, and technological leadership wield significant influence. Entities like Gestamp, with extensive European presence and a focus on high-end components, might not always eclipse Martinrea in revenue, but they hold sway in specific segments. Scrutinizing these subtleties unveils a more comprehensive picture of market domination.

Emerging Trends: Pioneering the Future

The landscape of automotive metal stamping is continuously evolving, propelled by emerging trends. The advent of electric vehicles (EVs) presents both challenges and opportunities. Lightweight metals like aluminum and magnesium gain traction for EV body panels, necessitating expertise in new materials and forming techniques. Companies like Adient strategically acquire aluminum stamping specialists to adapt to this evolving landscape. Moreover, automation and Industry 4.0 technologies are revolutionizing production lines. Gestamp's investment in robotic welding and intelligent press lines epitomizes this trend, aiming to bolster efficiency and quality.

Collaboration: The Contemporary Competitive Edge

In this dynamic milieu, collaboration emerges as a pivotal competitive edge. Partnerships between metal stampers and automakers foster co-development and knowledge exchange. Magna's joint venture with Ford to produce lightweight aluminum body structures is a prime example. Furthermore, strategic alliances between metal stampers themselves are on the rise, exemplified by the Gestamp and CIE Automotive partnership in Europe, aimed at sharing best practices and optimizing production capabilities.

Competitive Arena: Holistic Outlook

The automotive metal stamping market is an intense yet captivating battleground. Established players leverage global reach and operational prowess, while regional contenders excel in adaptability and cost efficiency. Unveiling the nuances of market share demands a profound understanding of factors beyond sheer revenue. Evolving trends such as EV adoption and automation are reshaping the competitive landscape. Collaboration, both with automakers and fellow metal stampers, emerges as a critical differentiator. As the market evolves, those who adeptly adapt to these trends and cultivate strategic alliances stand poised to triumph in this dynamic arena.

Recent Industry Developments in Automotive Metal Stamping:

Aro Metal Stamping Co. (U.S.):

- October 26, 2023: Announced a partnership with an EV battery manufacturer to produce high-precision stamped components for battery packs. (Source: Aro Metal Stamping press release)

Kenmode Precision Metal Stamping (U.S.):

- December 19, 2023: Awarded a major contract from a Tier 1 automotive supplier for the production of lightweight aluminum stampings. (Source: Kenmode Precision Metal Stamping press release)

Martinrea International Inc. (Canada):

- December 5, 2023: Reported a 15% increase in revenue from its metal stamping division compared to Q3 2022. (Source: Martinrea International Inc. Q3 earnings report)

Acro Metal Stamping Co. (U.S.):

- November 7, 2023: Received a supplier award from a major automaker for its outstanding quality and on-time delivery performance. (Source: Acro Metal Stamping Co. website)