Market Share

Introduction: Navigating Competitive Momentum in Automotive Metal Stamping

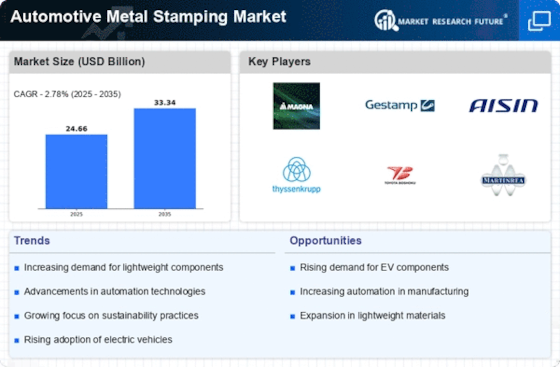

The stamping industry is currently undergoing a revolution caused by rapid technological progress, stricter regulations and changing consumer demands for performance and the environment. The players in the market, including the machine builders, the IT service companies and the smart AI start-ups, are fighting for leadership by using advanced technologies such as data analysis, automation and the Internet of Things. These technological innovations not only increase efficiency, but also enable the production of data that is essential for optimising production and compliance with regulations. The stamping industry is also moving towards a greener future, and companies that place a high priority on sustainable production will be able to capture a large share of the market. In addition, growth opportunities are emerging in the region, especially in Asia-Pacific and North America, where strategic trends, production capabilities and the demand for advanced solutions coincide. These trends are the driving forces behind the future of the stamping industry, and the industry is undergoing a transformation.

Competitive Positioning

Emerging Players & Regional Champions

- The company specializes in the stamping of parts for electric vehicles. It recently won a contract with a major EV manufacturer, which makes it a key player in the EV field and a rival of the big car parts suppliers.

- Kawasaki Steel, Japan, has been developing new methods of forming steel for the manufacture of lightweight components for energy-efficient automobiles. It has also developed a new production line to increase efficiency.

- Tata Metal Stamping (India) - Provides cost-effective metal stamping solutions for the Indian market, recently started to supply local automobile manufacturers with components for small cars, competes with the big players with its focus on the local market and the price.

- Meyer Tool (Germany): Provides specialized stamping for high-performance automotive parts, recently expanded its capabilities to include hybrid vehicle components, complementing established vendors by filling a niche in the hybrid market.

Regional Trends: The market for metal stampings for cars will be dominated by the use of lightweight materials and the components of electric vehicles by 2023. North America and Asia-Pacific are increasingly adopting advanced stamping technology, driven by the need for fuel-efficient and sustainable vehicles. Local suppliers are also gaining ground, focusing on cost-effective and local solutions that are tailored to the needs of the local automobile industry, which is putting pressure on the established international players.

Collaborations & M&A Movements

- Ford and Magna International have joined forces to develop a new lightweight stamping process that will help reduce the weight of the vehicle and thus improve its fuel efficiency. The aim is to strengthen the companies' position in the electric vehicle market.

- TOYOTA TSUSHOE CO., LTD. bought a controlling stake in a leading stamping-works and acquired a steady supply of quality components for its car production. This helped it to increase its market share in the Asia-Pacific region.

- General Motors and Novelis have teamed up to develop aluminum stamping processes that will help GM meet its commitment to sustainable development and make automobile components more recycl-able, which will put both companies in a strong position in the growing field of eco-cars.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Precision Stamping | Magna International, Gestamp | The use of advanced robots for high-precision stamping reduces waste and increases efficiency. Gestamp has developed new tooling methods to improve the accuracy of complex shapes, as shown in the recent project for a leading automobile manufacturer. |

| Material Innovation | Thyssenkrupp, Aisin Seiki | In the course of the last year a joint venture with an electric vehicle manufacturer has shown the possibilities of a new type of steel, which is light, cheap and strong. It is used in several new models. |

| Sustainability Practices | Honda, Ford | Honda has a policy of using a large amount of reclaimed materials in its stamping processes, which means that its carbon footprint is significantly reduced. Ford's sustainable initiatives include a closed-loop system for the recovery of metal scrap, which has been acknowledged in its latest sustainability report. |

| Automation and Smart Manufacturing | Toyota, Bendix | INTEGRATING IoT TECHNOLOGIES TO TOYOTA’S PRESS PLANTS INSTALLED MONITORING AND PREDICTIVE MAINTENANCE HAS HELPED TO IMPROVE THE OPERATIONS OF TOYOTA’S PRESS PLANTS TO IMPROVE PERFORMANCE OVERALL AND TO IMPROVE PRODUCTIVITY BENDIX NOW OFFERS A SMART MANUFACTURING APPROACH THAT HELPS STREAMLINE PRODUCTION AND ELIMINATES DOWNTIME. |

| Customization and Flexibility | Daimler AG, Nissan | Daimler AG is able to offer the stamping solutions that meet the individual needs of the customer, as has recently been shown by its collaboration with luxury car manufacturers. The production methods at Nissan are designed for fast changes in production line, to meet the varying demand. |

Conclusion: Navigating Competitive Terrain in Metal Stamping

The market for automobile metal stampings in 2023 will be characterized by a high degree of fragmentation and intense competition, with both established and new entrants competing for a share of the market. Local production will be influenced by the need for agility and responsiveness to the market. The strategic positioning of the suppliers will be based on the implementation of advanced technological capabilities such as artificial intelligence, automation and sustainable initiatives, which will be the main differentiators in this market. In the future, those who place flexibility and innovation in the foreground and who are able to meet the rising demands for efficiency and the environment will be the winners.

Leave a Comment