Automotive Metal Stamping Size

Market Size Snapshot

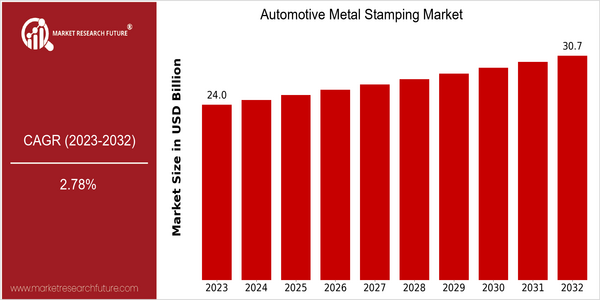

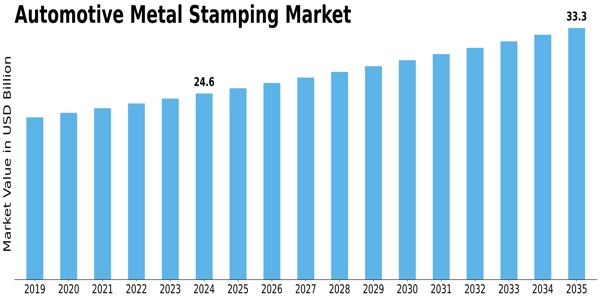

| Year | Value |

|---|---|

| 2023 | USD 23.99 Billion |

| 2032 | USD 30.7 Billion |

| CAGR (2024-2032) | 2.78 % |

Note – Market size depicts the revenue generated over the financial year

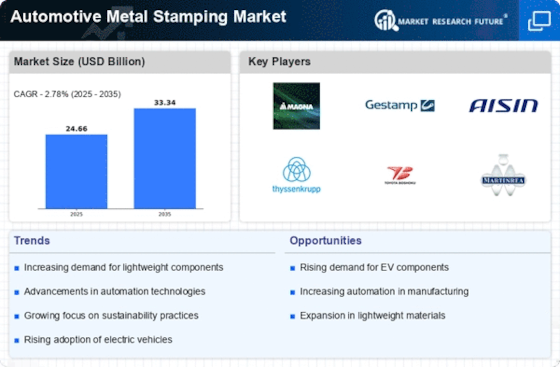

The market for stampings for the automobile is valued at about $ 24,000,000,000 in the year 2023, and is projected to grow at a CAGR of 2.86% from 2024 to 2032. It is a steady demand for metal stampings, which are used in the manufacture of various parts of the car, such as body panels, chassis and frame parts. The market is expanding because of the increasing production of vehicles worldwide, a result of the growing demand for automobiles and the development of automobile technology. There are many reasons for this, such as the growing use of lightweight materials in order to improve the fuel economy and reduce emissions. There is also a growing integration of automation and smart manufacturing into stamping processes. There are several companies in the stamping industry, such as Magna, Gestamp, and Aisin Seiki, which are investing in new technology and forming strategic alliances to improve their production capabilities and product offerings. Recent collaborations to develop advanced stamping technology and materials are expected to further drive the growth of the market and position these companies at the forefront of the changing automotive landscape.

Regional Market Size

Regional Deep Dive

The market for metal stampings in the automobile industry is characterized by robust demand, which is a result of the increasing production of automobiles and the growing need for lightweight materials in order to increase fuel efficiency. In North America, the market is supported by a strong automobile industry, which has made significant investments in advanced manufacturing technology. In Europe, the shift towards electric vehicles is influencing the types of metal stampings and materials used. The APAC region is growing rapidly, driven by the expansion of the automobile industry in China and India. The MEA region is also gradually developing its automobile industry, which is opening up new opportunities. Latin America, with its emerging economies, is also growing, but at a slower rate than the other regions.

Europe

- The European automotive sector is undergoing a significant transformation with the EU's stringent regulations on emissions, prompting manufacturers to innovate in metal stamping to produce lighter components for electric vehicles.

- Key players like Volkswagen and BMW are collaborating with technology firms to develop advanced metal stamping techniques that support the production of complex geometries required for electric vehicle components.

Asia Pacific

- China's automotive market is rapidly expanding, with local manufacturers like Geely and BYD investing in advanced metal stamping technologies to meet the growing demand for electric vehicles and smart cars.

- India is witnessing a surge in automotive production, with government initiatives like 'Make in India' encouraging local metal stamping companies to enhance their capabilities and cater to both domestic and export markets.

Latin America

- Brazil remains a key player in the Latin American automotive sector, with local companies focusing on modernizing their metal stamping facilities to improve production efficiency and meet international standards.

- The region is experiencing a shift towards electric vehicles, with governments in countries like Mexico offering incentives for manufacturers to invest in sustainable metal stamping technologies.

North America

- The U.S. automotive industry is increasingly adopting automation and robotics in metal stamping processes, with companies like Ford and General Motors investing heavily in smart manufacturing technologies to enhance efficiency and reduce costs.

- Regulatory changes aimed at reducing vehicle emissions are pushing manufacturers to explore lighter materials, leading to innovations in metal stamping techniques that accommodate advanced high-strength steels and aluminum.

Middle East And Africa

- The automotive industry in the Middle East is gaining momentum, with countries like Saudi Arabia investing in local manufacturing capabilities, including metal stamping, to reduce reliance on imports.

- The African automotive market is seeing growth through initiatives like the African Continental Free Trade Area (AfCFTA), which aims to boost intra-regional trade and encourage local metal stamping production.

Did You Know?

“Did you know that metal stamping can produce parts with tolerances as tight as ±0.005 inches, making it a highly precise manufacturing process essential for the automotive industry?” — Manufacturing.net

Segmental Market Size

The Automotive Metal Stamping Market is a crucial segment of the automotive industry, which is currently experiencing stable growth due to rising vehicle production and the increasing demand for lightweight materials. The increasing demand for fuel-efficient vehicles is a major factor driving the demand for advanced metal stamping to reduce weight without compromising safety. In addition, the growing stringency of government regulations to reduce vehicle emissions is pushing manufacturers to adopt new metal stamping solutions to enhance vehicle performance and reduce emissions. The market is currently in the mature stage of implementation, with Ford and General Motors leading in the implementation of advanced metal stamping. Metal stamping is mainly used to produce body panels, chassis parts, and frame parts, which are essential for vehicle assembly. The rising popularity of electric vehicles and the trend towards sustainable development are also driving the growth of the market. CAD/CAM and automation of stamping processes are the key drivers of the market, as they help to improve the precision and efficiency of production.

Future Outlook

From 2023 to 2032, the market for automobile metal stampings is expected to grow steadily. The market is expected to rise from $23.99 billion to $30.6 billion, with a CAGR of 2.78%. This is mainly due to the increase in the demand for lightweight and fuel-efficient vehicles, and the need for automobile manufacturers to use more advanced metal stamping methods to produce complex parts with high standards. The use of metal stampings for the production of batteries and structural components to improve the safety and performance of vehicles is expected to increase. The application of automation and Industry 4.0 is expected to change the landscape of the metal stamping industry. The use of smart manufacturing not only improves the efficiency of the production line, but also reduces the cost of production, and makes the metal stamping process more sustainable. The use of intelligent manufacturing is expected to promote the development of the metal stamping industry, and government policies to support the development of electric vehicles and reduce carbon dioxide emissions will also help to improve the investment environment for the metal stamping industry. The use of high-strength materials and advanced stamping techniques is expected to lead to a strong market growth in the next 10 years.

Leave a Comment