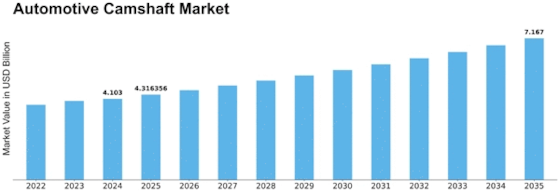

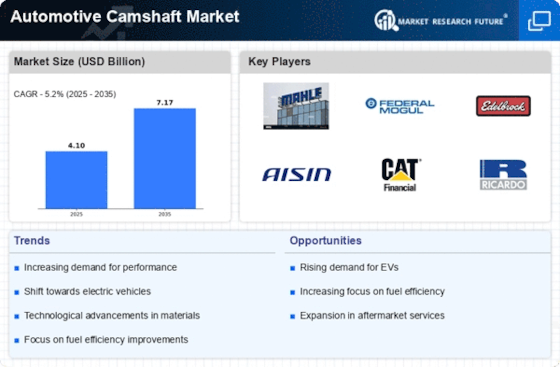

Automotive Camshaft Size

Automotive Camshaft Market Growth Projections and Opportunities

The automotive camshaft market is a dynamic and ever-evolving sector within the automotive industry. Market dynamics in this niche are influenced by a myriad of factors, creating a complex ecosystem that continually adapts to technological advancements, regulatory changes, and consumer preferences.

One significant driver of market dynamics is the constant pursuit of improved engine performance and fuel efficiency. As automotive manufacturers strive to meet stringent emission standards and consumer demands for more eco-friendly vehicles, the demand for advanced camshaft technologies rises. Innovations such as variable valve timing (VVT) and camless engines have gained prominence, shaping the market landscape.

Moreover, globalization plays a pivotal role in the automotive camshaft market dynamics. The interconnectedness of economies and the ease of cross-border trade impact the supply chain, pricing strategies, and competition. Manufacturers often face the challenge of navigating diverse regulatory frameworks and consumer preferences across different regions, contributing to the market's fluid nature.

The rise of electric vehicles (EVs) and hybrid technologies also introduces a transformative element to the automotive camshaft market. While traditional internal combustion engines remain prevalent, the increasing adoption of electric powertrains prompts manufacturers to reevaluate their product portfolios. As a result, the market experiences shifts in demand, with a growing emphasis on components tailored for electric and hybrid vehicles.

Consumer trends and preferences play a crucial role in shaping the market dynamics of automotive camshafts. As buyers become more conscious of sustainability and fuel efficiency, there is a growing demand for vehicles that offer enhanced performance without compromising environmental impact. This shift in consumer mindset influences automakers and camshaft manufacturers to focus on research and development, bringing forth innovations aligned with these evolving preferences.

Supply chain disruptions and material shortages add an additional layer of complexity to market dynamics. The automotive industry's reliance on global supply chains makes it susceptible to external factors such as natural disasters, geopolitical events, and pandemics. These disruptions can impact production schedules, lead times, and component costs, forcing market players to adapt swiftly to maintain competitiveness.

Furthermore, partnerships and collaborations within the automotive ecosystem contribute significantly to market dynamics. Camshaft manufacturers often engage in strategic alliances with automotive OEMs, technology providers, and research institutions to leverage expertise, share resources, and stay at the forefront of innovation. Such collaborations not only impact the product development process but also influence market trends and competition dynamics.

In conclusion, the automotive camshaft market is a dynamic and multifaceted industry, influenced by a combination of technological advancements, regulatory changes, consumer preferences, and global economic factors. As the automotive landscape continues to evolve, market players must remain agile, embracing innovation and collaboration to stay competitive in this ever-changing environment.

Leave a Comment