银行即服务市场概览

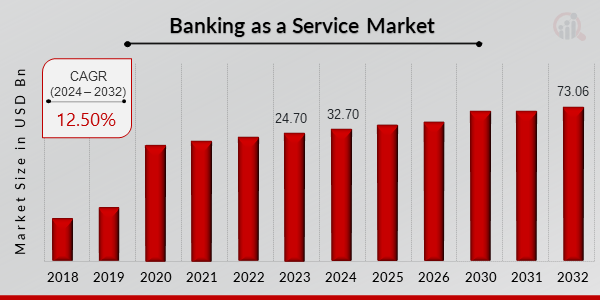

p预计银行即服务市场规模将从 2024 年的 327 亿美元 增长到 2032 年的 730.6 亿美元,在预测期内(2024 - 2032 年),复合年增长率 (CAGR) 为 12.50%。此外,2023 年银行服务的市场规模价值为 247 亿美元。银行即服务 (BaaS) 是一种端到端流程,允许金融科技公司和其他第三方通过 API 直接与银行系统交互,从而允许他们在提供商的基础设施之上构建银行服务,并重新调整金融服务格局。 BaaS 系统已发展成为开放银行业务的关键组成部分。在开放银行业务中,银行将其应用程序编程接口 (API) 开放给第三方,以便第三方能够开发新服务,从而为账户用户提供更多财务透明度选项。金融服务和商品与非金融数字渠道的无缝集成,使 BaaS 成为可能。消费者越来越多地使用这些网络来提供电子商务、旅行、购物、健身和电信等服务。

图 1:2018-2032 年银行即服务市场 strong 来源:二手资料研究、一手资料研究、MRFR 数据库和分析师评论

来源:二手资料研究、一手资料研究、MRFR 数据库和分析师评论

新冠疫情分析

p新冠疫情的爆发没有给各行各业和企业足够的时间来准备或保护自己免受损失。市场形势不明朗,可能急剧上升或下降,具体取决于各组织采取的行动和获得的结果。疫情已影响全球众多行业。这导致全球大多数工业单位的生产业务关闭或暂停。COVID-19 疫情的出现对航空、银行、汽车、制造业以及食品饮料等行业产生了巨大影响。由于 COVID-19 在全球迅速爆发,IT 行业受到了严重影响。不断变化的疫情形势导致消费者偏好和行为波动,这在预计的时间内对 IT 行业产生了相当大的影响。例如,2020 年 3 月,世界卫生组织 (WHO) 宣布 COVID-19 为大流行病,导致多个国家宣布封锁。由于制造业衰退和工厂关闭,疫情对各行各业造成了影响。短期中断导致了可访问性问题,中小企业/企业客户缩减了业务规模。除了中小企业/企业倒闭之外,长期的经济衰退还增加了客户对数字渠道和保险等产品的偏好。一场全面的疫情将导致中小企业和大型企业的需求大幅下降,客户行为发生结构性变化,以及人员职责和整个运营模式的变化。由于这些因素,互联网和先进技术在全球范围内的重要性日益凸显。

银行即服务 (BaaS) 是一种端到端流程,允许金融科技公司和其他第三方通过 API 直接与银行系统对接,从而允许他们在提供商的基础设施之上构建银行服务,并重塑金融服务格局。BaaS 系统已经发展成为开放银行业务的关键组成部分。在开放银行业务中,银行将其应用程序编程接口 (API) 开放给第三方,以便他们能够开发新的服务,为账户用户提供更多财务透明度选项。金融服务和商品与非金融数字渠道的无缝集成使 BaaS 成为可能。消费者越来越多地使用这些网络来提供电子商务、旅游、购物、健身和电信等服务。

银行即服务市场动态

p推动银行即服务市场增长的主要因素是金融服务需求的增长以及金融科技公司数量的增长。然而,高昂的采用成本阻碍了市场的增长。不过,嵌入式金融解决方案需求的增长预计将创造丰厚的市场增长机会。驱动因素:金融服务需求的增长

pBaaS 在金融服务领域日益普及,是推动 BaaS 市场向前发展的关键驱动力。银行业务、专业咨询、财富管理、共同基金、保险、股票交易、资金/债务工具、税务/审计咨询、资本重组和投资组合管理等金融服务的使用日益增长,表明银行业数字交易的使用日益增多。近年来,互联网服务的不断增长推动了数字革命,影响了移动用户和企业主在银行领域采用数字技术(包括银行软件、审计软件和服务)的 BaaS 模式。全球约有 5,000 家公司提供 API 和银行即服务 (BaaS) 解决方案,例如开户、贷款和成本管理仪表盘。限制:采用成本高

p各银行机构采用这项技术的高昂成本阻碍了 BaaS 业务的扩张。小型银行本身就缺乏采用新技术的能力和资金,因此将付出更高的代价。要全面实现 BaaS 技术,银行需要投资于主动 IT 软件和硬件,包括能够简化 BaaS 运营的云服务。基础设施即服务 (IaaS) 是云服务 (IaaS) 的另一个名称。嵌入式金融是指金融服务向传统非金融服务的无缝过渡,使客户能够在浏览众多应用程序和第三方服务的同时访问金融服务。银行即服务市场细分洞察

h3银行即服务类型洞察 p基于类型的银行即服务市场细分包括基于 API 的银行即服务和基于云的银行即服务。基于云的银行即服务细分市场在银行即服务市场的收入中占比最大。此外,预计该细分市场在预测期内将出现快速增长。此外,基于 API 的银行即服务领域预计在不久的将来会大幅增长。银行即服务组织规模洞察

p根据组织规模,市场分为大型企业和中小型企业。由于大型企业越来越多地采用银行即服务,因此它们占据了银行即服务收入的最大份额。图 2:2021 年银行即服务市场份额(按组织规模划分)

p来源:二手资料研究、一手资料研究、MRFR 数据库和分析师评论

银行即服务应用洞察

p银行即服务市场根据以下因素分为政府、银行和 NBFC应用。银行部门占据银行即服务收入的最大份额,这得益于银行业不断增长的举措,例如持续投资银行即服务、建立合作伙伴关系等。银行即服务区域洞察

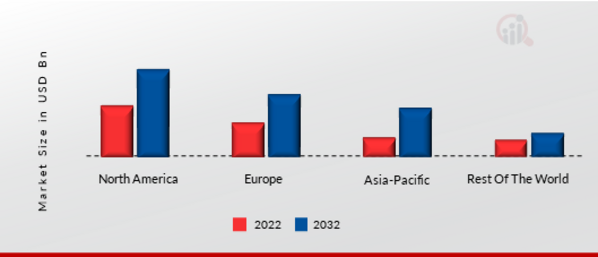

p从地理上看,银行即服务市场分为北美、欧洲、亚太地区、中东和非洲以及南美。由于北美地区发达国家(美国、加拿大和墨西哥)更快地采用金融科技技术,北美很可能成为主导的区域市场。这主要是因为该地区是技术最先进的地区之一,拥有大量市场参与者,例如 Greendot Corporation(美国)、Paypal(美国)、Moven(美国)和 Square Inc.(美国)。由于先进技术的利用率不断提高、金融服务需求不断增长以及金融科技公司在该地区的存在感不断增强,预计欧洲在预测期内的复合年增长率最高。预计欧洲将成为预测期内增长最快的区域市场。该区域市场被细分为德国、法国、意大利、英国和欧洲其他地区。由于该地区网上银行、数字支付系统和金融服务的使用增加,预计在整个预测期内,欧洲市场将快速增长。根据 2019 年管理国际会议,近一半的欧洲成年人 (51%) 使用网上银行。这一比例自 2007 年的 25% 以来一直在持续增长。网上银行在二三十岁的人群中最受欢迎,其中 68% 的人在使用。网上银行的使用率与用户的教育水平同步增长。只有 24% 的低教育水平人群使用电子银行。网上银行的使用率与用户的教育水平同步增长。在教育水平较低的人群中,只有 24% 会使用电子银行。随着云技术被用作数据存储库以供进一步分析,其普及率的提高预计将推动银行即服务市场的增长。

图 3:2021 年各地区银行即服务市场份额 (%)

p来源:二手资料研究、一手资料研究、MRFR 数据库和分析师评论银行即服务主要市场参与者及竞争洞察

p全球市场以众多市场参与者而闻名。银行即服务市场的特点是存在多家区域性和本地性供应商。由于金融服务需求的增长以及金融科技公司数量的增长,银行即服务市场在预测期内经历了显著增长。银行即服务市场中有许多国内、区域性和参与者,他们不断努力争取在整个市场中占据相当大的份额。Paypal、Moven 和 Solaris Bank 是市场领先企业。这些公司正在有效地为客户提供新的低成本产品,以在竞争激烈的银行即服务市场中竞争。此外,这些企业还通过在线和零售渠道在市场上销售银行即服务。

PayPal 的战略包括通过扩展其功能、增加客户群、扩大和增加客户对公司产品和服务的使用来帮助业务增长,通过更好地满足客户需求、管理和转移资金以及扩大新商家和消费者对解决方案的采用。它还注重扩大价值主张、拓展战略合作伙伴关系、通过全球国际市场寻求新领域,并强调数字和物理世界的创新。

银行即服务市场中的关键公司

p该市场中的一些关键参与者包括 Twilio Inc.(美国)、Braintree(美国)、BOKU(美国)、Coinbase Inc.、Dwolla(美国)、Zettle(瑞典)、Fidor Bank(德国)、GoCardless(英国)、金雅拓(荷兰)、Intuit(美国)、Square Inc.(美国)、PayPal(美国)、Prosper Inc.(美国)、Solaris Bank(德国)和 Moven(美国)。银行即服务行业发展

p2022 年 9 月:Solarisbank AG 宣布与 BP Europa SE 子公司 B2Mobility GmbH 建立合作伙伴关系。2021 年 5 月,银行和贷款数字化转型解决方案的知名提供商 Q2 宣布与Moven。银行即服务市场细分

h3银行即服务类型展望 ul-

基于 API 的银行即服务

-

基于云的银行即服务

-

大型企业

-

小型和中型企业

-

政府

-

银行

-

非银行金融公司

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 其他地区欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 亚太地区其他地区

- 中东和中东非洲

-

南美洲

FAQs

What is the current valuation of the Banking as a Service Market?

The Banking as a Service Market was valued at 32.7 USD Billion in 2024.

What is the projected market size for Banking as a Service by 2035?

The market is expected to reach 119.48 USD Billion by 2035.

What is the expected CAGR for the Banking as a Service Market from 2025 to 2035?

The expected CAGR during the forecast period 2025 - 2035 is 12.5%.

Which companies are considered key players in the Banking as a Service Market?

Key players include Solarisbank, Synapse, Galileo Financial Technologies, Marqeta, Railsbank, Bankable, Finastra, Mambu, and Temenos.

How does the market segment by type perform in terms of valuation?

In 2024, API-based Bank-as-a-Service was valued at 13.1 USD Billion, while Cloud-based Bank-as-a-Service reached 19.6 USD Billion.

Research Approach

Research Methodology on Banking as a Service Market

1. Introduction

The purpose of this research methodology report is to provide detailed information on the research methods used to develop the “Banking as a Service Market” report published by Market Research Future (MRFR). The report is a comprehensive analysis of the current state and future prospects of the global Banking as a Service Market. This report focuses on the various market drivers and restraints, key trends, regional analysis, segmental analysis, and competitive landscape.

2. Research Objectives

The research objectives associated with the report are as follows:

- To gain insights into the potential global Banking as a Service market for the years 2023-2030

- To analyze the key countries in the Banking as a Service market

- To analyze the market size, share, value chain and key players and strategies adopted in the market

- To perform an in-depth segmental analysis of the global Banking as a Service market

- To provide a detailed analysis of the regional markets

3. Research Design

The research design adopted for the “Banking as a Service Market” is an exploratory one and it is conducted taking into consideration the key stakeholders involved in the global Banking as a Service market and their interests. In addition, the data sources and market research instruments used are also considered in the research design.

4. Research Approach

The research approach adopted for the “Banking as a Service Market” is both quantitative and qualitative in nature. Primary research is performed through interviews with key stakeholders and industry experts. Surveys are also conducted with leaders and experts from the industry to gain a better understanding of the market. Secondary research is also conducted which relied heavily on existing sources like industry reports and studies, financial databases, and international news. The secondary research is done to fill the gaps identified during the primary research.

5. Research Sources

The data sources used for the “Banking as a Service Market” report consisted of both primary and secondary sources. Primary research sources include interviews with key stakeholders, industry surveys and reports, and interviews with market players. Secondary sources include media publications, white papers, articles, and magazine journals. Additionally, data from industry organizations, government institutions, and investment firms are also collected.

6. Data Collection

The data collection for the “Banking as a Service Market” is conducted through both primary and secondary sources. Primary data is collected from industry interviews and surveys and published reports. Secondary data is collected through media publications, trade journals, white papers and other industry-related sources. The collected data is assessed and analyzed by the research team to come up with the most accurate and reliable estimates.

7. Data Validation

In order to ensure the accuracy of the “Banking as a Service Market” report, the data is validated through the triangulation method. This method included using various data mining techniques, along with focus groups, surveys and interviews. The data validation process is a critical aspect of the research process, as it involves critically examining the collected data to identify any errors or discrepancies.

8. Research Method

The research method used to conduct the “Banking as a Service Market” report is qualitative and quantitative research. Primary research involves obtaining information through interviews and surveys with industry experts, regulatory bodies, and industry players. The sources used here include industry reports, trade journals, magazines, etc. Secondary research is conducted using various sources such as media reports, government websites, and investment reports.

9. Modelling and Forecast

Once the data is collected and validated, the research team used quantitative methods such as a SWOT analysis and Porter’s Five Forces Modeling to analyze the market data and to come up with comprehensive market-based forecasts. The research team used a bottom-up approach to determine the market sizes of different segments. The market is analyzed from both a regional level and a global level.

10. Market Size Estimation

The market size of the “Banking as a Service Market” report is estimated through a combination of top-down and bottom-up approaches. This helps us to arrive at the total market size master figures, which acted as the market size base. The calculation is based on the primary and secondary research conducted, along with the assumptions and estimated market data.

11. Research Scope

The research scope of the “Banking as a Service Market” report was limited to the size and scope of the global market. The scope of the research includes detailed qualitative and quantitative analysis of key market segments, regional analysis, and competitive landscape. The regional scope includes regional markets such as North America, Latin America, Europe, Asia Pacific, the Middle East and Africa.

请填写以下表格以获取本报告的免费样本

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”