Partnerships Between Banks and Fintechs

The South America Banking As A Service Market is characterized by an increasing number of partnerships between traditional banks and fintech companies. These collaborations aim to combine the strengths of established financial institutions with the agility and innovation of fintech startups. Such partnerships enable banks to enhance their service offerings and improve customer experiences while allowing fintechs to access a broader customer base. As of January 2026, several prominent banks in South America have entered into strategic alliances with fintech firms to co-develop new products and services. This trend not only fosters innovation but also strengthens the overall ecosystem of the South America Banking As A Service Market, positioning it for sustained growth.

Focus on Financial Inclusion Initiatives

Financial inclusion remains a critical focus within the South America Banking As A Service Market, as a significant portion of the population remains unbanked or underbanked. According to recent data, approximately 40% of adults in South America lack access to formal banking services. This gap presents a substantial opportunity for banking as a service providers to develop tailored solutions that cater to underserved communities. Initiatives aimed at enhancing financial literacy and providing affordable banking options are gaining traction, thereby driving the demand for innovative financial products. By addressing these challenges, the South America Banking As A Service Market can contribute to broader economic development and social equity.

Regulatory Support for Fintech Innovations

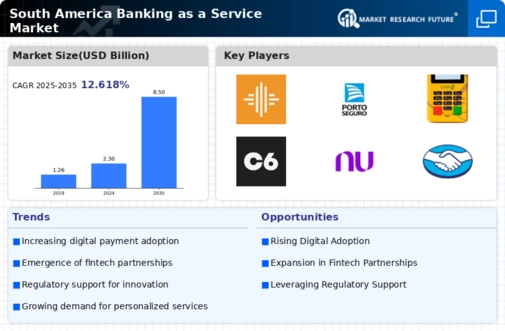

The South America Banking As A Service Market benefits from a favorable regulatory environment that encourages fintech innovations. Governments across the region are increasingly recognizing the importance of digital financial services in promoting economic growth and financial inclusion. For instance, Brazil's Central Bank has implemented regulations that facilitate the entry of fintech companies into the market, fostering competition and innovation. This regulatory support not only enhances consumer trust but also encourages investment in the fintech sector. As a result, the South America Banking As A Service Market is likely to experience accelerated growth, as more startups and established financial institutions leverage these regulations to develop and offer new services.

Growing Demand for Digital Banking Solutions

The South America Banking As A Service Market is witnessing a growing demand for digital banking solutions, driven by the increasing adoption of smartphones and internet connectivity. As of January 2026, approximately 70% of the population in major South American countries has access to the internet, facilitating the shift towards digital banking. This trend is further supported by the rise of neobanks and fintech companies that offer innovative financial products and services. The convenience of online banking, coupled with the need for efficient financial management, propels consumers towards digital solutions. Consequently, traditional banks are compelled to adapt their services to meet these evolving consumer preferences, thereby enhancing their competitive edge in the South America Banking As A Service Market.

Technological Advancements in Payment Systems

Technological advancements in payment systems are reshaping the South America Banking As A Service Market. The proliferation of contactless payment methods and mobile wallets has transformed consumer behavior, leading to a preference for seamless and efficient transaction experiences. As of January 2026, it is estimated that mobile payment transactions in South America have increased by over 50% compared to previous years. This shift not only enhances customer satisfaction but also encourages businesses to adopt banking as a service solutions that integrate these advanced payment technologies. Consequently, the South America Banking As A Service Market is poised for growth as more businesses seek to leverage these innovations to streamline their operations.