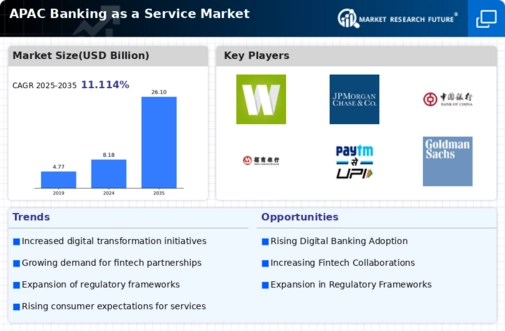

The APAC Banking as a Service Market is evolving rapidly, driven by the increasing need for financial institutions to offer agile, customer-centric services by leveraging advanced technological solutions. A competitive landscape is emerging where traditional banks, fintech companies, and technology giants vie for market share by providing seamless integration of banking services through APIs and other digital platforms. This shift towards digital transformation has encouraged innovation among players, enabling them to deliver products and services that cater to diverse consumer preferences across the region. The rise of neobanks and the expansion of digital wallets further add to the competitive dynamics, as they challenge traditional banking models by offering more flexible and convenient solutions for their customers.WeBank stands out in the APAC Banking as a Service Market due to its strong focus on innovation and customer satisfaction. As one of the leading digital banks in the region, WeBank leverages cutting-edge technology to deliver banking services that are faster, more efficient, and highly personalized. The bank’s first digital approach enables it to cater to a diverse client base, primarily targeting tech-savvy customers who prefer online financial solutions. WeBank's strength lies in its ability to provide a wide range of products, including digital loans, savings accounts, and payment solutions, all designed with user experience in mind. The bank's market presence is further enhanced by its partnerships with various technology firms and organizations that enable it to broaden its service offerings and maintain a competitive edge in the rapidly evolving APAC market.JPMorgan Chase has established a noticeable footprint in the APAC Banking as a Service Market through its comprehensive range of financial products and services tailored to meet the unique demands of the region's diverse consumer base. The company's strengths lie in its extensive global network, advanced technological capabilities, and deep industry expertise, allowing it to provide innovative solutions such as digital payments, wealth management, and corporate banking services. JPMorgan Chase actively engages in collaborations and strategic mergers and acquisitions to strengthen its position in APAC, enhancing its technological infrastructure and expanding its service offerings. Their commitment to harnessing fintech capabilities helps them in addressing the banking needs of both individuals and businesses effectively, enabling JP Morgan Chase to remain competitive in the dynamic APAC landscape.