Market Growth Projections

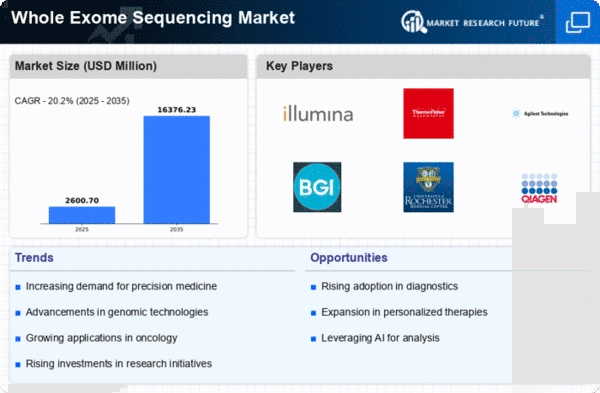

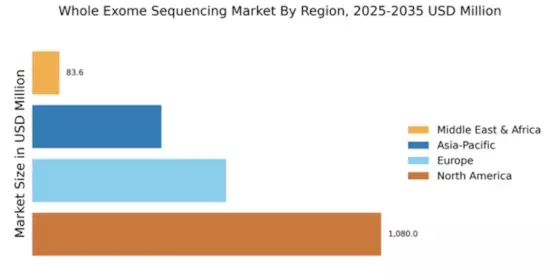

The Global Whole Exome Sequencing Market Industry is projected to experience substantial growth in the coming years. With a market value of 2.16 USD Billion in 2024, it is anticipated to reach 16.4 USD Billion by 2035, reflecting a remarkable compound annual growth rate of 20.23% from 2025 to 2035. This growth trajectory indicates a robust demand for whole exome sequencing services, driven by advancements in technology, increasing applications in various fields, and supportive government initiatives. The market's expansion is likely to reshape the landscape of genetic testing, making whole exome sequencing an integral component of modern healthcare.

Growing Applications in Oncology

The application of whole exome sequencing in oncology is a significant driver for the Global Whole Exome Sequencing Market Industry. As cancer research progresses, the ability to identify specific genetic mutations associated with various cancers allows for tailored treatment strategies. Whole exome sequencing aids in the discovery of novel biomarkers, which can lead to the development of targeted therapies. This trend is particularly evident in precision oncology, where understanding the genetic landscape of tumors enhances treatment efficacy. The increasing focus on personalized cancer therapies is likely to contribute to the market's growth trajectory in the coming years.

Rising Demand for Genetic Testing

The Global Whole Exome Sequencing Market Industry experiences a surge in demand for genetic testing, driven by the increasing prevalence of genetic disorders and the need for personalized medicine. As healthcare systems worldwide prioritize precision medicine, whole exome sequencing becomes a pivotal tool in identifying genetic mutations. In 2024, the market is valued at approximately 2.16 USD Billion, reflecting a growing recognition of the importance of genetic insights in clinical decision-making. This trend is expected to continue, with projections indicating a market expansion to 16.4 USD Billion by 2035, highlighting the critical role of whole exome sequencing in modern healthcare.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in advancing the Global Whole Exome Sequencing Market Industry. Various countries are investing in genomic research and infrastructure to promote the integration of genetic testing into routine clinical practice. For instance, national health programs are increasingly supporting initiatives that facilitate access to whole exome sequencing for patients with rare diseases. Such investments not only enhance research capabilities but also encourage collaboration between public and private sectors. As governments recognize the potential of genomics in improving healthcare outcomes, the market is poised for substantial growth, driven by supportive policies and funding.

Increasing Awareness and Education

Increasing awareness and education regarding the benefits of whole exome sequencing significantly influence the Global Whole Exome Sequencing Market Industry. Healthcare professionals and patients alike are becoming more informed about the advantages of genetic testing in disease prevention and management. Educational campaigns and resources provided by healthcare organizations contribute to a better understanding of how whole exome sequencing can impact patient care. This heightened awareness is likely to drive demand for genetic testing services, as individuals seek proactive approaches to their health. Consequently, the market is expected to expand as more stakeholders recognize the value of genomic insights.

Technological Advancements in Sequencing Techniques

Advancements in sequencing technologies significantly propel the Global Whole Exome Sequencing Market Industry. Innovations such as next-generation sequencing (NGS) enhance the speed and accuracy of exome sequencing, making it more accessible and cost-effective. These technological improvements not only reduce the time required for sequencing but also increase the throughput of genetic data analysis. As a result, healthcare providers are more inclined to adopt whole exome sequencing as a standard practice in diagnostics. The anticipated compound annual growth rate of 20.23% from 2025 to 2035 underscores the transformative impact of these advancements on the market.