Global Trade Dynamics

The Wheat Seed Industry in various ways. Changes in trade policies, tariffs, and international agreements can significantly impact the availability and pricing of wheat seeds. In 2025, it is projected that trade agreements will facilitate the exchange of innovative wheat seed technologies across borders, enhancing global access to high-quality seeds. This interconnectedness may lead to increased competition among seed producers, driving innovation and efficiency within the Wheat Seed Market. Furthermore, fluctuations in wheat prices on the international market can influence farmers' decisions regarding seed selection, thereby affecting the overall dynamics of the wheat seed market.

Government Support and Subsidies

Government support and subsidies play a crucial role in shaping the Wheat Seed Market. Many countries are implementing policies aimed at boosting domestic wheat production to ensure food security. For example, various governments are providing financial incentives for farmers to adopt improved wheat seed varieties, which can lead to higher yields and better quality crops. In 2025, it is anticipated that government initiatives will contribute to a 15% increase in the adoption of advanced wheat seeds. This support not only encourages farmers to invest in better seed technology but also stimulates growth within the Wheat Seed Market, fostering innovation and competitiveness.

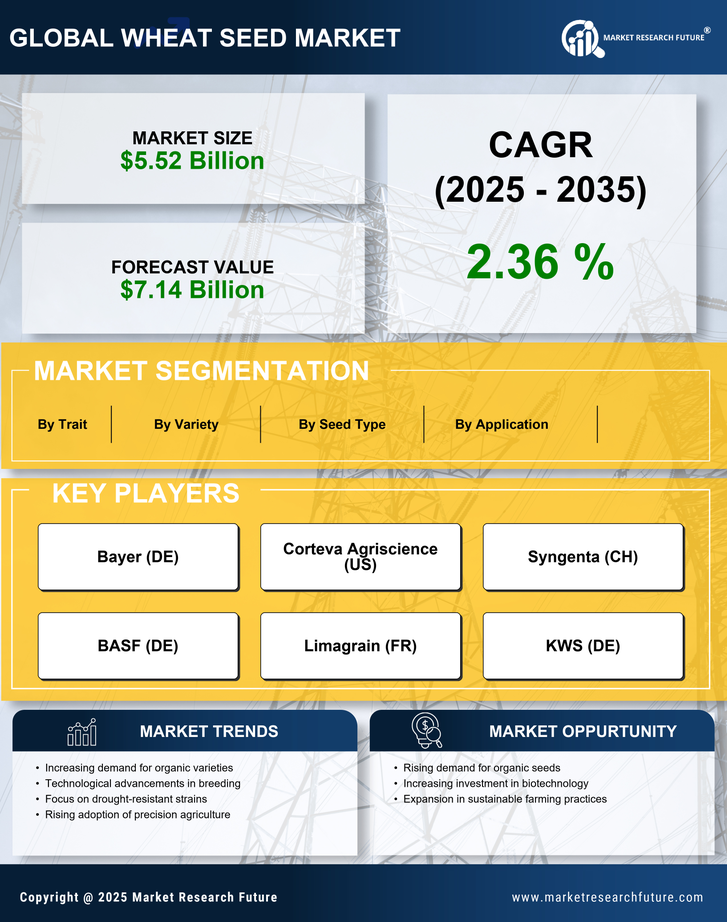

Increasing Demand for Wheat Products

The rising global population and changing dietary preferences are driving an increasing demand for wheat products. As consumers shift towards more carbohydrate-rich diets, the Wheat Seed Market is experiencing heightened interest. In 2025, wheat consumption is projected to reach approximately 760 million metric tons, indicating a robust growth trajectory. This demand surge necessitates the cultivation of high-yield and disease-resistant wheat varieties, thereby propelling the Wheat Seed Market forward. Additionally, the growing trend of convenience foods, which often utilize wheat as a primary ingredient, further amplifies this demand. Consequently, seed producers are likely to focus on developing innovative wheat seed varieties that cater to these evolving consumer preferences.

Sustainability and Environmental Concerns

Sustainability and environmental concerns are increasingly influencing the Wheat Seed Market. As awareness of climate change and its effects on agriculture grows, there is a pressing need for sustainable farming practices. This has led to a rise in demand for wheat seeds that require fewer inputs, such as water and fertilizers, while still delivering high yields. In 2025, the market for sustainable wheat seed varieties is expected to expand significantly, driven by consumer preferences for environmentally friendly products. Consequently, seed companies are likely to invest in research and development to create wheat varieties that align with these sustainability goals, thereby enhancing their market position within the Wheat Seed Market.

Technological Advancements in Seed Development

Technological advancements in seed development are significantly influencing the Wheat Seed Market. Innovations such as genetic modification and precision breeding techniques are enabling the creation of wheat varieties that are more resilient to environmental stresses and pests. For instance, the introduction of drought-resistant wheat seeds is becoming increasingly relevant as climate change impacts agricultural productivity. In 2025, it is estimated that the market for genetically modified wheat seeds could account for over 20% of the total wheat seed market. These advancements not only enhance yield potential but also contribute to sustainable farming practices, thereby attracting investment and interest in the Wheat Seed Market.