Top Industry Leaders in the Wheat Gluten Market

The wheat gluten market is a vital segment within the food industry, driven by the increasing demand for plant-based proteins and the versatile applications of wheat gluten in various food products. Key players in this market employ diverse strategies to establish and strengthen their positions, with factors such as product innovation, global distribution networks, and sustainability practices influencing the overall competitive landscape.

Key Players:

Royal Ingredients Group BV (Netherlands)

Pioneer Industries Limited (India)

Cargill Incorporated (US.)

Meelunie B.V. (Netherlands)

Permolex Ltd (Canada)

Amilina AB (Lithuania)

Z&F Sungold Corporation (China)

Tereos SCA (France)

Ardent Mills LLC (US.)

Bryan W. Nash & Sons Limited (UK),

Strategies Adopted:

To navigate the competitive landscape, key players in the wheat gluten market deploy strategic initiatives. Product diversification is a central strategy, with companies continually introducing new wheat gluten formulations and derivatives to cater to evolving consumer preferences. Strategic partnerships with food manufacturers, bakeries, and retailers enable companies to integrate wheat gluten into a wide range of products, expanding market reach. Moreover, marketing efforts focus on promoting the nutritional benefits, functional properties, and sustainability aspects of wheat gluten to drive consumer acceptance.

Market Share Analysis:

Several factors contribute to the analysis of market share within the wheat gluten market. Research and development capabilities are crucial, as companies that innovate and create high-quality wheat gluten products gain a competitive edge. Robust global distribution networks ensure market penetration and accessibility to a diverse customer base. Adherence to regulatory standards, quality control measures, and certifications such as ISO and FSSC 22000 play a pivotal role in ensuring wheat gluten products meet industry requirements. Brand reputation, customer relationships, and pricing strategies are also key factors influencing a company's market share within this competitive landscape.

News & Emerging Companies:

The wheat gluten market has witnessed the emergence of innovative startups and specialized companies focusing on unique wheat gluten formulations or applications. These emerging companies often introduce wheat gluten products that address specific dietary needs, such as gluten-free alternatives or enriched protein concentrates. Industry news suggests a growing trend of collaborations between wheat gluten manufacturers and plant-based food companies to develop customized solutions for meat substitutes and vegetarian products. Additionally, mergers and acquisitions contribute to the evolving competitive landscape as companies seek to enhance their product portfolios and market presence.

Industry Trends:

Recent industry news highlights a trend of increased investment in sustainable sourcing of wheat for gluten production. Companies are responding to consumer demands for transparency and ethical practices by investing in responsible wheat cultivation and supply chain management. Moreover, advancements in processing technologies, such as extrusion and wet gluten production methods, are gaining prominence, allowing for the production of wheat gluten with improved texture and functionality. The industry is also witnessing investments in marketing campaigns to promote the environmental benefits of plant-based proteins, aligning with the broader trend towards sustainable and ethical consumption.

Competitive Scenario:

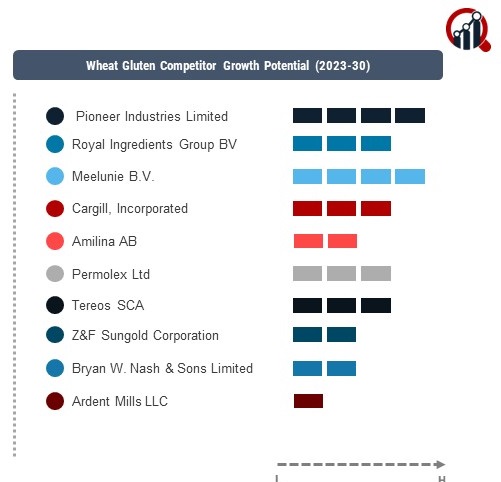

The wheat gluten market is characterized by robust competition among key players aiming to establish themselves as leaders in the plant-based protein sector. Companies compete based on factors such as product quality, innovation, and the ability to meet the diverse needs of food manufacturers and consumers. The market's dynamic nature requires players to stay abreast of technological advancements, regulatory changes, and evolving consumer preferences. Given the increasing popularity of plant-based diets, wheat gluten manufacturers must balance product affordability with nutritional value and sustainability to maintain a competitive edge.

Recent Development

The wheat gluten market was the announcement by Archer Daniels Midland Company regarding the launch of a new line of clean-label wheat gluten solutions designed to meet the growing demand for natural and minimally processed ingredients. This innovation aimed to address the evolving consumer preferences for transparent and clean-label products in the food industry. Additionally, Cargill, Incorporated revealed a strategic investment in expanding its wheat gluten production facilities to meet the rising market demand. These developments underscore the industry's commitment to innovation and capacity expansion to meet the evolving needs of consumers and food manufacturers in the competitive landscape of the wheat gluten market.