Automotive Industry Growth

The automotive industry is undergoing a transformation, with an increasing focus on electric vehicles and advanced manufacturing techniques. This shift is likely to drive the demand for welding products, as modern vehicles require sophisticated welding processes for assembly and structural integrity. In 2025, the automotive sector is anticipated to witness a growth rate of around 4%, which could lead to heightened demand for welding technologies. The Welding Products Market is expected to adapt to these changes by offering innovative solutions that cater to the specific needs of automotive manufacturers. Additionally, the integration of automation and robotics in welding processes is likely to enhance efficiency and precision, further propelling the market forward. Thus, the automotive industry's evolution appears to be a significant catalyst for the Welding Products Market.

Focus on Safety and Compliance

Safety regulations and compliance standards are becoming increasingly stringent across various industries, which is likely to drive the demand for high-quality welding products. The Welding Products Market is responding to this trend by developing products that meet or exceed safety standards, ensuring that workers are protected during welding operations. In 2025, the market for safety equipment related to welding is expected to grow by approximately 6%, reflecting the heightened awareness of workplace safety. Companies are investing in training and equipment to comply with regulations, which could lead to increased sales of personal protective equipment, welding helmets, and fume extraction systems. Therefore, the focus on safety and compliance is emerging as a crucial driver for the Welding Products Market.

Increasing Demand in Construction Sector

The construction sector is experiencing a notable surge in demand for welding products, driven by infrastructure development and urbanization. As nations invest in building and upgrading roads, bridges, and buildings, the Welding Products Market is poised to benefit significantly. In 2025, the construction industry is projected to grow at a compound annual growth rate of approximately 5.5%, which directly correlates with the rising need for welding applications. This growth is likely to stimulate the demand for various welding products, including welding machines, consumables, and safety equipment. Furthermore, the trend towards prefabrication in construction is expected to enhance the utilization of welding technologies, thereby reinforcing the market's expansion. Consequently, the construction sector's robust growth trajectory appears to be a pivotal driver for the Welding Products Market.

Emerging Markets and Economic Development

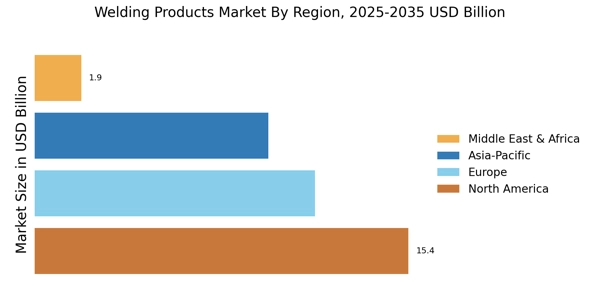

Emerging markets are witnessing rapid economic development, which is likely to create new opportunities for the Welding Products Market. As countries in Asia, Africa, and Latin America continue to industrialize, the demand for welding products is expected to rise significantly. In 2025, these regions are projected to experience economic growth rates exceeding 5%, which could lead to increased investments in manufacturing and construction. This growth is likely to stimulate the need for welding technologies, as industries seek to enhance production capabilities. Furthermore, the expansion of infrastructure projects in these regions is expected to further drive the demand for welding products. Thus, the economic development in emerging markets appears to be a vital driver for the Welding Products Market.

Rising Adoption of Automation and Robotics

The integration of automation and robotics in manufacturing processes is transforming the Welding Products Market. As industries seek to enhance productivity and reduce labor costs, the adoption of automated welding systems is on the rise. In 2025, the market for robotic welding is projected to grow at a rate of approximately 7%, indicating a strong trend towards automation. This shift not only improves efficiency but also ensures higher precision and consistency in welding applications. Industries such as aerospace, shipbuilding, and heavy machinery are increasingly relying on automated solutions, which could lead to a substantial increase in the demand for advanced welding products. Consequently, the growing trend of automation and robotics is likely to serve as a key driver for the Welding Products Market.