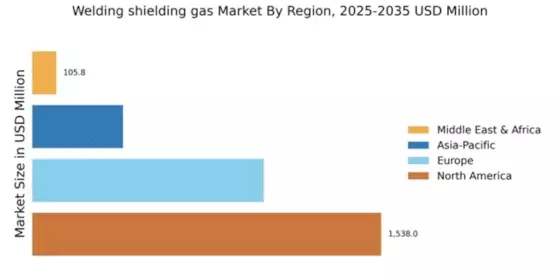

North America : Market Leader in Shielding Gases

North America is poised to maintain its leadership in the welding shielding gas market, holding a significant market share of 1538.0 million. The growth is driven by robust industrial activities, particularly in manufacturing and construction, alongside stringent safety regulations that mandate the use of high-quality shielding gases. The increasing adoption of advanced welding technologies further fuels demand, ensuring a steady market expansion. The United States stands out as the leading country in this region, hosting major players like Air Products, Praxair, and Matheson Tri-Gas. The competitive landscape is characterized by innovation and strategic partnerships among key players, enhancing product offerings and market reach. The presence of established companies ensures a stable supply chain, catering to diverse industrial needs, thus solidifying North America's market position.

Europe : Emerging Market with Growth Potential

Europe's welding shielding gas market is projected to grow significantly, with a market size of 1020.0 million. The region benefits from a strong manufacturing base and increasing investments in infrastructure projects. Regulatory frameworks promoting safety and environmental standards are also key drivers, pushing industries to adopt advanced welding solutions that utilize high-quality shielding gases, thereby enhancing market demand. Germany and France are leading countries in this market, with major companies like Linde and Air Liquide driving innovation and competition. The competitive landscape is marked by a focus on sustainability and efficiency, with companies investing in research and development to create eco-friendly gas solutions. This dynamic environment positions Europe as a vital player in The Welding shielding gas.

Asia-Pacific : Rapidly Growing Industrial Sector

The Asia-Pacific region is witnessing rapid growth in the welding shielding gas market, with a market size of 400.0 million. This growth is primarily driven by the booming manufacturing sector, particularly in countries like China and India, where industrialization is at its peak. The increasing demand for high-quality welding solutions, coupled with supportive government policies, is propelling the market forward, making it a key area for investment and development. China is the dominant player in this region, with significant contributions from local companies and international players like Taiyo Nippon Sanso. The competitive landscape is evolving, with a focus on technological advancements and cost-effective solutions. As industries continue to expand, the demand for welding shielding gases is expected to rise, further solidifying Asia-Pacific's position in the global market.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region is gradually emerging in the welding shielding gas market, with a market size of 105.8 million. The growth is driven by increasing industrial activities and infrastructure development, particularly in the Gulf Cooperation Council (GCC) countries. However, challenges such as political instability and fluctuating oil prices can impact market dynamics, necessitating strategic planning for sustained growth. Countries like South Africa and the UAE are leading the market, with a mix of local and international players. The competitive landscape is characterized by a focus on quality and reliability, with companies striving to meet the specific needs of diverse industries. As the region continues to develop, the demand for welding shielding gases is expected to grow, presenting opportunities for market expansion.