Market Growth Projections

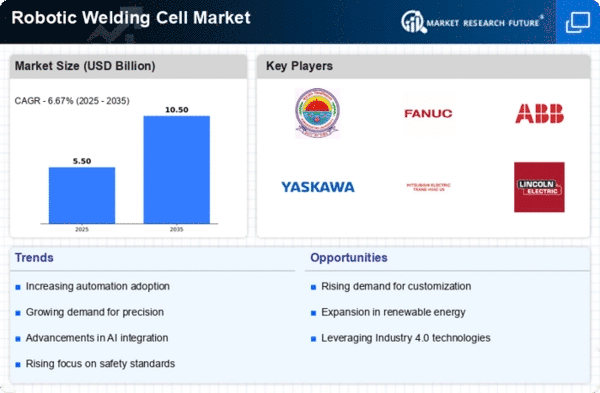

The Global Robotic Welding Cell Market Industry is poised for substantial growth, with projections indicating a market value of 5.16 USD Billion in 2024 and an anticipated increase to 10.5 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.67% from 2025 to 2035. Such figures reflect the increasing adoption of robotic welding solutions across various sectors, driven by factors such as automation, quality demands, and technological advancements. The market's expansion is indicative of a broader trend towards automation in manufacturing, positioning robotic welding cells as a critical component of future industrial operations.

Labor Shortages and Skills Gap

The Global Robotic Welding Cell Market Industry is significantly influenced by labor shortages and the skills gap in manufacturing. As the workforce ages and fewer skilled workers enter the field, companies are turning to robotic welding solutions to mitigate these challenges. By automating welding processes, manufacturers can maintain production levels without relying heavily on skilled labor. This shift not only addresses labor shortages but also enhances operational efficiency. The market's growth is further supported by a projected CAGR of 6.67% from 2025 to 2035, highlighting the increasing reliance on robotic solutions in the face of workforce challenges.

Rising Demand for High-Quality Welds

Quality assurance is paramount in manufacturing, particularly in sectors such as aerospace and automotive. The Global Robotic Welding Cell Market Industry is driven by the rising demand for high-quality welds that robotic systems can provide. These systems minimize human error and ensure consistent weld quality, which is crucial for safety and durability. As industries increasingly prioritize quality, the adoption of robotic welding cells is likely to rise. This trend is projected to contribute to the market's growth, with estimates suggesting a value of 10.5 USD Billion by 2035, indicating a robust trajectory for the industry.

Growing Focus on Safety and Compliance

Safety and compliance are critical considerations in the manufacturing sector, driving the Global Robotic Welding Cell Market Industry. Robotic welding cells enhance workplace safety by reducing the risk of accidents associated with manual welding processes. As regulations become more stringent, companies are compelled to adopt safer practices, including the use of robotic systems. This focus on safety not only protects workers but also ensures compliance with industry standards. The increasing emphasis on safety is expected to propel market growth, as organizations prioritize investments in technologies that enhance both safety and operational efficiency.

Increasing Automation in Manufacturing

The Global Robotic Welding Cell Market Industry is experiencing a surge in demand due to the increasing automation in manufacturing processes. Industries are increasingly adopting robotic welding cells to enhance productivity and reduce labor costs. For instance, automotive manufacturers are integrating these systems to streamline assembly lines, resulting in improved efficiency and precision. As of 2024, the market is valued at approximately 5.16 USD Billion, reflecting the industry's shift towards automation. This trend is expected to continue, as companies seek to optimize operations and maintain competitiveness in a rapidly evolving market.

Technological Advancements in Robotics

Technological advancements play a pivotal role in shaping the Global Robotic Welding Cell Market Industry. Innovations such as artificial intelligence, machine learning, and enhanced sensor technologies are making robotic welding systems more efficient and adaptable. These advancements allow for real-time monitoring and adjustments, improving the overall welding process. As manufacturers seek to leverage these technologies, the demand for advanced robotic welding cells is likely to increase. This trend is indicative of a broader movement towards smart manufacturing, where connectivity and automation are paramount for operational success.