Expansion of the Packaging Sector

The packaging industry is evolving, with a growing emphasis on sustainable and durable materials. Vulcanized fiber is increasingly recognized for its eco-friendly properties and strength, making it a suitable choice for packaging applications. The Vulcanized Fiber Market is expected to reach USD 1 trillion by 2027, with a notable shift towards sustainable solutions. This trend may provide a substantial opportunity for the Vulcanized Fiber Market, as manufacturers align their products with consumer preferences for environmentally responsible packaging. The versatility of vulcanized fiber in various packaging formats could enhance its adoption across multiple sectors, including food and consumer goods.

Growth in Automotive Applications

The automotive sector is witnessing a significant transformation, with a marked increase in the use of vulcanized fiber for various applications. This material is favored for its lightweight, durability, and resistance to heat and chemicals, making it ideal for components such as gaskets, seals, and insulation. The automotive industry is projected to grow at a CAGR of 4.5% through 2027, which could drive the Vulcanized Fiber Market as manufacturers seek materials that enhance vehicle performance and efficiency. As electric vehicles gain traction, the demand for high-performance materials like vulcanized fiber is likely to rise, further propelling market growth.

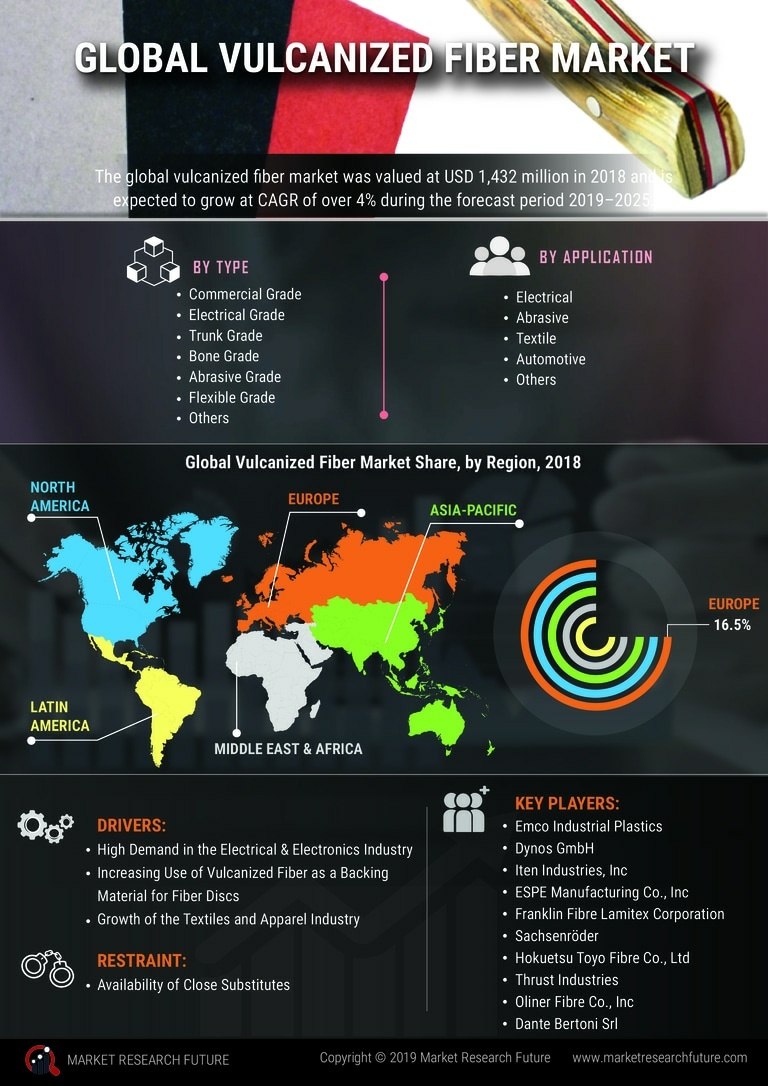

Rising Demand in Electrical Insulation

The increasing demand for electrical insulation materials is a prominent driver in the Vulcanized Fiber Market. As industries such as automotive, electronics, and renewable energy expand, the need for effective insulation solutions grows. Vulcanized fiber, known for its excellent dielectric properties, is increasingly utilized in electrical components, including transformers and circuit boards. The market for electrical insulation materials is projected to reach USD 30 billion by 2026, indicating a robust growth trajectory. This trend suggests that manufacturers in the Vulcanized Fiber Market may experience heightened demand as they cater to the evolving needs of these sectors, potentially leading to innovations in product offerings.

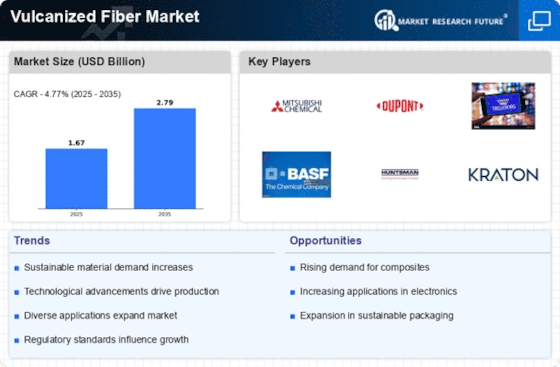

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are significantly influencing the Vulcanized Fiber Market. Innovations such as improved production techniques and enhanced material formulations are enabling manufacturers to produce higher quality vulcanized fiber with superior properties. These advancements not only improve the performance of the material but also reduce production costs, making it more competitive in various applications. As industries increasingly seek high-performance materials, the ability to innovate in manufacturing could position the Vulcanized Fiber Market favorably in the marketplace. The integration of automation and smart technologies in production lines may further streamline operations, enhancing overall efficiency.

Increased Focus on Renewable Energy Solutions

The Vulcanized Fiber Industry. As the demand for wind and solar energy systems rises, the need for reliable and durable materials for components such as wind turbine blades and solar panel insulation becomes critical. Vulcanized fiber's lightweight and resilient characteristics make it an attractive option for these applications. The renewable energy sector is projected to grow at a CAGR of 8% through 2030, suggesting a robust demand for materials that can withstand harsh environmental conditions. This trend may drive the Vulcanized Fiber Market as manufacturers adapt their offerings to meet the needs of this expanding sector.