Viral Vector Manufacturing Size

Viral Vector Manufacturing Market Growth Projections and Opportunities

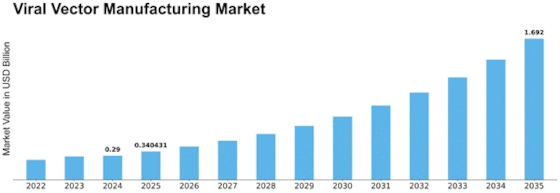

The Viral Vector Manufacturing Market is expected to grow at a CAGR of 20.2% to reach USD 1.04 Billion by 2032. Several factors are coming into play in shaping the Viral Vector Manufacturing Market, with many driving its growth. The major drivers include growth of gene therapy and use of viral vectors for delivery of therapeutic genes to target cells. Gene therapies that insert functional genes or change cellular functions have become popular for treatment of genetic disorders, cancers as well as other diseases. Therefore, the demand for gene therapy has increased necessitating the development of efficient and scalable viral vector production procedures.

Technological advancements Influence the Viral Vector Manufacturing Market. Continuous developments in viral vector production techniques like transient transfection, stable cell lines and suspension cell culture systems enhance manufacturing processes and output levels. Advances in downstream processing, purification and analytics foster higher efficiency and quality in viral vector production. Lentiviral vectors can now be manufactured alongside adeno-associated vectors (AAV) and adenoviral vectors, on the same platforms which can meet multiple therapeutic needs.

Gene therapy clinical trials are increasing their need for scalable standardized viral vector manufacturing methods along with approval processes they undergo. As gene therapy candidates move through clinical development large-scale manufacture of high-quality viral vectors will be required.. Gene therapy initiatives must have cGMP-compliant production process including enough amount of vectors for clinical trials plus future commercialization purposes.

Economic factors such as cost-effectiveness and scalability influence adoption of viral vector manufacturing. Viral vector production’s economic viability determines the commercialization of gene therapy. Development pipeline for gene therapies in biopharmaceutical companies is supported by scalable, economical production technologies. The Viral Vector production Market optimizes production processes to save costs, boost yields, and expand scalability.

Global collaboration and partnerships enhance the Viral Vector Manufacturing Market. Research institutes work together with biopharmaceutical companies and manufacturing plants to exchange data, experience, and resources. This kind cooperation is imperative due to regulatory differences, technological transfers, industrial standards that complicate viral vector manufacture. It also encompasses viral vector technology improvements through sharing of best practices.

The competitive landscape plus consolidation define the way Viral Vector Manufacturing Market shapes up over time. Existing plants compete by engaging Contract Development and Manufacturing Organizations (CDMOs) in strategic collaborations . Mergers and acquisitions are critical because they help firms streamline their manufacturing capabilities while expanding their product offering for a dynamic market like viral vector manufacturing industry. Competition drives the development of new technologies that reduce prices, improve quality or improve availability of viral vectors used in gene therapy.

Leave a Comment