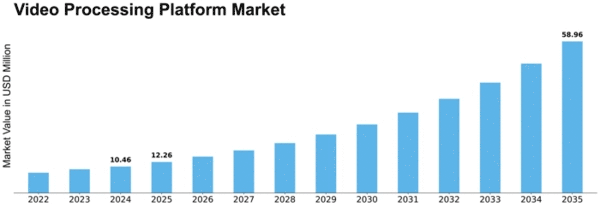

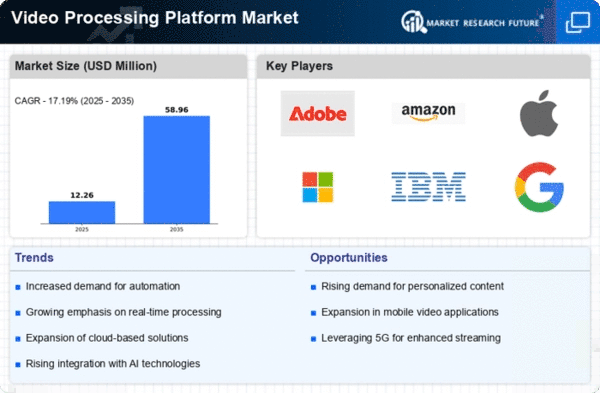

Video Processing Platform Size

Video Processing Platform Market Growth Projections and Opportunities

Recent years have seen major developments in the Video Processing Platform (VPP) industry. Because the digital world changes constantly. Video processing technologies are essential for managing and enhancing video in games, enjoyment, education, and monitoring. Video processing platforms are seeing greater demand for high-quality footage. Advanced video processing is needed because more individuals and corporations seek more engaging and visually attractive experiences. Increasingly, streaming providers and content creators are offering 4K and 8K video. This tendency is notably evident in entertainment. The Video Processing Platform industry has also evolved due to live broadcasting. Real-time video processing is becoming increasingly critical as Twitch and YouTube Live grow. Video processing platforms must provide low-latency alternatives to ensure a seamless and comfortable viewing experience for live sports, gaming competitions, and virtual events. Machine learning and AI are being used in video processing systems. These technologies enable sophisticated video analytics, content-suggesting algorithms, and real-time video enhancement. Artificial intelligence can identify material, recognize objects, and detect deepfakes in videos. This fixes content validity and security. Cloud-based video processing is another industry trend. Scalable, adaptable, and cost-effective cloud-based video processing platforms let enterprises process videos. The industry's shift toward cloud computing helps corporations encode, convert, and deliver films using remote computers. Security and privacy concerns have also affected the Video Processing Platforms industry. With more video data, securing private information and implementing data protection standards are crucial. Video Processing Platforms are adding security, access controls, and privacy capabilities to address these issues and develop user confidence. Many aspects of video editing are changing with 5G. 5G networks are faster and less delayed, so mobile devices can play high-quality videos seamlessly. Video processing platforms are adapting to 5G's characteristics, creating new prospects for mobile video applications, AR, and VR. Video Processing Platform interoperability is crucial. As devices and platforms proliferate, it's crucial that everything functions smoothly. Video processing systems that integrate with many hardware, software, and streaming protocols are becoming increasingly popular. Video processing becomes more linked and user-friendly.

Leave a Comment