Market Share

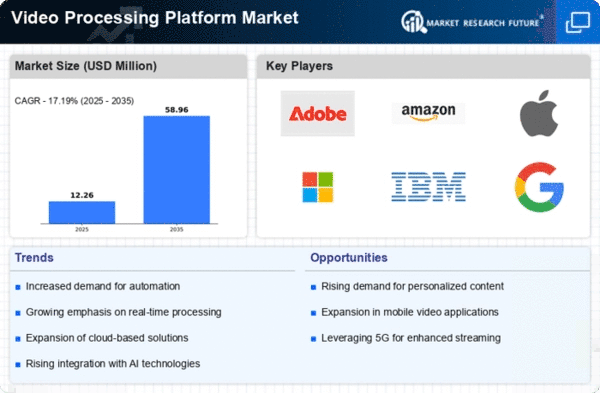

Video Processing Platform Market Share Analysis

Video Processing Platform Market is competitive and ever-changing. Companies utilize several market share positioning strategies to remain ahead. Companies must employ these strategies to stay ahead in a changing marketplace. Businesses employ differentiation to provide unique characteristics that set them apart from competitors. Advanced video editing, cutting-edge gear, and specialized software are examples. Companies highlight their platform's unique qualities to attract consumers seeking certain functionality or performance requirements. This is termed "cost leadership." Companies optimize manufacturing processes, negotiate strong supplier arrangements, and achieve economies of scale to be the most cost-effective option in the market. By offering an affordable video processing tool, companies may expand their market share. This may appeal to budget-conscious clients and enterprises. To avoid the issues associated with low-cost items, establish a balance between low prices and great quality. Video Processing Platform Market companies also segment the market. Finding out which groups have distinct demands helps companies tailor their products to certain markets. This might imply building versions of their platform for various companies or use cases like altering films, streaming, or monitoring. A concentrated approach may help organizations penetrate certain markets and improve their positions. Partnerships and agreements help organizations position their Video Processing Platform Market shares. Companies want smart collaborations with gadget manufacturers, software developers, and content suppliers to improve their sites. Working with other firms in the same sector helps companies provide better and more thorough answers. These collaborations boost service availability and assist the environment by fostering new ideas and mutually beneficial interactions. Innovation and product growth are crucial in this fast-paced sector. You must adapt to technology and anticipate client needs to maintain and expand your market share. Businesses invest in R&D to expand features, speed up handling, and improve overall performance. Regular adjustments and new goods attract new clients and discourage existing ones from migrating to rivals with superior offerings. Businesses often expand globally to gain market share. Because technology doesn't respect boundaries, companies hunt for opportunities in unexplored markets. This requires adapting their systems to local laws, infrastructure, and preferences and creating a robust sales and distribution network. Companies that go global may reach more clients and become less dependent on a few places. These aid long-term stability and growth. Customer-focused strategies are crucial in the Video Processing Platform Market. Knowing what the target audience wants and needs helps create tools that appeal to them. Businesses invest money on customer service, ask for feedback, and update products depending on user feedback. consumers who return will also promote excellent word of mouth, which may attract new consumers. Finally, clever purchases may alter a company's market position. firms might purchase competitors or complementary firms to expand their market share and product offerings. This strategy helps organizations develop quicker and use the acquired entity's clients and skills. Integrating and managing purchased assets properly are crucial to maximizing these agreements.

Leave a Comment