Rising Pet Ownership

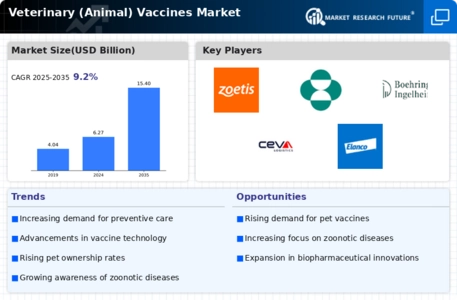

The increasing trend of pet ownership globally is a primary driver for the Global Veterinary Animal Vaccines Market Industry. As more households adopt pets, the demand for veterinary services, including vaccinations, rises significantly. In 2024, the market is valued at 6.27 USD Billion, reflecting the growing concern among pet owners for their animals' health. This trend is particularly pronounced in urban areas, where pet ownership rates have surged. Consequently, the need for effective vaccines to prevent diseases in pets is becoming more critical, thereby propelling the market forward.

Market Growth Projections

The Global Veterinary Animal Vaccines Market Industry is projected to experience substantial growth in the coming years. With a market value of 6.27 USD Billion in 2024, it is anticipated to reach 15.4 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 8.48% from 2025 to 2035. Such projections reflect the increasing demand for veterinary vaccines driven by factors such as rising pet ownership, advancements in vaccine technology, and heightened awareness of animal health. The market's expansion is indicative of the critical role that vaccines play in ensuring the health and well-being of animals globally.

Emerging Zoonotic Diseases

The emergence of zoonotic diseases is a significant driver for the Global Veterinary Animal Vaccines Market Industry. As new diseases that can be transmitted from animals to humans arise, there is an urgent need for effective vaccination strategies to control outbreaks. This concern is particularly relevant in regions where livestock and wildlife interactions are frequent. The increasing incidence of such diseases highlights the necessity for robust vaccination programs, thereby propelling market growth. The focus on preventing zoonotic diseases is expected to contribute to the overall expansion of the market in the coming years.

Regulatory Support and Standards

Regulatory frameworks and standards established by government agencies play a crucial role in shaping the Global Veterinary Animal Vaccines Market Industry. Governments worldwide are implementing stringent regulations to ensure the safety and efficacy of veterinary vaccines. This regulatory support fosters consumer confidence and encourages veterinarians to adopt new vaccines. Moreover, compliance with these regulations often leads to improved product quality, which can enhance market growth. As the industry evolves, adherence to these standards will likely remain a key driver for the market, ensuring that animal health is prioritized.

Advancements in Vaccine Technology

Technological advancements in vaccine development are transforming the Global Veterinary Animal Vaccines Market Industry. Innovations such as recombinant vaccines and mRNA technology are enhancing vaccine efficacy and safety. These advancements not only improve the immune response in animals but also reduce the incidence of adverse effects. As a result, veterinarians are more likely to recommend these modern vaccines, further driving market growth. The anticipated market expansion to 15.4 USD Billion by 2035 underscores the importance of these technological developments in meeting the evolving needs of animal health.

Increased Awareness of Animal Health

There is a growing awareness among pet owners and livestock producers regarding the importance of animal health, which significantly influences the Global Veterinary Animal Vaccines Market Industry. Educational campaigns and outreach programs by veterinary associations have heightened understanding of the benefits of vaccinations. This awareness leads to increased vaccination rates, thereby reducing the prevalence of infectious diseases in animals. As the market continues to expand, the projected compound annual growth rate of 8.48% from 2025 to 2035 indicates that this trend will likely persist, further solidifying the role of vaccines in animal health.