Rising Pet Ownership

The increasing trend of pet ownership in the UK appears to be a significant driver for the animal vaccines market. As more households adopt pets, the demand for veterinary services, including vaccinations, is likely to rise. According to recent statistics, approximately 50% of UK households own a pet, which translates to millions of potential vaccine recipients. This growing pet population necessitates a robust supply of vaccines to ensure the health and well-being of these animals. Furthermore, pet owners are becoming more aware of the importance of vaccinations, which may lead to increased spending on veterinary care. Consequently, the animal vaccines market is expected to expand as pet owners prioritize preventive healthcare for their animals.

Regulatory Changes and Compliance

The evolving regulatory landscape in the UK is likely to impact the animal vaccines market significantly. Stricter regulations regarding vaccine safety, efficacy, and quality control may drive manufacturers to invest in more advanced production processes. Compliance with these regulations is essential for market players to maintain their licenses and ensure consumer trust. The UK government has been proactive in updating its regulatory framework to align with international standards, which may lead to increased scrutiny of vaccine products. As a result, companies in the animal vaccines market may need to allocate more resources to research and development, ultimately influencing pricing and availability. This regulatory environment could create both challenges and opportunities for market participants.

Advancements in Veterinary Medicine

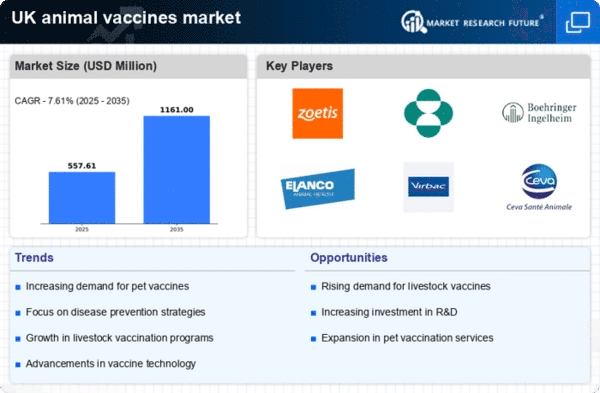

Innovations in veterinary medicine are likely to play a crucial role in shaping the animal vaccines market. The development of new vaccine formulations and delivery methods, such as intranasal and oral vaccines, may enhance the efficacy and convenience of vaccinations. Additionally, the integration of biotechnology in vaccine production could lead to more effective and safer vaccines. The UK veterinary sector has seen a surge in research and development activities, with investments reaching £200 million in recent years. This focus on innovation not only improves animal health outcomes but also drives market growth as veterinarians and pet owners seek the latest advancements in vaccine technology. As a result, the animal vaccines market is poised for expansion, driven by these advancements.

Growing Demand for Livestock Vaccination

The increasing focus on livestock health and productivity is likely to drive the animal vaccines market in the UK. Farmers are becoming more aware of the economic benefits associated with vaccinating their livestock, as it can lead to reduced disease outbreaks and improved productivity. The UK livestock sector contributes significantly to the economy, with an estimated value of £7 billion. As farmers seek to enhance the health of their herds and flocks, the demand for effective vaccines is expected to rise. This trend may be further supported by government initiatives aimed at promoting biosecurity and disease prevention in agriculture. Consequently, the animal vaccines market is anticipated to experience growth as livestock vaccination becomes a priority for farmers.

Increased Awareness of Zoonotic Diseases

The heightened awareness of zoonotic diseases among the UK population is likely to influence the animal vaccines market positively. With the recognition that many diseases can be transmitted from animals to humans, there is a growing emphasis on vaccinating pets and livestock to prevent outbreaks. Public health campaigns and educational initiatives have underscored the importance of vaccination in controlling zoonotic diseases, which may lead to increased demand for vaccines. The animal vaccines market could see a surge in sales as both pet owners and farmers prioritize vaccination as a preventive measure. This trend is further supported by government initiatives aimed at promoting animal health and reducing the risk of zoonotic disease transmission.