Technological Innovations

Technological advancements are playing a pivotal role in shaping the VAE Emulsion Market. Innovations in formulation chemistry and production processes are enhancing the performance characteristics of VAE emulsions. For instance, the development of advanced polymerization techniques has led to the creation of emulsions with superior adhesion, flexibility, and durability. These improvements are particularly beneficial in applications such as coatings, adhesives, and sealants, where performance is critical. Furthermore, the integration of digital technologies in manufacturing processes is streamlining operations, reducing costs, and improving product quality. As a result, companies that leverage these technological innovations are likely to enhance their market share and meet the evolving demands of consumers. The VAE Emulsion Market is thus positioned for growth, driven by continuous innovation and the quest for higher performance products.

Sustainability Initiatives

The increasing emphasis on sustainability within the VAE Emulsion Market is driving demand for eco-friendly products. Manufacturers are increasingly adopting sustainable practices, such as using renewable resources and minimizing waste. This shift is not merely a trend; it reflects a broader societal movement towards environmental responsibility. As consumers become more environmentally conscious, they are likely to prefer products that align with their values. Consequently, companies that prioritize sustainability may gain a competitive edge. The VAE Emulsion Market is witnessing a rise in formulations that are low in volatile organic compounds (VOCs), which are less harmful to the environment. This trend is expected to continue, as regulatory frameworks increasingly favor sustainable practices, potentially leading to a more robust market presence for eco-friendly VAE emulsions.

Rising Construction Activities

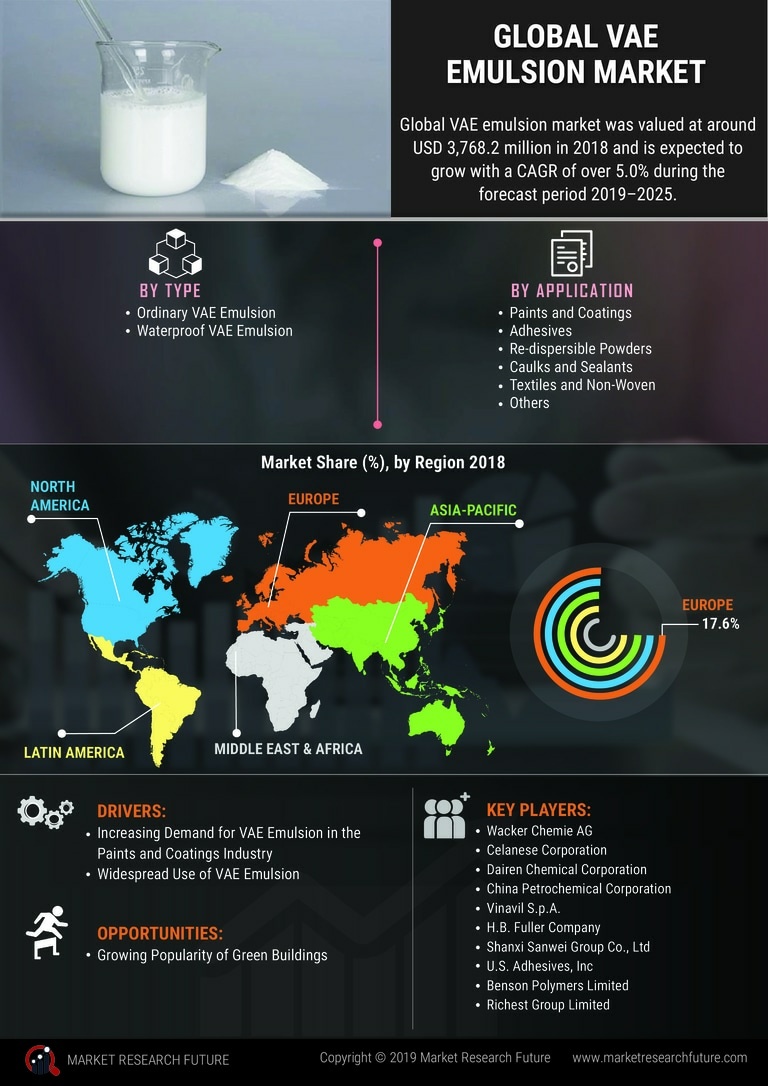

The resurgence of construction activities is significantly influencing the VAE Emulsion Market. As urbanization accelerates, there is a growing need for construction materials that offer durability and aesthetic appeal. VAE emulsions are increasingly utilized in paints, coatings, and adhesives, which are essential components of modern construction projects. According to industry reports, the construction sector is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next few years, thereby driving demand for VAE emulsions. This growth is further fueled by government initiatives aimed at infrastructure development, which are likely to create a favorable environment for the VAE Emulsion Market. Consequently, manufacturers are expected to ramp up production to meet the rising demand, positioning themselves strategically within this expanding market.

Regulatory Compliance and Standards

Regulatory compliance is becoming increasingly critical in the VAE Emulsion Market. Governments and regulatory bodies are implementing stringent standards regarding the use of chemicals in various applications, particularly in construction and consumer products. These regulations often focus on reducing harmful substances and promoting safer alternatives. As a result, manufacturers are compelled to innovate and reformulate their products to meet these evolving standards. The VAE Emulsion Market is witnessing a shift towards formulations that comply with these regulations, which may include lower VOC content and enhanced safety profiles. This compliance not only ensures market access but also enhances brand reputation among environmentally conscious consumers. Consequently, companies that proactively adapt to regulatory changes are likely to secure a competitive advantage in the VAE Emulsion Market.

Consumer Preference for High-Performance Products

Consumer preferences are evolving towards high-performance products, which is a key driver for the VAE Emulsion Market. As end-users seek materials that offer enhanced durability, flexibility, and resistance to environmental factors, VAE emulsions are increasingly favored for their superior properties. This trend is particularly evident in sectors such as automotive, construction, and consumer goods, where performance is paramount. Market data indicates that the demand for high-performance coatings and adhesives is expected to rise, potentially leading to a market expansion for VAE emulsions. Manufacturers are responding to this shift by developing specialized formulations that cater to specific application needs, thereby enhancing their product offerings. The VAE Emulsion Market is thus likely to benefit from this growing consumer inclination towards high-quality, performance-driven products.