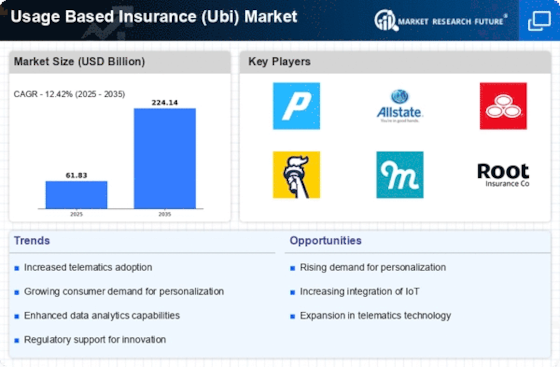

Market Competition

The competitive landscape of the Usage Based Insurance (Ubi) Market is intensifying as new entrants and established players vie for market share. Insurers are increasingly recognizing the potential of Ubi to differentiate their offerings and attract a broader customer base. The entry of insurtech companies, which leverage technology to provide innovative insurance solutions, is reshaping the market dynamics. These companies often offer more flexible and user-friendly Ubi products, appealing to tech-savvy consumers. Additionally, traditional insurers are investing in technology and partnerships to enhance their Ubi capabilities, leading to a more diverse range of products in the market. This heightened competition may drive down prices and improve service quality, ultimately benefiting consumers. As the market continues to evolve, insurers that can effectively navigate this competitive landscape may emerge as leaders in the Ubi sector.

Regulatory Support

Regulatory frameworks are evolving to support the growth of the Usage Based Insurance (Ubi) Market. Governments are increasingly recognizing the benefits of Ubi in promoting safer driving and reducing road accidents. As a result, some jurisdictions are implementing regulations that encourage the adoption of telematics-based insurance models. For instance, incentives for insurers to offer Ubi products may be introduced, fostering a more competitive market environment. Additionally, regulatory bodies are working to establish guidelines that protect consumer data privacy while allowing for the collection of driving behavior data. This regulatory support is likely to enhance consumer confidence in Ubi offerings, as individuals become more assured that their data is handled responsibly. As the regulatory landscape continues to evolve, it may create a more favorable environment for insurers to innovate and expand their Ubi product lines.

Technological Advancements

The rapid evolution of technology plays a pivotal role in the Usage Based Insurance (Ubi) Market. Innovations in telematics, mobile applications, and data analytics enable insurers to gather real-time data on driving behavior. This data-driven approach allows for personalized insurance premiums based on actual usage patterns, rather than traditional risk assessment methods. As of 2025, the integration of artificial intelligence and machine learning in data analysis is expected to enhance predictive capabilities, leading to more accurate pricing models. Furthermore, the proliferation of connected vehicles is likely to increase the volume of data available, thereby driving the demand for Ubi products. Insurers that leverage these technological advancements may gain a competitive edge, appealing to a tech-savvy consumer base that values transparency and customization in their insurance policies.

Environmental Considerations

The growing emphasis on sustainability and environmental responsibility is influencing the Usage Based Insurance (Ubi) Market. As consumers become more environmentally conscious, there is a rising demand for insurance products that align with eco-friendly practices. Ubi policies that reward low-emission driving behaviors or the use of electric vehicles are gaining traction among environmentally aware consumers. Insurers are increasingly incorporating sustainability metrics into their underwriting processes, which may lead to the development of specialized Ubi products aimed at promoting greener driving habits. Furthermore, as governments implement stricter emissions regulations, the demand for Ubi products that incentivize eco-friendly driving may increase. This alignment of insurance offerings with environmental goals could not only enhance brand reputation for insurers but also attract a new segment of consumers who prioritize sustainability in their purchasing decisions.

Changing Consumer Preferences

Consumer preferences are shifting towards more personalized and flexible insurance solutions, significantly impacting the Usage Based Insurance (Ubi) Market. As individuals become more aware of their driving habits and the potential for cost savings, they are increasingly inclined to opt for Ubi policies that reward safe driving behaviors. Recent surveys indicate that a substantial percentage of consumers express interest in pay-as-you-drive models, which align insurance costs with actual vehicle usage. This trend is particularly pronounced among younger demographics, who prioritize affordability and transparency in their financial decisions. Consequently, insurers are adapting their offerings to meet these evolving expectations, potentially leading to a surge in Ubi adoption rates. The ability to provide tailored insurance solutions that resonate with consumer values may prove crucial for insurers aiming to capture market share in this dynamic landscape.