Enhanced Data Collection Capabilities

advancements in data collection technologies are propelling the utility drones market.. Drones equipped with high-resolution cameras, LiDAR, and thermal imaging sensors are capable of capturing detailed data that is invaluable for utility companies. This enhanced data collection allows for more accurate assessments of utility assets, leading to improved decision-making and resource allocation. For instance, the ability to conduct thermal inspections of power lines can identify potential failures before they occur, thereby reducing downtime and maintenance costs. The integration of artificial intelligence and machine learning with drone data is also on the rise, further enhancing the analytical capabilities of utility drones. As a result, increased adoption is likely as companies leverage these advanced data collection methods to optimize their operations..

Cost Efficiency and Operational Savings

significant driving factors for utility drones include potential cost efficiency and operational savings.. Drones can perform tasks that traditionally required extensive manpower and resources, such as surveying and monitoring utility assets. By automating these processes, companies can reduce labor costs and minimize the time required for inspections. Reports suggest that the use of drones can lead to savings of up to 50% in operational costs compared to conventional methods. This financial incentive is compelling for utility companies, particularly in a competitive market where cost management is crucial. As organizations continue to seek ways to enhance profitability, the utility drones market is expected to grow, driven by the clear economic advantages that drone technology offers.

Increased Adoption in Emergency Response

increased adoption of utility drones is occurring in emergency response scenarios.. Drones provide rapid situational awareness during natural disasters, enabling utility companies to assess damage and restore services more efficiently. Their ability to cover large areas quickly and gather real-time data is invaluable in crisis situations. For example, drones can be deployed to inspect downed power lines or assess the impact of flooding on infrastructure. This capability not only speeds up recovery efforts but also enhances safety for personnel who would otherwise be exposed to hazardous conditions. As the frequency of extreme weather events continues to rise, the utility drones market is likely to expand, with more companies integrating drone technology into their emergency response strategies.

Growing Demand for Infrastructure Inspection

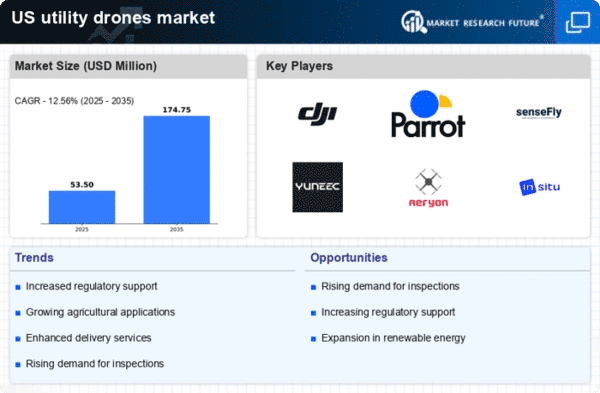

The utility drones market is experiencing a surge in demand for infrastructure inspection services. As aging infrastructure in the US requires regular monitoring and maintenance, utility drones offer a cost-effective and efficient solution. These drones can quickly assess the condition of bridges, power lines, and pipelines, reducing the need for manual inspections that are often time-consuming and hazardous. According to recent data, the market for infrastructure inspection using drones is projected to grow at a CAGR of 15% over the next five years. This trend indicates a strong shift towards adopting drone technology in the utility sector, as companies seek to enhance safety and operational efficiency. The utility drones market is thus positioned to benefit significantly from this growing demand, as stakeholders recognize the advantages of utilizing drones for comprehensive infrastructure assessments.

Rising Focus on Environmental Sustainability

The utility drones market is increasingly influenced by the growing emphasis on environmental sustainability. As utility companies strive to minimize their carbon footprint, drones present an eco-friendly alternative to traditional inspection and maintenance methods. Drones consume less energy and can operate in hard-to-reach areas without disturbing the environment. Furthermore, the ability to conduct aerial surveys reduces the need for ground vehicles, which contributes to lower emissions. Recent studies indicate that the use of drones can reduce operational costs by up to 30%, while also supporting sustainability goals. This alignment with environmental objectives is likely to drive further investment in the utility drones market, as companies seek to enhance their corporate social responsibility initiatives and comply with regulatory requirements.