Growing Demand for Marine Research

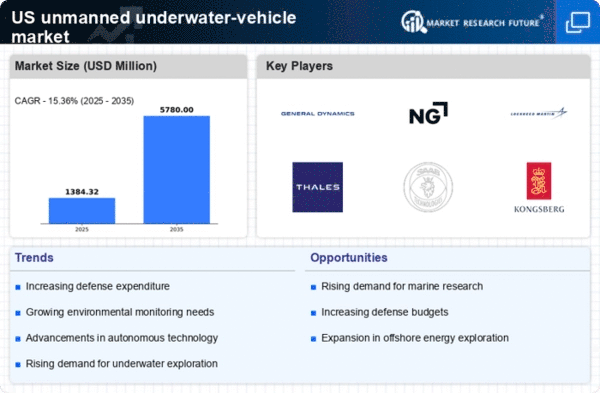

The unmanned underwater-vehicle market is experiencing a surge in demand driven by the increasing need for marine research and exploration. Institutions and organizations are investing in advanced underwater vehicles to study marine ecosystems, monitor environmental changes, and conduct geological surveys. The National Oceanic and Atmospheric Administration (NOAA) has reported a growing interest in utilizing unmanned vehicles for oceanographic research, which is expected to contribute to a market growth rate of approximately 15% annually. This trend indicates a shift towards more efficient and cost-effective methods of data collection in marine environments, thereby enhancing the capabilities of researchers and scientists in understanding ocean dynamics.

Advancements in Autonomous Technologies

The unmanned underwater-vehicle market is benefiting from advancements in autonomous technologies, which enhance the operational capabilities of these vehicles. Innovations in artificial intelligence, machine learning, and sensor technologies are enabling vehicles to perform complex tasks with minimal human intervention. This trend is particularly relevant in applications such as underwater mapping, search and rescue operations, and infrastructure inspection. As these technologies continue to evolve, the market is projected to grow at a compound annual growth rate (CAGR) of 12% over the next five years, driven by the increasing demand for autonomous solutions in various sectors.

Environmental Monitoring and Compliance

The need for environmental monitoring and compliance is a critical driver for the unmanned underwater-vehicle market. Regulatory bodies are increasingly mandating the use of advanced technologies to monitor water quality, assess pollution levels, and ensure compliance with environmental standards. The Environmental Protection Agency (EPA) has emphasized the importance of utilizing unmanned vehicles for effective monitoring of aquatic environments. This regulatory push is expected to create a market opportunity valued at approximately $500 million by 2027, as industries and governmental agencies adopt these vehicles to meet compliance requirements and enhance environmental stewardship.

Military Applications and Defense Spending

The unmanned underwater-vehicle market is significantly influenced by military applications and increased defense spending. The U.S. Department of Defense has recognized the strategic advantages of deploying unmanned underwater vehicles for surveillance, reconnaissance, and anti-submarine warfare. In recent years, defense budgets have allocated substantial funds towards the development and procurement of these vehicles, with estimates suggesting an investment of over $1 billion in the next five years. This focus on enhancing naval capabilities is likely to propel the market forward, as military organizations seek to leverage advanced technologies for operational superiority.

Commercial Exploration and Resource Management

The unmanned underwater-vehicle market is also being propelled by commercial exploration and resource management activities. Industries such as oil and gas, mining, and renewable energy are increasingly utilizing unmanned vehicles for underwater inspections, resource mapping, and maintenance operations. The Bureau of Ocean Energy Management (BOEM) has reported a rise in offshore exploration activities, which is likely to drive demand for unmanned vehicles capable of operating in challenging underwater environments. This sector is expected to account for a substantial share of the market, with projections indicating a growth potential of over $800 million by 2028 as companies seek to optimize their operations and reduce costs.