Focus on Autonomous Operations

The Military Unmanned Aerial Vehicle Market Industry is witnessing a pronounced focus on autonomous operations, which is reshaping military strategies. The demand for UAVs capable of conducting missions with minimal human intervention is on the rise, driven by the need for efficiency and reduced risk to personnel. As of 2025, it is estimated that autonomous UAVs will account for a significant portion of the market, with applications ranging from reconnaissance to combat support. This shift towards autonomy not only enhances operational effectiveness but also allows for real-time data processing and decision-making. The integration of autonomous systems into military operations is likely to streamline mission execution and improve overall situational awareness on the battlefield.

Technological Advancements in UAVs

The Military Unmanned Aerial Vehicle Market Industry is experiencing rapid technological advancements that enhance the capabilities of UAVs. Innovations in artificial intelligence, machine learning, and sensor technology are driving the development of more sophisticated unmanned systems. For instance, the integration of advanced imaging systems allows for improved reconnaissance and surveillance capabilities. As of 2025, the market is projected to grow at a compound annual growth rate of approximately 12%, driven by these technological enhancements. Furthermore, the development of swarming technology, which enables multiple UAVs to operate in coordination, is expected to revolutionize military operations. This trend indicates a shift towards more autonomous and efficient systems, which could redefine operational strategies in various military applications.

Emerging Markets and Defense Modernization

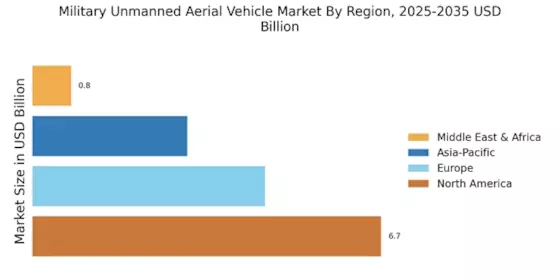

The Military Unmanned Aerial Vehicle Market Industry is benefiting from the emergence of new markets and ongoing defense modernization efforts. Countries in Asia, the Middle East, and Africa are increasingly investing in military capabilities, including UAV technology, to enhance their defense posture. As of 2025, these emerging markets are expected to contribute significantly to the overall growth of the UAV market. The modernization of existing military fleets and the acquisition of advanced UAV systems are key components of these nations' defense strategies. This trend indicates a shift towards adopting cutting-edge technologies to address evolving security challenges. The growing interest in UAVs among these nations reflects a broader commitment to strengthening defense capabilities and ensuring national security.

Geopolitical Tensions and Defense Spending

The Military Unmanned Aerial Vehicle Market Industry is significantly influenced by rising geopolitical tensions across various regions. Nations are increasingly investing in defense capabilities to address security threats, leading to heightened demand for UAVs. In 2025, defense budgets are anticipated to increase, with many countries prioritizing the acquisition of advanced military technologies, including unmanned aerial systems. This trend is particularly evident in regions experiencing territorial disputes or conflicts, where UAVs provide strategic advantages in surveillance and combat operations. The emphasis on maintaining a technological edge over potential adversaries further propels the market, as countries seek to enhance their military capabilities through the integration of UAVs into their defense strategies.

Increased Demand for Surveillance and Reconnaissance

The Military Unmanned Aerial Vehicle Market Industry is experiencing increased demand for surveillance and reconnaissance capabilities. As military operations become more complex, the need for real-time intelligence has never been greater. UAVs equipped with advanced sensors and imaging technologies are essential for gathering critical information in various operational environments. In 2025, the market for surveillance UAVs is projected to expand significantly, driven by their effectiveness in monitoring enemy movements and assessing battlefield conditions. This demand is further fueled by the growing emphasis on intelligence, surveillance, and reconnaissance (ISR) missions, which are integral to modern military strategies. The ability of UAVs to provide persistent surveillance capabilities enhances situational awareness and supports informed decision-making in military operations.