Market Growth Projections

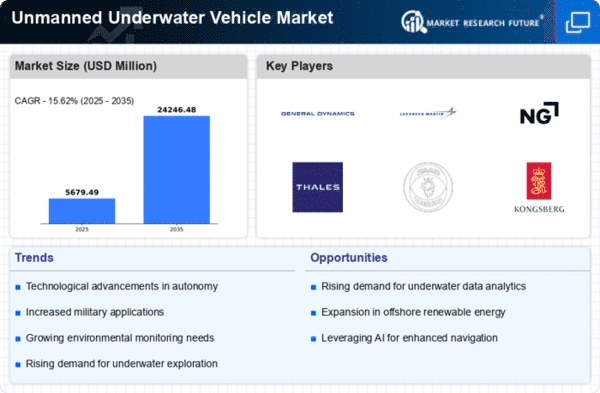

The Global Unmanned Underwater Vehicle Market Industry is projected to experience substantial growth over the coming years. With a market value of 4.91 USD Billion in 2024, the industry is expected to expand significantly, reaching 24.2 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 15.59% from 2025 to 2035. Such projections reflect the increasing adoption of UUVs across various sectors, including defense, marine research, and environmental monitoring. The anticipated growth underscores the importance of UUVs in addressing contemporary challenges in underwater exploration and resource management.

Growing Military Applications

The Global Unmanned Underwater Vehicle Market Industry is significantly influenced by the growing military applications of UUVs. Defense organizations worldwide are increasingly adopting these vehicles for surveillance, reconnaissance, and mine detection operations. For instance, the U.S. Navy has integrated UUVs into its naval operations, enhancing its underwater capabilities. This trend is likely to continue as nations prioritize maritime security and invest in advanced technologies. The military sector's demand for UUVs is expected to contribute to a compound annual growth rate (CAGR) of 15.59% from 2025 to 2035, reflecting the strategic importance of these vehicles in modern warfare.

Technological Advancements in UUVs

Technological advancements play a pivotal role in shaping the Global Unmanned Underwater Vehicle Market Industry. Innovations in sensors, navigation systems, and communication technologies enhance the capabilities of UUVs, making them more efficient and versatile. For example, advancements in autonomous navigation allow UUVs to operate in complex underwater environments with minimal human intervention. Such improvements not only increase operational efficiency but also reduce costs associated with underwater missions. As these technologies continue to evolve, they are likely to attract investment and drive market growth, potentially leading to a market valuation of 24.2 USD Billion by 2035.

Rising Demand for Marine Exploration

The Global Unmanned Underwater Vehicle Market Industry experiences a surge in demand driven by the increasing need for marine exploration. As nations seek to understand their marine resources better, the utilization of unmanned underwater vehicles (UUVs) becomes essential. These vehicles facilitate the collection of data on oceanic conditions, marine life, and underwater geology. For instance, the U.S. National Oceanic and Atmospheric Administration emphasizes the importance of UUVs in conducting oceanographic research. This growing interest in marine exploration is projected to contribute to the market's expansion, with the industry expected to reach 4.91 USD Billion in 2024.

Environmental Monitoring and Conservation Efforts

Environmental monitoring and conservation efforts significantly drive the Global Unmanned Underwater Vehicle Market Industry. UUVs are increasingly employed in monitoring marine ecosystems, assessing the impact of climate change, and conducting biodiversity studies. Organizations such as the United Nations Environment Programme advocate for the use of UUVs in marine conservation initiatives. By providing critical data on underwater habitats, UUVs facilitate informed decision-making for environmental protection. This growing emphasis on sustainability and conservation is expected to bolster market growth, as stakeholders recognize the value of UUVs in safeguarding marine environments.

Increasing Investment in Research and Development

Investment in research and development is a key driver of the Global Unmanned Underwater Vehicle Market Industry. Governments and private entities are allocating substantial resources to enhance UUV technologies and expand their applications. For instance, various countries are funding initiatives aimed at developing next-generation UUVs capable of performing complex tasks autonomously. This focus on innovation not only improves the functionality of UUVs but also opens new avenues for their use in various sectors, including oil and gas exploration, scientific research, and environmental monitoring. As R&D efforts intensify, the market is poised for robust growth.