Emergence of Industry 4.0

The advent of Industry 4.0 is reshaping the landscape of the tension control market. With the integration of IoT, big data, and AI, manufacturers are increasingly adopting smart technologies that require sophisticated tension control systems. These advancements enable real-time monitoring and predictive maintenance, which can significantly reduce downtime and enhance operational efficiency. As industries transition towards smart manufacturing, the demand for advanced tension control solutions is expected to rise. This shift not only improves productivity but also allows for more flexible manufacturing processes, catering to the evolving needs of consumers and markets.

Rising Demand for Automation

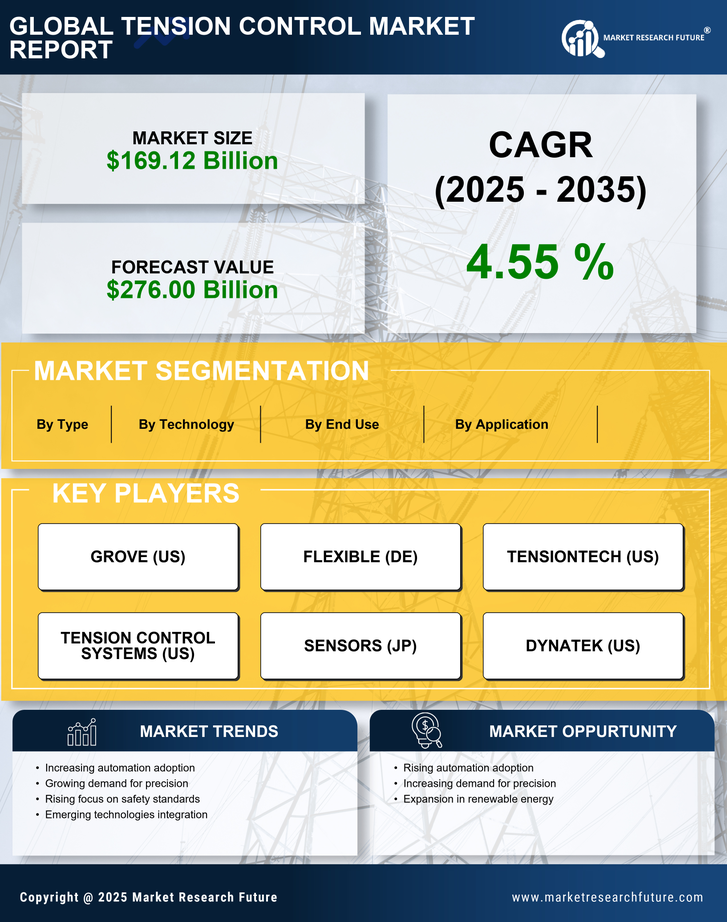

The increasing demand for automation across various industries is a key driver for the tension control market. As manufacturers seek to enhance efficiency and reduce operational costs, automated systems that incorporate tension control mechanisms are becoming essential. Industries such as packaging, textiles, and printing are particularly influenced by this trend, as they require precise tension management to ensure product quality. According to recent data, the automation sector is projected to grow at a CAGR of 10% through 2027, which is likely to bolster the tension control market. This growth indicates a shift towards more sophisticated machinery that integrates advanced tension control solutions, thereby enhancing productivity and reducing waste in manufacturing processes.

Growth in Manufacturing Sector

The expansion of the US manufacturing sector significantly impacts the tension control market. As production facilities scale up operations, the need for effective tension management systems becomes increasingly critical. Industries such as automotive, aerospace, and consumer goods are experiencing robust growth, which drives the demand for tension control solutions. Recent statistics suggest that the manufacturing sector contributes approximately 8% to the US GDP, highlighting its importance. This growth is likely to create opportunities for tension control market players to develop innovative solutions tailored to the specific needs of various manufacturing processes, thereby enhancing operational efficiency and product quality.

Increased Focus on Quality Control

Quality control remains a pivotal concern for manufacturers, directly influencing the tension control market. As companies strive to meet stringent quality standards, the implementation of precise tension control systems becomes paramount. This focus on quality is particularly evident in industries such as food and beverage, pharmaceuticals, and electronics, where product integrity is crucial. The tension control market is expected to benefit from this trend, as manufacturers invest in advanced technologies to monitor and adjust tension levels in real-time. This investment is likely to enhance product consistency and reduce defects, ultimately leading to higher customer satisfaction and loyalty.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent across various industries, driving the demand for effective tension control solutions. Manufacturers are required to adhere to specific guidelines that ensure product safety and operational efficiency. This trend is particularly relevant in sectors such as construction, automotive, and aerospace, where the consequences of tension-related failures can be severe. The tension control market is likely to see growth as companies invest in systems that not only meet regulatory requirements but also enhance overall safety. This focus on compliance may lead to increased adoption of advanced tension control technologies, ultimately benefiting manufacturers and consumers alike.